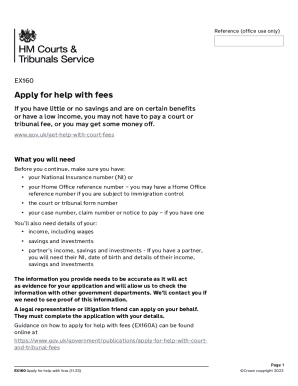

Ex160 Form

What is the Ex160 Form

The Ex160 form is a legal document used in the United States for individuals seeking assistance with fees associated with certain applications or processes. This form is particularly relevant for those who may be unable to afford the costs involved in submitting various legal or administrative requests. By completing the Ex160 form, applicants can request a waiver or reduction of fees based on their financial circumstances.

How to use the Ex160 Form

Using the Ex160 form involves a series of straightforward steps. First, applicants need to download the form from an official source. Once downloaded, individuals should carefully read the instructions provided. The form requires personal information, including income details and household size, to assess eligibility for fee waivers. After filling out the form, applicants must submit it along with any required documentation to the appropriate agency or court.

Steps to complete the Ex160 Form

Completing the Ex160 form requires attention to detail to ensure all necessary information is included. Follow these steps:

- Download the Ex160 form from an official source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information accurately, including income and household details.

- Attach any supporting documents that demonstrate your financial situation.

- Review the completed form for accuracy before submission.

- Submit the form to the designated agency or court, either online or by mail.

Legal use of the Ex160 Form

The Ex160 form is legally recognized when filled out correctly and submitted according to the specified guidelines. It serves as a formal request for fee waivers, making it essential for individuals who meet the eligibility criteria. Compliance with legal requirements ensures that the submitted form is valid and can be processed by the respective authorities.

Eligibility Criteria

To qualify for a fee waiver using the Ex160 form, applicants must meet specific eligibility criteria. Generally, this includes demonstrating financial hardship, such as low income or limited resources. The form may require details about household income, number of dependents, and any relevant financial obligations. Meeting these criteria is crucial for the approval of the fee waiver request.

Required Documents

When submitting the Ex160 form, applicants must provide certain documents to support their request for a fee waiver. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of any government assistance received.

- Information about household size and expenses.

Including these documents helps establish the applicant's financial situation and supports the validity of the request.

Form Submission Methods

The Ex160 form can be submitted through various methods, depending on the requirements of the agency or court involved. Common submission methods include:

- Online submission via the agency's official website.

- Mailing the completed form and supporting documents to the appropriate address.

- In-person submission at designated offices or courthouses.

It is essential to check the specific submission guidelines to ensure the form is submitted correctly and on time.

Quick guide on how to complete ex160 form 29730321

Complete Ex160 Form seamlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without delays. Handle Ex160 Form on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Ex160 Form effortlessly

- Locate Ex160 Form and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ex160 Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex160 form 29730321

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ex160 and how does it enhance document signing?

ex160 is a powerful tool within the airSlate SignNow platform that enhances the document signing experience. It allows users to send and eSign documents quickly and securely, streamlining workflows and improving efficiency. With ex160, businesses can manage their document processes seamlessly.

-

How much does airSlate SignNow cost for using ex160?

The pricing for airSlate SignNow varies depending on the plan you choose, but it offers competitive rates for powerful features like ex160. You can access flexible subscription options that fit your budget and needs. Visit our pricing page to find the best plan that includes ex160 functionalities.

-

What features does the ex160 offer?

The ex160 comes packed with features designed to simplify document management, including customizable templates, bulk sending options, and advanced eSignature tools. These features help users create, send, and track documents effortlessly. With ex160, you can enhance your efficiency in document handling.

-

How can ex160 benefit my business?

Using ex160 can signNowly benefit your business by reducing the time spent on document signing and management. It improves overall workflow efficiency, enhances collaboration, and ensures secure and legal transactions. By adopting ex160, businesses can focus more on their core operations instead of administrative tasks.

-

Can I integrate ex160 with other applications?

Yes, airSlate SignNow, including ex160, offers seamless integration with various applications. You can easily connect it with popular tools such as Google Workspace, Salesforce, and Zapier to automate your document processes. This connectivity ensures that your workflows remain uninterrupted and efficient.

-

Is ex160 suitable for small businesses?

Absolutely! ex160 is designed to cater to businesses of all sizes, including small businesses. Its affordability and user-friendly interface make it easy for small teams to adopt and improve their document management processes. With ex160, small businesses can operate like larger enterprises without the heavy investment.

-

What security measures does ex160 implement?

Security is a top priority for airSlate SignNow and its ex160 features. The platform offers advanced encryption, secure data storage, and compliance with industry regulations to protect your sensitive information. With ex160, you can trust that your documents are handled with the highest level of security.

Get more for Ex160 Form

- Applicants guide to licensing bright from the start georgia form

- Hvac inspection checklist residential editable fillable ampamp printable form

- Rds key atf form

- Palm tran connection application form 5446763

- Killer performance in a small format for a fair price serious issues

- Order on petition to expunge records special certificate from bci form

- 15 94virginia tax virginia department of taxation form

- Solid waste ampamp recycling city of minneapolis form

Find out other Ex160 Form

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template