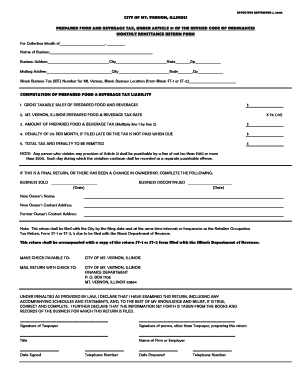

Prepared Food and Beverage Tax Return in Mt Vernon Illinois Form

What is the Prepared Food and Beverage Tax Return in Mt Vernon, Illinois

The Prepared Food and Beverage Tax Return in Mt Vernon, Illinois, is a specific form that businesses must complete to report and remit taxes collected on prepared food and beverages sold within the city. This tax is typically applied to establishments such as restaurants, cafes, and catering services that provide food and drink for immediate consumption. Understanding this tax is essential for compliance and financial management for local businesses.

How to Use the Prepared Food and Beverage Tax Return in Mt Vernon, Illinois

Using the Prepared Food and Beverage Tax Return involves several steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales of prepared food and beverages, as well as any exemptions or deductions applicable. Next, the business completes the form accurately, ensuring all figures are correct. Finally, the completed return must be submitted to the appropriate city department, either electronically or via mail, along with any payment due.

Steps to Complete the Prepared Food and Beverage Tax Return in Mt Vernon, Illinois

Completing the Prepared Food and Beverage Tax Return involves a series of methodical steps:

- Gather sales data for the reporting period, including total sales and any applicable exemptions.

- Fill out the form with accurate figures, ensuring that all sections are completed as required.

- Review the completed form for any errors or omissions.

- Submit the form along with payment to the designated city department by the deadline.

Legal Use of the Prepared Food and Beverage Tax Return in Mt Vernon, Illinois

The legal use of the Prepared Food and Beverage Tax Return ensures that businesses comply with local tax laws. This form serves as a formal declaration of the taxes owed based on sales of prepared food and beverages. Proper completion and submission are crucial, as failure to do so may result in penalties or legal repercussions. Additionally, maintaining accurate records related to this tax is essential for audit purposes and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Prepared Food and Beverage Tax Return in Mt Vernon are typically set by the city’s finance department. It is important for businesses to be aware of these dates to avoid late penalties. Returns are usually due on a quarterly basis, with specific dates outlined in the city’s tax regulations. Keeping a calendar of these deadlines can help ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with the Prepared Food and Beverage Tax Return requirements can lead to significant penalties for businesses. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand their obligations and ensure timely submission of the form to avoid these consequences. Regularly reviewing compliance practices can help mitigate risks associated with non-compliance.

Quick guide on how to complete city of mount vernon prepared food and beverage tax return

Complete city of mount vernon prepared food and beverage tax return seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage mt vernon tax rate on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign city of mount vernon prepared food and beverage tax return effortlessly

- Obtain prepared food and beverage tax return in mt vernon illinois and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign mt vernon tax rate and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to prepared food and beverage tax return in mt vernon illinois

Create this form in 5 minutes!

How to create an eSignature for the mt vernon tax rate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask prepared food and beverage tax return in mt vernon illinois

-

What is the current Mt Vernon tax rate, and how does it affect my business?

The Mt Vernon tax rate is crucial for businesses operating within the area, as it impacts overall operating costs. Understanding the Mt Vernon tax rate helps you budget accurately for expenses, including potential tax obligations related to document transactions. Staying updated on changes to the Mt Vernon tax rate can also aid in strategic planning.

-

How can airSlate SignNow help me manage documents related to the Mt Vernon tax rate?

airSlate SignNow simplifies the document management process, allowing you to send and eSign documents related to the Mt Vernon tax rate efficiently. With features like templates and collaboration tools, you can ensure compliance and streamline communications with tax consultants. This helps you stay organized and up-to-date on all tax-related documentation.

-

What features does airSlate SignNow offer that are relevant for understanding the Mt Vernon tax rate?

airSlate SignNow offers features like document templates, eSignature options, and real-time tracking that can be beneficial when dealing with the Mt Vernon tax rate. These features facilitate easier documentation of tax-related agreements and forms. Additionally, the platform’s user-friendly interface ensures that you can navigate tax forms with ease.

-

Is there a cost associated with using airSlate SignNow for Mt Vernon tax rate documents?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses managing documents related to the Mt Vernon tax rate. Different pricing plans are available to fit your needs, whether you are a small business or a larger enterprise. The investment can lead to time savings and improved accuracy in handling tax documents.

-

What are the benefits of eSigning documents concerning the Mt Vernon tax rate?

eSigning documents related to the Mt Vernon tax rate offers numerous benefits, including efficiency and legal validity. With airSlate SignNow, you can sign necessary tax documents instantly, reducing the turnaround time signNowly. Additionally, eSigned documents are typically easier to store and retrieve, which is crucial during tax season.

-

Can I integrate airSlate SignNow with my current accounting software to manage Mt Vernon tax rate documents?

Absolutely! airSlate SignNow offers integration with various accounting software platforms, making it easier to manage documents related to the Mt Vernon tax rate. This integration allows for seamless transfer of data, reducing the chances of errors in tax filings and improving overall efficiency. With the right setup, you can streamline your tax documentation process.

-

How does airSlate SignNow ensure compliance with the Mt Vernon tax rate regulations?

airSlate SignNow helps ensure compliance with the Mt Vernon tax rate regulations by providing templates and workflows that adhere to legal standards. The platform includes audit trails and secure storage, which are essential for maintaining compliance during tax audits. You can trust that your document handling practices will support adherence to local tax laws.

Get more for mt vernon tax rate

- Pdf theo van leeuwen discourse and practice new too form

- Nstar gas case overview eversource form

- Form master consulting services agreement for the

- Statistics and probability for engineering applications form

- Form web site development and services agreement

- Sample web site development agreement form

- Free and open source software wikipedia form

- Glyphs fonts free download onlinewebfontscom form

Find out other city of mount vernon prepared food and beverage tax return

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online