Mortgagor Certification Hud Form

What is the Mortgagor Certification Hud

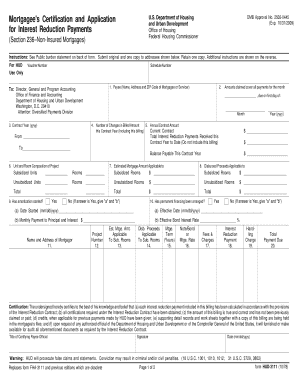

The Mortgagor Certification HUD is a crucial document in the mortgage process, particularly for borrowers seeking federal housing assistance. This certification verifies the accuracy of information provided by the borrower regarding their financial status and property details. It ensures that the borrower meets the eligibility criteria for the mortgage program, which is often tied to federal guidelines. The form is essential for maintaining compliance with housing regulations and protecting both the lender and the borrower.

Steps to complete the Mortgagor Certification Hud

Completing the Mortgagor Certification HUD involves several systematic steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary documents, including income statements, tax returns, and property information.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and truthful.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Mortgagor Certification Hud

The legal use of the Mortgagor Certification HUD is governed by federal housing regulations. This document must be completed accurately to avoid legal repercussions. Misrepresentation or failure to disclose pertinent information can lead to penalties, including denial of mortgage applications or legal action. It is essential for borrowers to understand the legal implications of the information they provide and to ensure compliance with all relevant laws.

Eligibility Criteria

To qualify for the Mortgagor Certification HUD, borrowers must meet specific eligibility criteria. These criteria typically include:

- Proof of income that meets the program's requirements.

- A satisfactory credit history.

- Demonstration of the ability to repay the mortgage.

- Compliance with property eligibility standards set by the HUD.

Meeting these criteria is essential for a successful application and to ensure that the borrower qualifies for the desired mortgage assistance.

Required Documents

When completing the Mortgagor Certification HUD, several documents are necessary to support the information provided. Commonly required documents include:

- Recent pay stubs or proof of income.

- Tax returns for the past two years.

- Bank statements to verify assets.

- Documentation of any additional income sources.

Having these documents ready can streamline the application process and help ensure that the certification is completed accurately.

Form Submission Methods (Online / Mail / In-Person)

The Mortgagor Certification HUD can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online submission through the lender's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at the lender's office.

Choosing the appropriate submission method can facilitate a smoother application process and ensure timely processing of the certification.

Quick guide on how to complete mortgagor certification hud

Complete Mortgagor Certification Hud effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Mortgagor Certification Hud on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Mortgagor Certification Hud effortlessly

- Locate Mortgagor Certification Hud and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Mortgagor Certification Hud and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgagor certification hud

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is mortgagor certification HUD?

Mortgagor certification HUD refers to the documentation process required by the Department of Housing and Urban Development for borrowers obtaining FHA loans. This certification ensures that borrowers meet specific requirements necessary for loan approval. Understanding mortgagor certification HUD is essential for navigating the mortgage process efficiently.

-

How does airSlate SignNow simplify mortgagor certification HUD processes?

airSlate SignNow offers a streamlined platform that allows users to prepare, send, and eSign mortgagor certification HUD documents quickly. By automating the documentation flow, businesses can reduce errors and expedite the signing process. This efficiency ultimately helps borrowers receive their approvals faster.

-

Is airSlate SignNow suitable for small businesses dealing with mortgagor certification HUD?

Yes, airSlate SignNow is an ideal solution for small businesses engaged in mortgagor certification HUD processes. Its cost-effective pricing plans provide access to essential features without breaking the bank. This makes it easier for small businesses to manage their documentation needs effectively.

-

What features does airSlate SignNow offer for managing mortgagor certification HUD?

Key features of airSlate SignNow for mortgagor certification HUD include real-time document tracking, customizable templates, and integration capabilities with popular CRM systems. These features enhance document management and improve overall workflow efficiency. This allows users to focus on service delivery instead of paperwork.

-

Are there integration options available with airSlate SignNow for mortgagor certification HUD?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including Google Drive, Salesforce, and Microsoft Office. These integrations facilitate smooth workflows for managing mortgagor certification HUD documentation across different platforms. As a result, users can work without friction between tools.

-

What are the benefits of using airSlate SignNow for mortgagor certification HUD processes?

Using airSlate SignNow for mortgagor certification HUD offers numerous benefits, such as increased efficiency, reduced turnaround times, and enhanced compliance. Users can electronically sign documents from anywhere, making it easier to keep transactions moving. This flexibility is crucial for meeting tight deadlines in the mortgage process.

-

How secure is airSlate SignNow for handling mortgagor certification HUD documents?

Security is a top priority for airSlate SignNow when managing mortgagor certification HUD documents. The platform uses advanced encryption methods and complies with industry regulations to ensure the safety of your data. This gives users peace of mind while handling sensitive documentation.

Get more for Mortgagor Certification Hud

- Fx international payments from american express new account application form

- Amex ecs enrollment form

- American express bank a tm card application form

- Pd10700201 form

- Financial services institution account application american express form

- Ansgning om firmakonto company application form

- Company application form ans gning om firmakonto

- Qantas application for the qantas american express card form

Find out other Mortgagor Certification Hud

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors