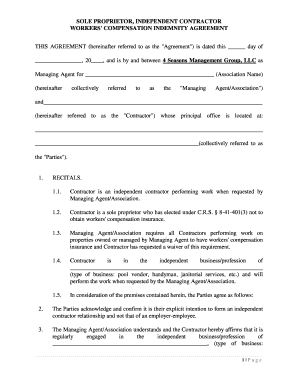

SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS Form

Understanding the sole proprietorship agreement

A sole proprietorship agreement is a legal document that outlines the terms and conditions under which a sole proprietor operates their business. This agreement serves to clarify the relationship between the owner and their business, detailing aspects such as responsibilities, financial arrangements, and operational procedures. It is essential for establishing clear expectations and protecting the proprietor's interests.

The agreement typically includes provisions regarding the management of business finances, decision-making processes, and the handling of liabilities. By having a written agreement, sole proprietors can mitigate potential disputes and ensure that all parties involved understand their roles and obligations.

Key elements of the sole proprietorship agreement

When drafting a sole proprietorship agreement, several key elements should be included to ensure its effectiveness. These elements typically encompass:

- Business name: Clearly state the name under which the business operates.

- Owner's information: Include the full name and contact details of the sole proprietor.

- Business purpose: Define the nature of the business and its objectives.

- Financial arrangements: Outline how profits and losses will be handled, including any initial capital contributions.

- Decision-making authority: Specify who has the authority to make decisions on behalf of the business.

- Liability clauses: Address how liabilities will be managed and the extent of personal liability for the owner.

Steps to complete the sole proprietorship agreement

Completing a sole proprietorship agreement involves several important steps. Follow these guidelines to ensure a comprehensive and legally sound document:

- Identify the business details: Gather information about the business name, purpose, and ownership structure.

- Draft the agreement: Use clear and concise language to outline the key elements, ensuring all relevant details are included.

- Review legal requirements: Check for any state-specific regulations that may affect the agreement.

- Consult a legal professional: Consider having a lawyer review the document to ensure compliance and adequacy.

- Sign and date the agreement: Both the sole proprietor and any other involved parties should sign the document to make it binding.

Legal use of the sole proprietorship agreement

The legal use of a sole proprietorship agreement is crucial for establishing the legitimacy of the business. This agreement can serve as evidence of the business's operational framework in case of disputes or legal challenges. It is important to ensure that the agreement complies with local laws and regulations, as this can impact its enforceability.

Additionally, having a well-drafted agreement can help in securing financing, as lenders may require documentation of the business structure and financial arrangements. By formalizing the business operations through this agreement, sole proprietors can protect their interests and enhance their credibility in the marketplace.

Examples of using the sole proprietorship agreement

There are various scenarios in which a sole proprietorship agreement proves beneficial. For instance:

- Freelancers: A freelance graphic designer can use the agreement to outline payment terms and project expectations with clients.

- Consultants: A business consultant may detail their services, fees, and confidentiality obligations in the agreement.

- Retailers: A sole proprietor running a retail shop can specify inventory management and financial responsibilities.

These examples illustrate the versatility of the sole proprietorship agreement in different business contexts, helping to clarify roles and expectations for all parties involved.

Quick guide on how to complete sole proprietor independent contractor workers

Complete SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files promptly without setbacks. Handle SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS effortlessly

- Find SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and eSign SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS and ensure exceptional clarity at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sole proprietor independent contractor workers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sole proprietorship agreement?

A sole proprietorship agreement is a legal document that outlines the terms and conditions of a business owned by a single individual. This agreement defines the business structure, the owner's responsibilities, and any financial arrangements. It is essential for clarifying the operational framework of a sole proprietorship.

-

How does airSlate SignNow facilitate the creation of a sole proprietorship agreement?

AirSlate SignNow allows users to easily create, edit, and eSign a sole proprietorship agreement using customizable templates. This ensures that your agreement meets specific legal requirements while being user-friendly. The platform streamlines the document process, making it faster and more efficient to manage your agreements.

-

What are the benefits of using airSlate SignNow for a sole proprietorship agreement?

Using airSlate SignNow for your sole proprietorship agreement offers several benefits, including time savings, enhanced security, and ease of use. The platform enables you to electronically sign documents, reducing the need for paper and in-person meetings. Additionally, it offers secure storage for all your agreements, making them easily accessible.

-

Is there a cost associated with creating a sole proprietorship agreement on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow to create a sole proprietorship agreement, but the pricing is competitive and offers signNow value. Users can choose from different plans based on their needs, allowing for flexibility and scalability. Each plan includes features such as document templates, eSigning, and secure storage.

-

Can I integrate airSlate SignNow with other business tools for my sole proprietorship agreement?

Absolutely! AirSlate SignNow offers seamless integrations with various business tools and applications, allowing you to streamline your workflow. Whether you use CRM systems, cloud storage, or accounting software, integrating these tools will enhance the management of your sole proprietorship agreement.

-

How secure is the signing process for a sole proprietorship agreement on airSlate SignNow?

The signing process for a sole proprietorship agreement on airSlate SignNow is highly secure. The platform utilizes industry-standard encryption methods to protect your data and documents, ensuring that all signatures and transactions are safe. This commitment to security provides peace of mind for users and clients alike.

-

Can I customize my sole proprietorship agreement using airSlate SignNow?

Yes, airSlate SignNow provides customizable templates that allow you to tailor your sole proprietorship agreement to meet your specific business needs. You can easily modify sections, add clauses, and personalize your document to reflect your brand. This flexibility ensures that your agreement fits your operational requirements.

Get more for SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS

Find out other SOLE PROPRIETOR INDEPENDENT CONTRACTOR WORKERS

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document