Release of Liability and Assumption of Risk Rental Property Form

Understanding the Release of Liability and Assumption of Risk for Rental Property

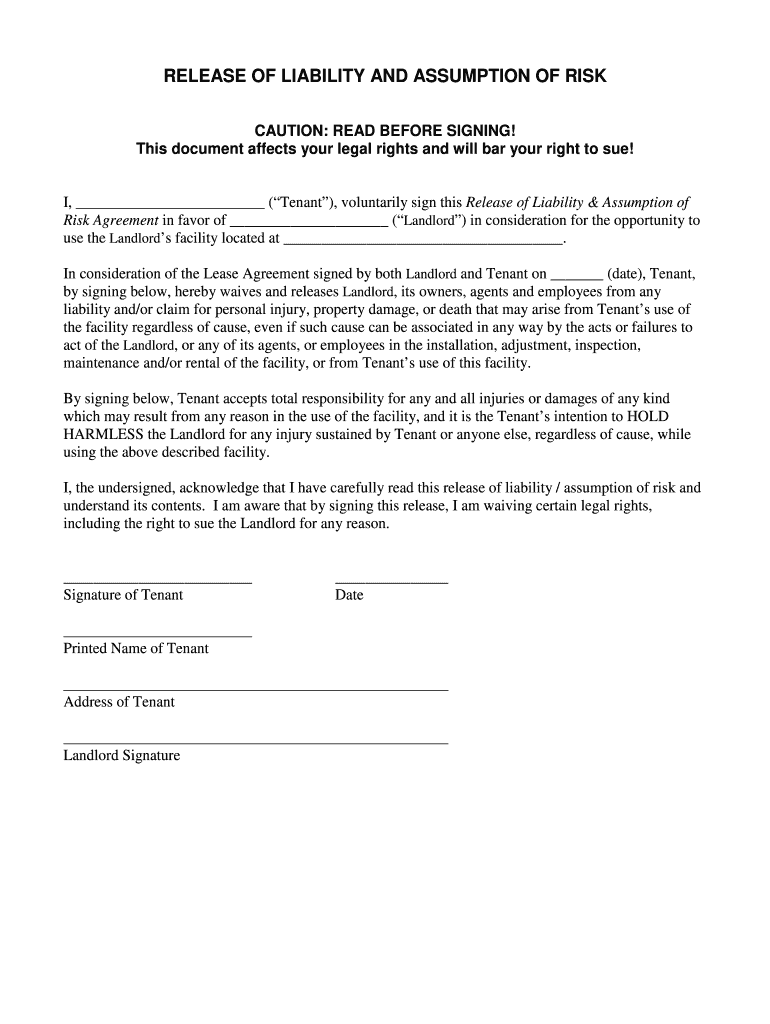

The release of liability and assumption of risk for rental property is a legal document that protects property owners from claims arising from injuries or damages that occur on their premises. This form is crucial for landlords and property managers as it establishes a clear understanding between the parties involved. By signing this waiver, tenants acknowledge the risks associated with using the property and agree not to hold the landlord liable for any accidents or injuries that may occur during their tenancy.

How to Use the Release of Liability and Assumption of Risk for Rental Property

Using the release of liability and assumption of risk form involves several steps to ensure it is legally binding and effective. First, landlords should provide the form to tenants before they move in or engage in any activities on the property. It is essential for tenants to read the document thoroughly and understand its implications. After both parties have discussed any concerns, tenants should sign the form, which should then be kept on file by the landlord. This process helps protect both parties and clarifies responsibilities.

Key Elements of the Release of Liability and Assumption of Risk for Rental Property

A comprehensive release of liability and assumption of risk form should include specific key elements to be effective. These elements typically consist of:

- Identification of Parties: Clearly state the names of the landlord and tenant.

- Description of the Property: Include the address and details of the rental property.

- Assumption of Risk: A clause where the tenant acknowledges understanding the risks associated with the property.

- Release of Liability: A statement where the tenant agrees not to hold the landlord responsible for injuries or damages.

- Signatures: Spaces for both parties to sign and date the document.

Steps to Complete the Release of Liability and Assumption of Risk for Rental Property

Completing the release of liability and assumption of risk form involves several straightforward steps:

- Gather necessary information about the rental property and the parties involved.

- Draft the document, ensuring all key elements are included.

- Provide the form to the tenant for review.

- Discuss any questions or concerns the tenant may have.

- Have the tenant sign the form, ensuring they understand its contents.

- Keep a signed copy for your records and provide one to the tenant.

Legal Use of the Release of Liability and Assumption of Risk for Rental Property

The legal use of a release of liability and assumption of risk form is governed by state laws and regulations. It is important for landlords to ensure that the form complies with local legal requirements. This includes ensuring that the language used is clear and unambiguous, as well as confirming that the form is not overly broad, which could render it unenforceable in court. Consulting with a legal professional can help ensure that the document meets all necessary legal standards.

Examples of Using the Release of Liability and Assumption of Risk for Rental Property

There are various scenarios in which a release of liability and assumption of risk form can be beneficial. For instance:

- A tenant participating in a recreational activity on the property, such as a pool party.

- A tenant hosting guests for a gathering, where the potential for accidents may arise.

- Seasonal rentals where tenants may engage in outdoor activities, such as hiking or biking.

In each of these situations, having a signed waiver can help protect the landlord from potential legal claims related to injuries or damages that occur during the tenant's use of the property.

Quick guide on how to complete release of liability and assumption of risk free rental property

Effortlessly Prepare Release Of Liability And Assumption Of Risk rental property on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Release Of Liability And Assumption Of Risk rental property from any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to Modify and eSign Release Of Liability And Assumption Of Risk rental property with Ease

- Obtain Release Of Liability And Assumption Of Risk rental property and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to confirm your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Release Of Liability And Assumption Of Risk rental property to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long does it take to evict a tenant and have him completely out of your rental property?

It is going to depend a lot upon the local law is whatever jurisdiction the property is in. Each state is going to be slightly different and there may also be county or city laws that apply. You need to familiarize yourself with these laws if you are going to be a landlord. In some jurisdictions the process can be a matter of days or weeks and in others it could take considerably longer.

-

How will the new law requiring landlords to rent to the disabled with service dogs affect an already tight rental market? Will landlords take their properties out of service rather than risk uncompensable destruction of their properties?

Legitimate service dogs are better trained than some people. The problem is when someone has a regular dog and claims it's a service dog to get an apartment.Landlords have to be careful when verifying whether a service dog is legit or not to avoid discrimination suits, but if you have a good tenant applicant who also has a service dog, there would be no reason to keep your property vacant out of spite.Some landlords who might be phobic of dogs in general, or who don't understand how well trained real service dogs are might feel alienated, but I don't think they would afford to keep a property vacant. Maybe some would sell their units off prematurely, but they will be bought by a landlord who won't mind renting to good tenants.Landlords worried about dander could ask for a cleaning fee, or have an agreement in the lease that the apartment will be kept in a certain condition, just like they can do for anyone else. As long as they aren't unreasonable or discriminating against people with disabilities they will be fine.

-

What are the forms of the various universities and states that need to be filled out after the NEET results are released?

For All India Quota and Deemed universities online counselling will be done by Medical Counselling Committee(MCC) Visit NEET UG 2016 Registration starts on 3rd July 2017.For state quota and private medical/dental colleges Counselling will be done by respective state authorities. List is given on MCI website. Visit Official Website of Medical Council of India.Karnataka Registration started on 3rd June and has been extended till 26th June 2017.(Initially the last date was mentioned as 8th, then they extended till 15th, again got extended till 20th, Now it has been extended till 26th).Hope this helps.

-

How many rental properties do you need to own (and rent out) to earn a positive cash flow of at least $3,000 USD per month?

One of the largest social media (website, blog, podcast, etc) outlets for real estate is called BiggerPockets dot com. One of the hosts of the podcast did exactly what you asked. His first real estate goal was to buy enough rentals to replace his salary. Which happened to be $3,000/month so that he could retire. He accomplished this goal and then decided that he wanted more. You should check out that podcast.The answer to your question though is that it depends. Every rental property has different characteristics. For example, I have one that gives me $300/month in cashflow and one that gives me around $50/month. Each rental has to be examined individually. It may be hard to find one that has any cashflow in some areas. There is a general rule of thumb (the 1% Rule) that if you can find one that rents for 1% of the value of the home that is generally going to be a good investment. So if the house is worth $100,000 and you can rent it for $1000/month that would probably be a good rental. This isn’t always true but it’s a good rule of thumb. This rule breaks down and doesn’t work when you start getting into more expensive homes. Once the rent gets high enough you start to wonder why the person is renting and not buying. I am willing to accept much less than the 1% rule but if I find one that makes 1% I will definitely make an offer.

-

My parents owns a rental property, they put the house under my name, but they collect the rent all to themselves. What is the impact of this situation on my tax return and how do I get out?

Obviously you should consult a tax professional if you are concerned. It as I understand it, the home is deeded in your name. If that’s true, you own the home. I am assuming they transferred ownership through a quit claim deed and they have no ownership rights. Since you are not personally in the rental business you have no rental business to report to the IRS if in US. At the same time, you have given permission by default for your parents to use your house as a rental business. They might be filing a business tax return for their rental business. I am guessing that they pay the taxes, insurance and all expenses so they deserve the income. Since they don’t own the home, they likely can’t write off depreciation. Your taxes might get questionable if you try to deduct real estate taxes paid if you didn’t pay them. If all of this bothers you and depending on your relationship to your parents you could transfer ownership back to them via a quit claim deed and pay the required filing fees. There would be a potential liability issue of course to you if you continue as is. You are owner of record and could be sued if someone was hurt or damaged in the home. Not sure if your parents can book insurance since they are not the home owners. Sounds a bit shady.

Create this form in 5 minutes!

How to create an eSignature for the release of liability and assumption of risk free rental property

How to make an eSignature for the Release Of Liability And Assumption Of Risk Free Rental Property in the online mode

How to make an eSignature for the Release Of Liability And Assumption Of Risk Free Rental Property in Chrome

How to generate an eSignature for putting it on the Release Of Liability And Assumption Of Risk Free Rental Property in Gmail

How to make an electronic signature for the Release Of Liability And Assumption Of Risk Free Rental Property right from your smart phone

How to generate an electronic signature for the Release Of Liability And Assumption Of Risk Free Rental Property on iOS

How to create an electronic signature for the Release Of Liability And Assumption Of Risk Free Rental Property on Android OS

People also ask

-

What is a rental liability waiver template?

A rental liability waiver template is a customizable document that landlords can use to protect themselves from potential damages caused by renters. This template outlines the responsibilities of the tenants and helps mitigate liability. Using airSlate SignNow, you can easily create and manage your rental liability waiver template.

-

How can I create a rental liability waiver template with airSlate SignNow?

Creating a rental liability waiver template with airSlate SignNow is straightforward. Simply use our user-friendly document editor to customize a pre-made template or start from scratch. The platform allows you to add fields for tenant details and specify terms, making it efficient to generate legally binding agreements.

-

Is there a cost associated with using the rental liability waiver template?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including access to a rental liability waiver template. You can choose a plan that best fits your business while enjoying cost-effective solutions for document management and eSigning.

-

What features are included in the rental liability waiver template?

The rental liability waiver template includes customizable sections for tenant information, property details, and terms of liability. Additionally, you can include digital signatures, date fields, and checkboxes to ensure all necessary information is captured. This feature-rich template enhances clarity and legal protection.

-

What are the benefits of using a rental liability waiver template?

Using a rental liability waiver template can signNowly reduce your risk of liability as a landlord. It establishes clear terms and conditions, ensuring that tenants are aware of their responsibilities. Furthermore, airSlate SignNow streamlines the signing process, improving efficiency and record-keeping.

-

Can I integrate the rental liability waiver template with other tools?

Absolutely! airSlate SignNow allows for integrations with various third-party applications, enhancing your document workflow. You can seamlessly connect it with your CRM, accounting software, or other platforms to manage your rental agreements and liability waivers more effectively.

-

How secure is my information when using the rental liability waiver template?

Your information is highly secure with airSlate SignNow. The platform uses advanced encryption methods and complies with industry standards to ensure that all documents, including your rental liability waiver template, are protected. You can trust that your data is safe while you manage your agreements.

Get more for Release Of Liability And Assumption Of Risk rental property

Find out other Release Of Liability And Assumption Of Risk rental property

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online