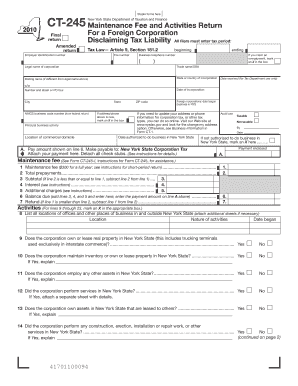

Ny Form Ct 245

What is the Ny Form Ct 245

The Ny Form Ct 245 is a legal document used primarily in New York for specific court-related procedures. It is essential for individuals or entities involved in legal matters to understand the purpose and requirements of this form. The form is often utilized in various legal contexts, including civil cases, and helps streamline the judicial process by ensuring that necessary information is formally documented. Understanding the nuances of the Ny Form Ct 245 can significantly impact the outcome of legal proceedings.

How to use the Ny Form Ct 245

Using the Ny Form Ct 245 involves several steps that ensure proper completion and submission. First, it is crucial to read the instructions carefully to understand the required information. Next, fill out the form accurately, providing all necessary details such as names, addresses, and relevant case information. After completing the form, review it for accuracy and completeness. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person, to ensure it is received by the appropriate court.

Steps to complete the Ny Form Ct 245

Completing the Ny Form Ct 245 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from a reliable source.

- Carefully read all instructions provided with the form.

- Fill in the required fields, ensuring that all information is accurate and up-to-date.

- Double-check for any missing information or errors.

- Sign and date the form where indicated.

- Submit the completed form according to the specified submission methods.

Legal use of the Ny Form Ct 245

The legal use of the Ny Form Ct 245 is vital for ensuring that submissions to the court are valid and recognized. The form must be filled out in compliance with applicable laws and regulations. Proper use of the form can facilitate the processing of court cases, making it essential for parties involved in legal proceedings to adhere to the requirements outlined in the form. Failure to use the form correctly may result in delays or complications in legal matters.

Key elements of the Ny Form Ct 245

Key elements of the Ny Form Ct 245 include specific sections that require detailed information. These elements typically encompass:

- Identification of the parties involved in the legal matter.

- Case number and relevant court information.

- Details of the legal issue being addressed.

- Signatures of the parties or their representatives.

Each of these elements plays a crucial role in the form's effectiveness and legal standing.

Form Submission Methods

The Ny Form Ct 245 can be submitted through various methods, depending on the requirements of the specific court. Common submission methods include:

- Online submission through the court's electronic filing system.

- Mailing the completed form to the appropriate court address.

- In-person submission at the court clerk's office.

Choosing the correct submission method is essential to ensure timely processing of the form.

Quick guide on how to complete ny form ct 245

Complete Ny Form Ct 245 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Handle Ny Form Ct 245 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to edit and eSign Ny Form Ct 245 effortlessly

- Locate Ny Form Ct 245 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any chosen device. Modify and eSign Ny Form Ct 245 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny form ct 245

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ny Form Ct 245 and how can airSlate SignNow assist with it?

The Ny Form Ct 245 is a specific form used in Connecticut for tax purposes. airSlate SignNow simplifies the process of filling out and submitting the Ny Form Ct 245 by providing an easy-to-use interface for eSigning documents and securely sharing them. This helps users efficiently manage their tax documents while ensuring compliance.

-

How does airSlate SignNow pricing compare for users needing to file Ny Form Ct 245?

airSlate SignNow offers competitive pricing that suits businesses of all sizes looking to manage their documents electronically, including the Ny Form Ct 245. With flexible subscription options, users can choose a plan that best fits their needs, ensuring that they receive maximum value for their investment in document management solutions.

-

What features does airSlate SignNow offer for electronic signing of Ny Form Ct 245?

airSlate SignNow provides a variety of features that enhance the electronic signing process for the Ny Form Ct 245, including templates, in-person signing, and automatic reminders. These features ensure that users can efficiently complete their forms without delays, making the entire process seamless and user-friendly.

-

Can I integrate airSlate SignNow with other tools for managing Ny Form Ct 245?

Yes, airSlate SignNow offers integrations with numerous platforms and applications, making it easy to manage workflows that include the Ny Form Ct 245. Whether you're using CRM systems, document storage solutions, or other productivity tools, these integrations help streamline your document management process.

-

What benefits does using airSlate SignNow bring for filing the Ny Form Ct 245?

Using airSlate SignNow to file the Ny Form Ct 245 helps ensure that your documents are securely signed and stored. The platform not only enhances efficiency but also reduces the risk of errors in paperwork, thus expediting the processing of your form. This reliability is crucial for meeting deadlines with the Connecticut tax office.

-

Is it easy to learn how to use airSlate SignNow for Ny Form Ct 245?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to learn how to complete the Ny Form Ct 245 electronically. The platform offers tutorials and customer support resources to assist users in navigating the application and making the most of its features.

-

Does airSlate SignNow provide support for tracking Ny Form Ct 245 submissions?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of their Ny Form Ct 245 submissions. Users can receive notifications when their documents are viewed or signed, thus keeping them informed throughout the process and ensuring that no steps are missed.

Get more for Ny Form Ct 245

- Patient information please print planned parenthood plannedparenthood

- Nj 4 h event permission form for youth njaes rutgers

- This asthma action plan meets nj law n form

- Discover the leader in you leadership conference north jersey form

- Csea dental and vision enfrollment form

- Dignity health authorization form

- Agent application form pdf

- Map 909e form

Find out other Ny Form Ct 245

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online