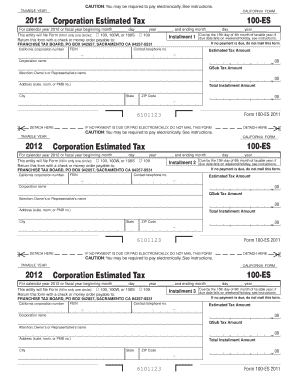

Form 100 Es

What is the Form 100 Es

The Form 100 Es is a tax form used by corporations in the United States to report their income and calculate their state tax liability. This form is essential for ensuring compliance with state tax regulations. It is specifically designed for C corporations operating within California and is part of the state's corporate tax return process. Understanding the purpose and requirements of the Form 100 Es is crucial for accurate tax reporting and compliance.

How to use the Form 100 Es

Using the Form 100 Es involves several key steps. First, gather the necessary financial information, including income, deductions, and credits. Next, complete the form by accurately filling out each section, ensuring that all figures are correct and supported by documentation. After completing the form, review it for accuracy before submission. The form can be filed electronically or by mail, depending on the preferences of the corporation.

Steps to complete the Form 100 Es

Completing the Form 100 Es requires careful attention to detail. Follow these steps for successful completion:

- Gather all financial records, including income statements and expense reports.

- Fill out the identification section, including the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Deduct allowable expenses, such as operating costs and taxes paid.

- Calculate the total tax liability based on the net income reported.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Form 100 Es

The legal use of the Form 100 Es is governed by state tax laws. It must be completed accurately to fulfill the corporation's tax obligations. Submitting an incorrect or incomplete form can lead to penalties or audits. Corporations are required to maintain accurate records and documentation to support the information reported on the form. Compliance with all relevant tax regulations is essential to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100 Es are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to be aware of these deadlines to avoid late fees and penalties. Corporations may also request an extension to file, but this does not extend the payment deadline.

Required Documents

To complete the Form 100 Es, several documents are required. These typically include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and deductions.

- Previous tax returns for reference.

- Documentation supporting any credits claimed.

Having these documents organized and accessible will facilitate a smoother filing process.

Quick guide on how to complete form 100 es 100024779

Finish Form 100 Es effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to locate the needed form and store it securely on the internet. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form 100 Es on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 100 Es effortlessly

- Locate Form 100 Es and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 100 Es and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100 es 100024779

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 100 Es and how does it work with airSlate SignNow?

The Form 100 Es is a specific document used for various business applications, and airSlate SignNow allows you to easily create, send, and eSign this form. By leveraging our platform, you can streamline the entire process, ensuring your Form 100 Es is signed quickly and securely.

-

How much does it cost to use airSlate SignNow for Form 100 Es?

airSlate SignNow offers competitive pricing plans that cater to different business needs when working with Form 100 Es. You can choose from monthly or annual plans, and our cost-effective solution ensures that you get the most value for your investment in document management.

-

Can I integrate airSlate SignNow with other software for managing Form 100 Es?

Yes, airSlate SignNow offers integrations with popular software applications like Salesforce, Google Drive, and Dropbox, making it easier to manage your Form 100 Es alongside your existing workflows. This enhances productivity and ensures a seamless document management experience.

-

What are the key features of airSlate SignNow for handling Form 100 Es?

Key features include customizable templates for Form 100 Es, advanced eSignature capabilities, and document tracking options. These tools help ensure that you can efficiently send, sign, and store your documents while keeping everything organized.

-

Are there any security measures in place for Form 100 Es in airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your Form 100 Es documents by implementing robust encryption and compliance with industry standards. Our platform ensures that your data remains safe and accessible only to authorized users.

-

How does airSlate SignNow enhance the signing process for Form 100 Es?

airSlate SignNow simplifies the signing process for your Form 100 Es by enabling users to sign documents electronically from any device. This flexibility accelerates approval times, allowing you to complete transactions faster and more efficiently.

-

Can I store and manage Form 100 Es documents in airSlate SignNow?

Yes, you can easily store and manage your Form 100 Es documents within airSlate SignNow. Our platform provides cloud storage solutions, allowing you to access and organize your documents securely anytime, anywhere.

Get more for Form 100 Es

Find out other Form 100 Es

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later