Ctax Lbbd Gov Uk Form

What is the Ctax Lbbd Gov Uk

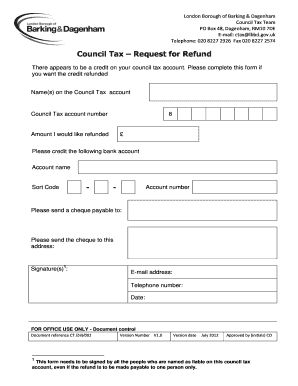

The Ctax Lbbd Gov Uk refers to the council tax system managed by the London Borough of Barking and Dagenham. This tax is a local taxation system that helps fund local services such as education, transportation, and public safety. Residents are required to pay this tax based on the estimated value of their property, which is assessed by the local council. Understanding the Ctax Lbbd Gov Uk is essential for residents to ensure compliance and to access available services.

How to Use the Ctax Lbbd Gov Uk

Using the Ctax Lbbd Gov Uk involves several steps, primarily focused on registration, payment, and accessing services. Residents can register for council tax online through the Barking and Dagenham council website. Once registered, individuals can manage their accounts, view bills, and make payments digitally. The online portal also provides access to forms and information regarding discounts, exemptions, and payment plans.

Steps to Complete the Ctax Lbbd Gov Uk

Completing the Ctax Lbbd Gov Uk involves a straightforward process:

- Visit the Barking and Dagenham council website.

- Navigate to the council tax section to find relevant forms.

- Fill out the required forms accurately, ensuring all personal details are correct.

- Submit the forms electronically or print and mail them as instructed.

- Monitor your account for updates and ensure payments are made on time.

Legal Use of the Ctax Lbbd Gov Uk

The legal use of the Ctax Lbbd Gov Uk is governed by local regulations that outline the responsibilities of residents and the council. This includes the obligation to pay council tax based on property valuation and the right to appeal assessments if discrepancies arise. Compliance with these regulations ensures that residents contribute to local services while also receiving the benefits associated with their payments.

Required Documents

To effectively manage your Ctax Lbbd Gov Uk, certain documents may be required. These typically include:

- Proof of identity, such as a driver's license or passport.

- Proof of residency, like a utility bill or lease agreement.

- Any previous council tax bills for reference.

Having these documents ready can streamline the registration and payment processes.

Eligibility Criteria

Eligibility for the Ctax Lbbd Gov Uk is primarily based on residency and property ownership. All adult residents of a property are liable for council tax, while certain exemptions may apply for students, individuals with disabilities, or those on specific benefits. It is important for residents to check their eligibility for discounts or exemptions to ensure they are not overpaying.

Quick guide on how to complete ctax lbbd gov uk

Effortlessly Prepare Ctax Lbbd Gov Uk on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal sustainable substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Ctax Lbbd Gov Uk on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Ctax Lbbd Gov Uk with Ease

- Find Ctax Lbbd Gov Uk and click Get Form to initiate.

- Use the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Ctax Lbbd Gov Uk to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ctax lbbd gov uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ctax lbbd gov uk and how does it relate to airSlate SignNow?

Ctax lbbd gov uk refers to the council tax system in the London Borough of Barking and Dagenham. airSlate SignNow integrates seamlessly with systems like ctax lbbd gov uk, allowing businesses to manage and sign council tax documents efficiently and securely.

-

How can airSlate SignNow improve the management of documents related to ctax lbbd gov uk?

airSlate SignNow enables businesses to streamline the signing and sending of documents related to ctax lbbd gov uk. With its user-friendly interface and robust features, users can quickly draft, sign, and manage council tax agreements, improving overall efficiency.

-

What are the pricing options for using airSlate SignNow with ctax lbbd gov uk?

airSlate SignNow offers various pricing plans that cater to different business needs, all of which are cost-effective for managing documents related to ctax lbbd gov uk. Users can choose a plan that fits their budget while enjoying the full range of features necessary for document management.

-

Is airSlate SignNow secure for handling sensitive documents like those related to ctax lbbd gov uk?

Absolutely! airSlate SignNow provides top-notch security protocols to protect sensitive documents, including those associated with ctax lbbd gov uk. With encryption and secure cloud storage, your council tax documents are safe from unauthorized access.

-

What features does airSlate SignNow provide for businesses dealing with ctax lbbd gov uk documents?

airSlate SignNow offers numerous features, such as electronic signatures, document templates, and integration capabilities that simplify the process of handling ctax lbbd gov uk documents. These tools streamline workflows and ensure compliance with legal requirements for document handling.

-

Can airSlate SignNow integrate with other tools used for managing ctax lbbd gov uk?

Yes, airSlate SignNow can integrate with various third-party applications, making it a versatile solution for managing documents related to ctax lbbd gov uk. This integration enables users to connect their existing tools, improving overall functionality and productivity.

-

What benefits can businesses expect from using airSlate SignNow for ctax lbbd gov uk?

Businesses using airSlate SignNow for ctax lbbd gov uk can expect signNow improvements in efficiency, reduced processing time, and lower operational costs. The platform’s ease of use and feature-rich environment empower teams to focus on important tasks rather than administrative paperwork.

Get more for Ctax Lbbd Gov Uk

- Corporate card application form

- Texas state university application form

- Ach authorization form

- Masters certification programs university of nebraska omaha form

- Instructions for annual reports form

- Animal handler injury report form

- Auburn application form

- Non custodial parent information waiver request zucker

Find out other Ctax Lbbd Gov Uk

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation