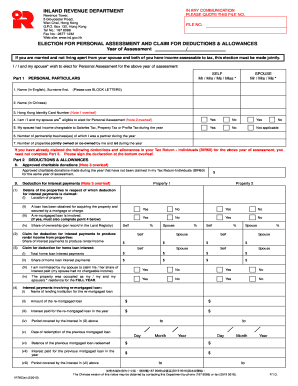

Ir76c Form

What is the IR76C?

The IR76C is a specialized form used primarily for tax purposes, particularly in relation to certain financial transactions or reporting obligations. This form is essential for individuals and businesses that need to report specific information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the IR76C is crucial for ensuring compliance with U.S. tax laws.

How to Use the IR76C

Using the IR76C involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the transactions being reported. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled, review it for any errors or omissions before submitting it to the IRS. The IR76C can be submitted electronically or via traditional mail, depending on your preference and the IRS guidelines.

Steps to Complete the IR76C

Completing the IR76C requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial information, including income statements and transaction records.

- Access the IR76C form, either online or in printed format.

- Fill in your personal and business information as required.

- Provide details of the transactions or financial activities being reported.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form electronically or mail it to the appropriate IRS address.

Legal Use of the IR76C

The IR76C is legally recognized as a valid document for tax reporting when completed correctly. It must adhere to the regulations set forth by the IRS, ensuring that all information provided is truthful and accurate. Failure to comply with the legal requirements associated with the IR76C can result in penalties or legal repercussions.

Required Documents

When preparing to complete the IR76C, certain documents are necessary to ensure accurate reporting. These may include:

- Income statements for the reporting period.

- Transaction records relevant to the activities being reported.

- Any previous tax documents that may provide context or additional information.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IR76C to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, specific deadlines may vary based on individual circumstances or IRS updates, so it is advisable to check the latest guidelines each tax year.

Quick guide on how to complete ir76c

Effortlessly Prepare Ir76c on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers a superb environmentally friendly option to conventional printed and signed documents, as you can locate the suitable form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any holdups. Handle Ir76c on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Modify and eSign Ir76c Smoothly

- Find Ir76c and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Edit and eSign Ir76c and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir76c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ir76c?

airSlate SignNow is a powerful eSignature tool that allows businesses to easily send and eSign documents. The ir76c feature enhances the signing process by offering a seamless user experience, ensuring that documents are signed quickly and securely.

-

How much does airSlate SignNow cost for users interested in ir76c?

airSlate SignNow offers competitive pricing plans tailored for all business sizes. The cost-effectiveness of using ir76c within SignNow provides users with a comprehensive solution without breaking the bank, ensuring value for money.

-

What features does airSlate SignNow include to enhance the ir76c experience?

airSlate SignNow includes features such as template creation, automated workflows, and user-friendly document tracking. These features, in conjunction with ir76c, streamline the signing process and save users valuable time.

-

What are the benefits of using airSlate SignNow with ir76c for businesses?

Using airSlate SignNow with ir76c allows businesses to increase efficiency, reduce paperwork, and improve compliance. The intuitive interface and robust capabilities make it an ideal choice for companies looking to modernize their workflow.

-

Can I integrate airSlate SignNow with other software while using ir76c?

Yes, airSlate SignNow supports a variety of integrations with popular business applications, enhancing the functionality of ir76c. This enables users to connect existing tools and improve their overall workflow seamlessly.

-

Is it easy to get started with airSlate SignNow and ir76c?

Absolutely! Getting started with airSlate SignNow and using ir76c is simple and straightforward. Users can easily create an account and access comprehensive tutorials to guide them through the signing process.

-

How secure is the signing process in airSlate SignNow when using ir76c?

The security of the signing process in airSlate SignNow is top-notch, especially when utilizing ir76c. The platform implements advanced encryption and compliance measures, ensuring that your documents and data remain safe and confidential.

Get more for Ir76c

- If not your notice may be invalid form

- The department of human services business applicationcentrepay sa389 form

- Pptc482pdf save reset form protected when

- Pdf 36kb australian maritime safety authority amsa gov form

- P 1018 form

- Act of grace application form august 2011doc act of grace application

- Httpsapi15ilovepdfcomv1download pinterest 529746599 form

- Pdf temporary resident visa application form

Find out other Ir76c

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement