BampO Annual Tax Report City of Lacey Form

What is the BampO Annual Tax Report City Of Lacey

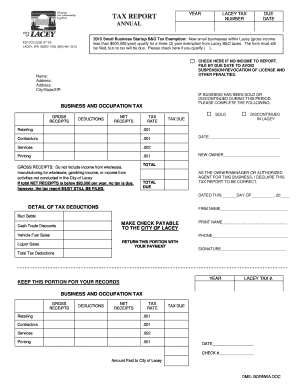

The BampO Annual Tax Report City Of Lacey is a tax form that businesses operating within the city must complete to report their business and occupation taxes. This report is essential for the city to assess the tax obligations of various businesses based on their revenue and activities. The form captures critical information about the business, including gross revenue, deductions, and any applicable tax credits. Accurate completion of this form ensures compliance with local tax regulations and helps maintain the financial health of the city.

Steps to complete the BampO Annual Tax Report City Of Lacey

Completing the BampO Annual Tax Report requires several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements and receipts. Next, fill out the form with the required information, ensuring that you report your gross revenue accurately. Be sure to include any deductions or credits that may apply to your business. Once the form is completed, review it carefully for any errors or omissions. Finally, submit the form by the specified deadline to avoid penalties.

Legal use of the BampO Annual Tax Report City Of Lacey

The legal use of the BampO Annual Tax Report is crucial for businesses in Lacey. This form serves as an official document that outlines a business's tax obligations to the city. It is important to submit this report accurately and on time to comply with local tax laws. Failure to do so may result in penalties or legal repercussions. Additionally, the information provided in this report can be used by the city for various purposes, including budget planning and resource allocation.

Filing Deadlines / Important Dates

Businesses must adhere to specific filing deadlines for the BampO Annual Tax Report to avoid penalties. Typically, the report is due on April 30th of each year, covering the previous calendar year's activities. It is essential to stay informed about any changes to these deadlines, as local regulations may vary. Marking these dates on your calendar can help ensure timely submission and compliance with local tax requirements.

Required Documents

When completing the BampO Annual Tax Report, businesses must have several documents on hand to ensure accurate reporting. Required documents typically include:

- Income statements detailing gross revenue

- Receipts for any deductions claimed

- Previous year's tax returns for reference

- Any relevant tax credit documentation

Having these documents ready will facilitate a smoother completion process and help ensure compliance with local tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The BampO Annual Tax Report can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission through the city's tax portal

- Mailing a printed copy to the designated tax office

- In-person submission at the local tax office

Each method has its own advantages, and businesses should choose the one that best fits their needs while ensuring they meet the submission deadline.

Penalties for Non-Compliance

Failure to file the BampO Annual Tax Report on time or providing inaccurate information can result in significant penalties. The city may impose fines based on the amount of tax owed or the length of the delay in filing. Additionally, businesses may face interest charges on any unpaid taxes. Understanding these penalties can motivate timely and accurate submissions, helping to avoid financial repercussions.

Quick guide on how to complete bampo annual tax report city of lacey

Complete BampO Annual Tax Report City Of Lacey effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage BampO Annual Tax Report City Of Lacey on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign BampO Annual Tax Report City Of Lacey with ease

- Find BampO Annual Tax Report City Of Lacey and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign BampO Annual Tax Report City Of Lacey and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bampo annual tax report city of lacey

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BampO Annual Tax Report City Of Lacey?

The BampO Annual Tax Report City Of Lacey is a tax document that businesses in Lacey must file annually to report their gross income and pay the appropriate Business and Occupation taxes. This report helps the city calculate tax revenues necessary for local services. Understanding this report is vital for compliance and financial accuracy.

-

How can airSlate SignNow assist with the BampO Annual Tax Report City Of Lacey?

airSlate SignNow provides a streamlined platform for signing and submitting the BampO Annual Tax Report City Of Lacey electronically. Our solution simplifies document management, making it easy to collect signatures and store documents securely. This saves time and reduces the hassle of paper filing.

-

What features does airSlate SignNow offer for managing the BampO Annual Tax Report City Of Lacey?

With airSlate SignNow, you can easily create, send, and track the BampO Annual Tax Report City Of Lacey. Key features include customizable templates, reminder notifications for deadlines, and secure cloud storage to keep your documents safe and accessible. These features ensure you never miss a filing deadline.

-

Is airSlate SignNow cost-effective for preparing the BampO Annual Tax Report City Of Lacey?

Yes, airSlate SignNow offers a cost-effective solution for preparing documents like the BampO Annual Tax Report City Of Lacey. With flexible pricing plans, you can choose the option that best fits your business needs. Our solution provides excellent value, saving you time and reducing the need for physical administrative resources.

-

Can I integrate airSlate SignNow with other accounting software for the BampO Annual Tax Report City Of Lacey?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your financial documents, including the BampO Annual Tax Report City Of Lacey. This integration enhances your workflow, allowing for real-time updates and improved document handling throughout the tax reporting process.

-

What benefits can I expect from using airSlate SignNow for the BampO Annual Tax Report City Of Lacey?

Using airSlate SignNow for the BampO Annual Tax Report City Of Lacey ensures a hassle-free and efficient document signing experience. You'll benefit from reduced paperwork, faster processing times, and the ability to manage documents remotely. Overall, it's designed to help you save time and avoid costly mistakes.

-

How secure is airSlate SignNow when handling the BampO Annual Tax Report City Of Lacey?

Security is a top priority at airSlate SignNow. When managing the BampO Annual Tax Report City Of Lacey, your documents are protected through advanced encryption and authentication measures. This ensures that sensitive financial information remains confidential and secure during the eSigning process.

Get more for BampO Annual Tax Report City Of Lacey

Find out other BampO Annual Tax Report City Of Lacey

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT