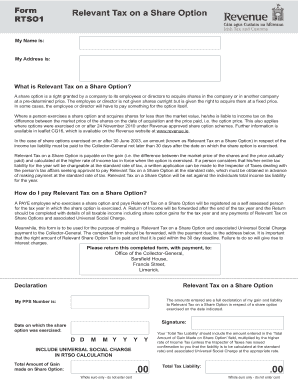

Rtso Form

What is the Rtso Form

The Rtso form, also known as the rtso1, is a crucial document used in various legal and administrative processes. It serves as a formal request or declaration that must be completed accurately to ensure compliance with relevant regulations. This form is particularly significant in contexts where precise information is required for legal validation, such as in business transactions or governmental procedures.

How to use the Rtso Form

Using the Rtso form involves several key steps to ensure that it is completed correctly. First, gather all necessary information that needs to be included in the form. This may involve personal details, business information, or specific declarations relevant to the purpose of the form. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once completed, the form may need to be submitted electronically or via traditional mail, depending on the requirements set forth by the issuing authority.

Steps to complete the Rtso Form

Completing the Rtso form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation and information needed to fill out the form.

- Fill in each section of the form, ensuring accuracy and completeness.

- Double-check the information entered for any errors or omissions.

- Sign and date the form as required, ensuring that your signature meets legal standards.

- Submit the completed form according to the specified submission methods.

Legal use of the Rtso Form

The legal use of the Rtso form is paramount in ensuring that the document is recognized by courts and other institutions. To be considered legally binding, the form must comply with relevant laws governing electronic signatures and document submissions. Utilizing a trusted platform for electronic signing, such as airSlate SignNow, can enhance the legal standing of the form by providing necessary certifications and compliance with regulations like ESIGN and UETA.

Key elements of the Rtso Form

Understanding the key elements of the Rtso form is essential for proper completion. These elements typically include:

- Personal Information: Details such as name, address, and contact information.

- Purpose of the Form: A clear statement indicating why the form is being submitted.

- Signatures: Required signatures from all relevant parties to validate the form.

- Date: The date on which the form is completed and signed.

Examples of using the Rtso Form

The Rtso form can be utilized in various scenarios, including:

- Business registrations where formal declarations are needed.

- Legal proceedings requiring documentation of agreements or contracts.

- Government applications that necessitate specific information from applicants.

Quick guide on how to complete rtso form

Complete Rtso Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage Rtso Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Rtso Form effortlessly

- Locate Rtso Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Rtso Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rtso form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RTSO full form in the context of airSlate SignNow?

The RTSO full form refers to 'Real-Time Security Operation,' an essential feature of airSlate SignNow that ensures your document signing process remains secure and efficient. This feature guarantees that every transaction is monitored in real-time to prevent unauthorized access and ensure compliance.

-

How does airSlate SignNow support businesses in understanding the RTSO full form?

AirSlate SignNow provides comprehensive resources and support to help businesses comprehend the RTSO full form and its implications for document security. Our customer support team is available to answer any questions and guide you through the features that enhance security within the platform.

-

What are the pricing options available for airSlate SignNow users?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs, starting from basic to advanced tiers. Each plan is designed to help users maximize their document signing experience, ensuring clear value while addressing the RTSO full form and overall security measures.

-

What features does airSlate SignNow offer related to the RTSO full form?

In addition to the RTSO full form feature, airSlate SignNow offers electronic signatures, document templates, and workflow automation to streamline your signing process. These features enhance efficiency while keeping your documents secure and compliant with industry standards.

-

How can airSlate SignNow help remote teams understand the RTSO full form?

AirSlate SignNow equips remote teams with tools that highlight the RTSO full form in practice, ensuring that every member understands the importance of real-time security in document management. Interactive tutorials and webinars are available to educate users about best practices for secure document handling.

-

What integrations are available with airSlate SignNow to enhance security related to the RTSO full form?

AirSlate SignNow seamlessly integrates with various platforms, including CRMs, cloud storage services, and productivity tools, to enhance document security and operational efficiency. These integrations support the essence of the RTSO full form by providing a secure environment for document exchanges across different applications.

-

What benefits does understanding the RTSO full form bring to businesses?

Understanding the RTSO full form is crucial for businesses as it directly relates to securing their document processes against fraud and non-compliance. With airSlate SignNow, knowing this term empowers organizations to adopt better practices in document management, leading to increased trust and streamlined operations.

Get more for Rtso Form

Find out other Rtso Form

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer