Indiana State Form 23104 Fillable

What is the Indiana State Form 23104 Fillable

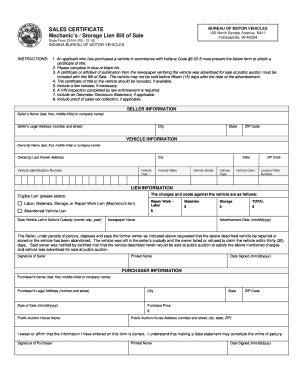

The Indiana State Form 23104 is a specific document used for reporting and filing certain tax-related information within the state of Indiana. This fillable form allows taxpayers to provide necessary details regarding their income, deductions, and credits. It is designed to streamline the process of tax reporting, making it easier for individuals and businesses to comply with state tax regulations. The form is available in a digital format, allowing users to fill it out electronically, which enhances accessibility and convenience.

How to use the Indiana State Form 23104 Fillable

Using the Indiana State Form 23104 fillable is a straightforward process. First, access the form online and download it or fill it out directly in your browser. Next, ensure that you have all the required information at hand, such as your Social Security number, income details, and any applicable deductions. As you complete the form, make sure to follow the instructions provided for each section to avoid errors. Once finished, you can save the completed form for your records or submit it electronically, depending on the submission options available.

Steps to complete the Indiana State Form 23104 Fillable

Completing the Indiana State Form 23104 fillable involves several key steps:

- Access the form from a reliable source.

- Gather necessary documents, including income statements and deduction records.

- Fill in your personal information accurately in the designated fields.

- Provide details about your income, including wages, dividends, and other earnings.

- List any deductions or credits you are eligible for, following the guidelines provided.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing, based on your preference.

Legal use of the Indiana State Form 23104 Fillable

The Indiana State Form 23104 fillable is legally valid when completed and submitted according to state regulations. To ensure its legal standing, it is essential to provide accurate information and adhere to submission deadlines. The form must be signed, either electronically or by hand, depending on the submission method chosen. Compliance with state tax laws is critical, as any discrepancies or inaccuracies can lead to penalties or legal issues.

Key elements of the Indiana State Form 23104 Fillable

Several key elements define the Indiana State Form 23104 fillable, including:

- Personal Information: This includes your name, address, and Social Security number.

- Income Details: A section for reporting various sources of income.

- Deductions and Credits: Areas to claim eligible deductions and tax credits.

- Signature Line: A space for your signature to validate the form.

- Instructions: Guidance on how to complete the form correctly.

Form Submission Methods

The Indiana State Form 23104 fillable can be submitted through various methods to accommodate different preferences. Users may choose to submit the form electronically via a secure online portal, ensuring a quick and efficient process. Alternatively, the completed form can be printed and mailed to the appropriate tax authority. In-person submissions may also be available at designated state offices, providing additional options for taxpayers who prefer direct interaction.

Quick guide on how to complete indiana state form 23104 fillable

Complete Indiana State Form 23104 Fillable effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Indiana State Form 23104 Fillable on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Indiana State Form 23104 Fillable effortlessly

- Locate Indiana State Form 23104 Fillable and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that intention.

- Create your signature using the Sign tool, which takes seconds and holds the same legal status as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Indiana State Form 23104 Fillable and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 23104 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is state form 23104 and why do I need it?

State form 23104 is a crucial document used for specific state compliance requirements. It is essential for businesses to complete this form accurately to ensure they meet regulatory standards. Using airSlate SignNow makes it easy to fill out, eSign, and submit state form 23104 efficiently.

-

How can airSlate SignNow help with filling out state form 23104?

airSlate SignNow provides a user-friendly platform that simplifies the filling process for state form 23104. Our template options allow you to pre-fill information, ensuring accuracy and saving time. You can also collaborate with team members to complete the form seamlessly.

-

Is there a fee to use airSlate SignNow for state form 23104?

airSlate SignNow offers a range of pricing plans designed to fit different business needs. You can choose a plan that allows you to eSign state form 23104 without worrying about additional costs. Our cost-effective solutions ensure you only pay for what you need.

-

What features does airSlate SignNow offer for processing state form 23104?

With airSlate SignNow, you can access features like eSigning, document storage, and real-time tracking specifically for state form 23104. The platform also integrates with various applications, simplifying your workflow and enhancing productivity. These features ensure you have everything needed for compliance.

-

Can I integrate airSlate SignNow with other tools I use for state form 23104?

Yes, airSlate SignNow can easily integrate with various tools such as CRM and project management software, allowing for a seamless workflow when handling state form 23104. This integration helps you keep your documents organized and easily accessible, streamlining your processes.

-

What are the benefits of using airSlate SignNow for state form 23104?

Using airSlate SignNow for state form 23104 provides several benefits, such as time savings, increased accuracy, and enhanced security. The platform's eSigning capabilities ensure that your documents are signed securely and stored safely, giving you peace of mind during the compliance process.

-

How does airSlate SignNow ensure the security of my state form 23104 documents?

airSlate SignNow employs advanced security measures including encryption and secure data storage to protect your state form 23104 documents. These features help ensure that your private information is safeguarded against unauthorized access. You can trust that your documents are secure with airSlate SignNow.

Get more for Indiana State Form 23104 Fillable

Find out other Indiana State Form 23104 Fillable

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure