Guide to Your PSERS Issued Form 1099 R Psers State Pa 2013

What is the Guide to Your PSERS Issued Form 1099-R?

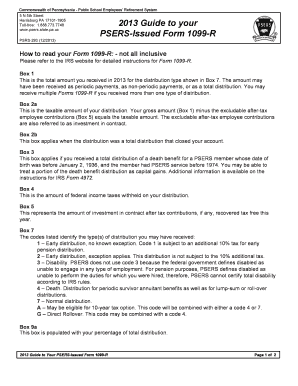

The Guide to Your PSERS Issued Form 1099-R is a crucial resource for individuals receiving retirement benefits from the Pennsylvania Public School Employees' Retirement System (PSERS). This form reports distributions from retirement accounts, including pensions, and is essential for tax reporting purposes. Understanding this guide helps recipients accurately interpret the information on their Form 1099-R, ensuring compliance with IRS regulations.

How to Use the Guide to Your PSERS Issued Form 1099-R

Using the Guide to Your PSERS Issued Form 1099-R involves several steps. First, familiarize yourself with the form's layout and the various boxes that contain important information. Each section of the guide corresponds to specific parts of the form, explaining what each entry means. This understanding allows recipients to verify the accuracy of their reported income and any taxes withheld, which is vital for completing tax returns correctly.

Steps to Complete the Guide to Your PSERS Issued Form 1099-R

Completing the Guide to Your PSERS Issued Form 1099-R requires careful attention to detail. Follow these steps:

- Review the personal information on the form, ensuring your name and Social Security number are correct.

- Check the distribution amount reported in Box 1, which indicates the total taxable amount.

- Verify the amount of federal income tax withheld in Box 4, if applicable.

- Refer to the guide for explanations of any codes in Box 7, as these indicate the type of distribution.

- Consult the IRS guidelines referenced in the guide for any specific filing requirements related to your situation.

Legal Use of the Guide to Your PSERS Issued Form 1099-R

The legal use of the Guide to Your PSERS Issued Form 1099-R is essential for ensuring compliance with tax laws. The information contained in the form must be reported accurately on your tax return. Misreporting can lead to penalties or audits by the IRS. The guide clarifies the legal implications of each section of the form, ensuring that recipients understand their responsibilities in reporting retirement income.

IRS Guidelines for the Guide to Your PSERS Issued Form 1099-R

The IRS provides specific guidelines for reporting income from retirement distributions, which are outlined in the Guide to Your PSERS Issued Form 1099-R. Recipients should be aware of the tax implications of their distributions, including potential penalties for early withdrawal. The guide emphasizes the importance of adhering to these IRS guidelines to avoid any issues during tax season.

Filing Deadlines and Important Dates

Filing deadlines for the Guide to Your PSERS Issued Form 1099-R are critical for compliance. Typically, recipients must report their retirement income by April 15 of the following tax year. It is important to stay informed about any changes to these deadlines, which may vary based on individual circumstances or IRS announcements. The guide includes a calendar of key dates to help recipients plan their filing accordingly.

Quick guide on how to complete 2013 guide to your psers issued form 1099 r psers state pa

Complete Guide To Your PSERS Issued Form 1099 R Psers State Pa effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without complications. Manage Guide To Your PSERS Issued Form 1099 R Psers State Pa on any device through airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Guide To Your PSERS Issued Form 1099 R Psers State Pa with ease

- Find Guide To Your PSERS Issued Form 1099 R Psers State Pa and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or hide sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Verify the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Guide To Your PSERS Issued Form 1099 R Psers State Pa and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 guide to your psers issued form 1099 r psers state pa

Create this form in 5 minutes!

How to create an eSignature for the 2013 guide to your psers issued form 1099 r psers state pa

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Guide To Your PSERS Issued Form 1099 R Psers State Pa?

The Guide To Your PSERS Issued Form 1099 R Psers State Pa is a comprehensive resource that helps you understand the purpose and details of your tax documents issued by PSERS. This guide offers insights into how to read your form, important deadlines, and how it impacts your tax filings.

-

How can airSlate SignNow help with my PSERS tax documents?

With airSlate SignNow, you can easily send, eSign, and manage your PSERS tax documents, including the Guide To Your PSERS Issued Form 1099 R Psers State Pa. Our user-friendly platform streamlines the process of obtaining necessary signatures and ensures your documents are securely stored.

-

What features are included in the airSlate SignNow solution?

airSlate SignNow provides robust features such as document templates, secure eSigning, and real-time tracking. These tools can signNowly enhance your workflow when dealing with the Guide To Your PSERS Issued Form 1099 R Psers State Pa, making the documentation process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for PSERS documents?

Yes, while airSlate SignNow offers various pricing plans, it is designed to be cost-effective for both individuals and businesses. By using it for the Guide To Your PSERS Issued Form 1099 R Psers State Pa, you can save time and reduce costs associated with traditional document handling methods.

-

Can I integrate airSlate SignNow with other services?

Absolutely! airSlate SignNow is compatible with a wide range of integrations, allowing you to streamline your document processes. When working with the Guide To Your PSERS Issued Form 1099 R Psers State Pa, you can connect with services like Google Drive and Dropbox for seamless document management.

-

What benefits does airSlate SignNow offer for handling tax forms?

Using airSlate SignNow for your tax forms, including the Guide To Your PSERS Issued Form 1099 R Psers State Pa, provides signNow benefits. These include enhanced document security, reduced processing time, and the ability to track the status of your forms, ensuring you never miss a deadline.

-

How long does it take to set up airSlate SignNow for my PSERS forms?

Setting up airSlate SignNow to manage your PSERS forms is quick and straightforward. Typically, you can start utilizing the platform to handle the Guide To Your PSERS Issued Form 1099 R Psers State Pa within just a few minutes, allowing you to focus on what matters most.

Get more for Guide To Your PSERS Issued Form 1099 R Psers State Pa

Find out other Guide To Your PSERS Issued Form 1099 R Psers State Pa

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later