Pa Rev 1220 Form 2020

What is the Pa Rev 1220 Form

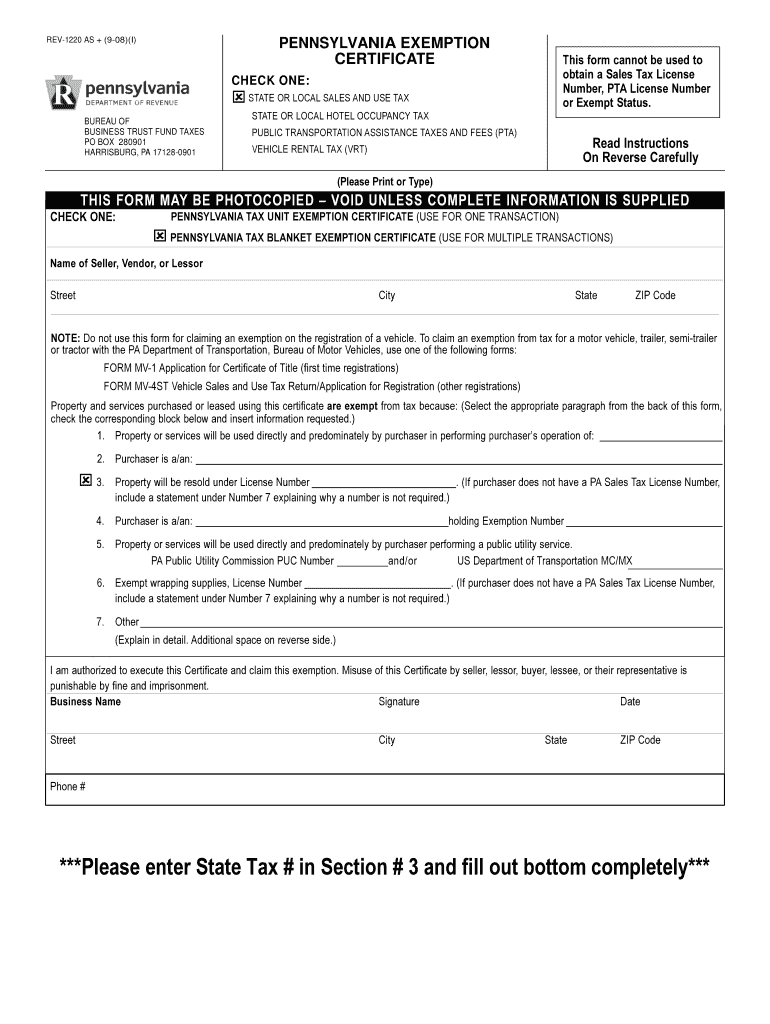

The Pa Rev 1220 Form is a Pennsylvania state tax form used primarily for the purpose of claiming a refund of overpaid personal income tax. This form is essential for individuals who have had excess taxes withheld from their paychecks or who qualify for various tax credits. Understanding the specific use of this form is crucial for ensuring compliance with Pennsylvania tax regulations.

How to use the Pa Rev 1220 Form

To effectively use the Pa Rev 1220 Form, individuals must accurately fill out the required sections, including personal information, income details, and the amount of tax withheld. It is important to double-check all entries for accuracy, as errors can delay processing or result in incorrect refunds. Additionally, taxpayers should ensure they have all necessary documentation, such as W-2 forms, to support their claims.

Steps to complete the Pa Rev 1220 Form

Completing the Pa Rev 1220 Form involves several key steps:

- Gather all relevant tax documents, including W-2s and any other income statements.

- Fill out personal information, including name, address, and Social Security number.

- Report total income and the amount of Pennsylvania income tax withheld.

- Calculate any eligible credits and deductions.

- Sign and date the form to confirm its accuracy.

Key elements of the Pa Rev 1220 Form

Several key elements are essential to the Pa Rev 1220 Form:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Reporting: Accurate reporting of total income is vital for determining tax liability.

- Tax Withheld: This section details the amount of Pennsylvania income tax that has been withheld.

- Signature: The form must be signed and dated by the taxpayer to validate the information provided.

Legal use of the Pa Rev 1220 Form

The Pa Rev 1220 Form is legally binding when completed and submitted according to Pennsylvania state tax laws. It is crucial for taxpayers to ensure that all information is accurate and truthful, as providing false information can lead to penalties or legal repercussions. Compliance with state regulations is essential for the form to be accepted and processed by the Pennsylvania Department of Revenue.

Form Submission Methods

The Pa Rev 1220 Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Taxpayers may have the option to submit the form electronically through the Pennsylvania Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate state tax office.

- In-Person: Individuals may also choose to deliver the form in person at designated state tax offices.

Quick guide on how to complete pa rev 1220 2008 form

Prepare Pa Rev 1220 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Pa Rev 1220 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Pa Rev 1220 Form with ease

- Locate Pa Rev 1220 Form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or misplaced documents, tedious form navigation, or errors that necessitate new document printouts. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Pa Rev 1220 Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa rev 1220 2008 form

Create this form in 5 minutes!

How to create an eSignature for the pa rev 1220 2008 form

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Pa Rev 1220 Form and why is it important?

The Pa Rev 1220 Form is a crucial document for Pennsylvania residents, used for tax reporting and compliance. It's important because it ensures accurate filings and prevents penalties by allowing users to report their income and deductions systematically. Proper handling of the Pa Rev 1220 Form can save you time and money in your tax preparations.

-

How can airSlate SignNow assist with completing the Pa Rev 1220 Form?

airSlate SignNow simplifies the process of completing the Pa Rev 1220 Form by providing an easy-to-use interface for filling out and signing documents. The platform allows for seamless collaboration, so multiple users can work on the form simultaneously, improving accuracy and efficiency. Additionally, electronic signatures ensure a legally binding process.

-

Is airSlate SignNow a cost-effective solution for managing the Pa Rev 1220 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for all your document management needs, including the Pa Rev 1220 Form. By eliminating the need for printing and mailing, it signNowly reduces overhead costs. The software offers affordable pricing plans that cater to businesses of all sizes.

-

What features does airSlate SignNow offer for the Pa Rev 1220 Form?

airSlate SignNow offers various features to aid the completion of the Pa Rev 1220 Form, including templates, in-document annotations, and integrated eSignature capabilities. Users can track the status of their documents in real-time, ensuring efficient processing. The platform is also mobile-friendly, allowing users to manage their forms on-the-go.

-

Can I integrate airSlate SignNow with other software for the Pa Rev 1220 Form?

Absolutely, airSlate SignNow offers integrations with various software applications to enhance your workflow while managing the Pa Rev 1220 Form. Whether you use CRM systems, storage solutions, or workflow automation tools, you can easily connect them with airSlate SignNow. This integration capability streamlines the process and minimizes the need for manual entry.

-

How does using airSlate SignNow benefit my business when managing the Pa Rev 1220 Form?

Using airSlate SignNow to manage the Pa Rev 1220 Form benefits your business by improving efficiency and reducing errors in document management. The ability to sign documents electronically not only speeds up the process but also enhances security and compliance. Additionally, your team can collaborate in real-time, ensuring the form is filled out correctly and promptly.

-

What related documents can be managed alongside the Pa Rev 1220 Form?

Alongside the Pa Rev 1220 Form, you can manage various related documents such as tax returns, annual reports, and other compliance paperwork using airSlate SignNow. The platform's versatility allows for the efficient handling of all pertinent paperwork in a unified system. This ensures that you remain organized and up-to-date with your financial obligations.

Get more for Pa Rev 1220 Form

- Sample letter for lost wages due to car accident from employer form

- Limited liability company articles of organization form

- Taltz enrollment form

- Pension form 7 in word format

- Da185 4a1 form

- How to check rental references for a ucsc student housing housing ucsc form

- Soccer camp registration form template jotform

- The marian carmichael 4 h scholarship form

Find out other Pa Rev 1220 Form

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation