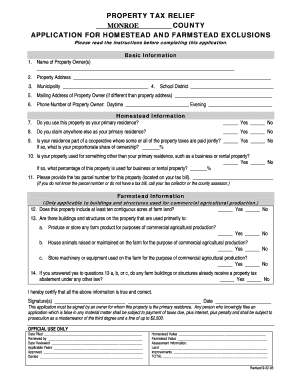

Monroe County Homestead Exemption Form

What is the Monroe County Homestead Exemption

The Monroe County Homestead Exemption is a tax relief program designed to reduce the property tax burden for eligible homeowners. This exemption allows qualifying residents to exempt a portion of their home's assessed value from taxation, resulting in a lower property tax bill. The program aims to support homeowners, particularly those with limited income, by making homeownership more affordable.

Eligibility Criteria

To qualify for the Monroe County Homestead Exemption, applicants must meet specific criteria. Generally, the following conditions apply:

- The applicant must be a legal resident of Monroe County.

- The property must be the applicant's primary residence.

- The applicant must not have income exceeding the limits set by the county.

- The property must not be used for commercial purposes.

Steps to Complete the Monroe County Homestead Exemption

Filling out the Monroe County Homestead Exemption form involves several key steps:

- Gather necessary documentation, including proof of residency and income statements.

- Obtain the Monroe County Homestead Exemption application form from the county office or online.

- Complete the form, ensuring all information is accurate and complete.

- Submit the application by the designated deadline, either online, by mail, or in person.

Required Documents

When applying for the Monroe County Homestead Exemption, certain documents are required to verify eligibility. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of income, such as pay stubs or tax returns.

- Proof of residency, such as a utility bill or lease agreement.

Form Submission Methods

Applicants can submit the Monroe County Homestead Exemption form through various methods to ensure convenience:

- Online submission via the county's official website.

- Mailing the completed form to the appropriate county office.

- In-person submission at designated county offices.

Legal Use of the Monroe County Homestead Exemption

The Monroe County Homestead Exemption is governed by specific laws that outline its legal use. Homeowners must adhere to these regulations to maintain their exemption status. Misuse or failure to comply with the requirements can lead to penalties, including the revocation of the exemption and potential back taxes owed.

Quick guide on how to complete monroe county homestead exemption

Effortlessly prepare Monroe County Homestead Exemption on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Monroe County Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Monroe County Homestead Exemption with ease

- Find Monroe County Homestead Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and eSign Monroe County Homestead Exemption to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monroe county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Monroe County PA homestead exemption?

The Monroe County PA homestead exemption is a tax benefit designed to reduce the taxable value of your primary residence, ultimately lowering your property taxes. Homeowners can apply for this exemption to gain substantial savings, making it a valuable financial tool for residents in Monroe County.

-

How can I apply for the Monroe County PA homestead exemption?

To apply for the Monroe County PA homestead exemption, you need to complete the application form available on the county's official website. Ensure you provide accurate information about your property and submit the application before the deadline to receive the exemption for the upcoming tax year.

-

Are there eligibility requirements for the Monroe County PA homestead exemption?

Yes, to qualify for the Monroe County PA homestead exemption, you must be a resident of Monroe County and occupy the property as your primary residence. Additionally, you may need to meet certain income and ownership criteria, so it's essential to review the guidelines provided by the county.

-

What benefits does the Monroe County PA homestead exemption offer?

The primary benefit of the Monroe County PA homestead exemption is the reduction in property taxes, which can provide signNow savings for homeowners. This exemption not only lowers the financial burden but also allows residents to allocate their resources towards other essential needs.

-

Can I combine the Monroe County PA homestead exemption with other tax benefits?

Yes, you can combine the Monroe County PA homestead exemption with other tax benefits, like the senior citizen tax rebate or other local property tax discounts. Combining these benefits can maximize your savings, allowing you to enjoy a more manageable tax bill.

-

How much will I save with the Monroe County PA homestead exemption?

The savings offered by the Monroe County PA homestead exemption can vary based on the assessed value of your home and the specific exemption amount set by the county. Typically, homeowners can expect to see a noticeable reduction in their annual property taxes, enhancing their financial feasibility.

-

Is there a renewal process for the Monroe County PA homestead exemption?

Once granted, the Monroe County PA homestead exemption does not usually require annual renewal, as long as you continue to meet the eligibility criteria. However, it's advisable to check periodically with the local tax authority to ensure that your records are updated and accurate.

Get more for Monroe County Homestead Exemption

- How to get record expunged in henry county ga form

- Gwinnett county magistrate court file a traverse online form

- Cdocuments and settingsrmcphaulgacourtsdesktopnew pto formsepfvpowpd

- Georgia qit form

- Illinois qildro form

- Form 8014 300 20m first mortgage individual or corporation

- Applicants name name of reference form

- Aoc pt 55 form

Find out other Monroe County Homestead Exemption

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast