Ct Form

What is the Ct

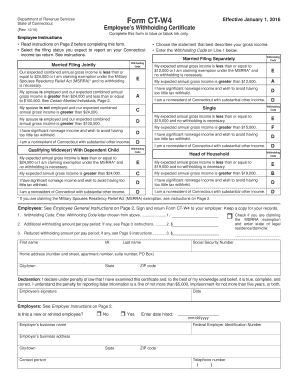

The Ct form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). The form is essential for compliance with federal tax regulations and helps ensure accurate reporting of income and expenses. Understanding the purpose and requirements of the Ct form is crucial for anyone involved in tax filing or financial reporting.

How to use the Ct

Using the Ct form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and expense records. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors. Once completed, review the form for any mistakes before submitting it to the IRS. Proper use of the Ct form can help prevent delays in processing and potential penalties.

Steps to complete the Ct

Completing the Ct form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, input your income details, including wages, dividends, and any other sources of income. Follow this by listing any deductions or credits you are eligible for. After filling out each section, double-check all entries for accuracy. Finally, sign and date the form before submitting it according to the specified guidelines.

Legal use of the Ct

The Ct form is legally binding when completed and submitted according to IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or penalties. The form must be filed by the designated deadline to maintain compliance with tax laws. Additionally, using a reliable electronic signature solution can enhance the legitimacy of the form, ensuring that it meets all legal requirements for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Ct form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as these can vary based on specific tax situations or updates from the IRS. Marking these dates on a calendar can help ensure timely submission.

Required Documents

To complete the Ct form accurately, several documents are typically required. These may include W-2 forms from employers, 1099 forms for freelance income, and any receipts or documentation related to deductions. It is advisable to gather all relevant financial documents before starting the form to streamline the process. Having these documents on hand can help prevent errors and ensure that all necessary information is included.

Who Issues the Form

The Ct form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that individuals and businesses understand their obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to filing procedures.

Quick guide on how to complete ct 100691825

Complete Ct seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly without delays. Manage Ct on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Ct effortlessly

- Obtain Ct and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting. airSlate SignNow fulfills your document management needs in a few clicks from any device you choose. Alter and eSign Ct and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 100691825

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work in Ct.?

airSlate SignNow is a comprehensive eSignature solution that enables businesses in Ct. to send and sign documents digitally. It simplifies the document workflow, allowing users to manage contracts and agreements efficiently without the hassle of paper processes. With a user-friendly interface, you can get documents signed from anywhere and on any device.

-

What pricing plans does airSlate SignNow offer for businesses in Ct.?

airSlate SignNow provides flexible pricing plans tailored to meet the diverse needs of businesses in Ct. The plans range from basic to advanced options, allowing you to choose the right fit based on the number of users and features required. Each plan offers essential functionalities, including unlimited eSignatures and document templates.

-

Can airSlate SignNow integrate with other tools and applications used in Ct.?

Yes, airSlate SignNow offers robust integrations with a wide range of applications commonly used by businesses in Ct. This includes popular tools like Salesforce, Google Drive, and Microsoft Office. These integrations help streamline your workflow and enhance collaboration across various platforms.

-

What features of airSlate SignNow benefit businesses in Ct.?

AirSlate SignNow comes with numerous features that benefit businesses in Ct., such as customizable templates, real-time tracking of document status, and advanced security measures. Additionally, users can create automated workflows to save time and increase productivity. The intuitive design ensures a seamless signing experience for both senders and recipients.

-

Is airSlate SignNow secure for handling sensitive documents in Ct.?

Absolutely! airSlate SignNow prioritizes security, ensuring that sensitive documents are protected with encryption and compliance with industry standards. Businesses in Ct. can safely send and receive documents knowing that their data is secure. The platform also offers features like multi-factor authentication to enhance security further.

-

How can airSlate SignNow help improve document turnaround time in Ct.?

By using airSlate SignNow, businesses in Ct. can signNowly reduce document turnaround time. The eSignature solution allows for instant sending and signing of documents, eliminating the delays associated with traditional paper methods. With automated reminders and notifications, you'll never miss a deadline.

-

What benefits does airSlate SignNow provide for small businesses in Ct.?

For small businesses in Ct., airSlate SignNow offers a cost-effective and user-friendly solution to manage electronic signatures efficiently. Its affordability and rich feature set help small teams streamline their operations and enhance productivity. Plus, the mobile accessibility allows business owners to stay productive while on the go.

Get more for Ct

Find out other Ct

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe