Lavalink Loans Form

What is the Lavalink Loans

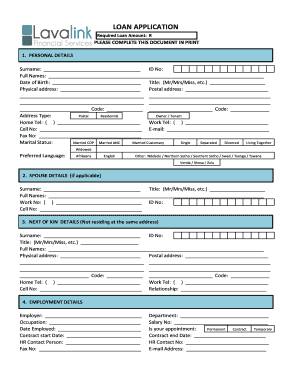

The Lavalink Loans form is a financial document used to apply for loans through specific lending institutions. This form typically requires detailed personal and financial information to assess eligibility and determine loan terms. Understanding the purpose of this form is crucial for borrowers seeking financial assistance.

How to use the Lavalink Loans

Using the Lavalink Loans form involves several key steps. First, gather all necessary personal and financial documents, such as identification, income statements, and credit history. Next, fill out the form accurately, ensuring all information is complete and truthful. After completing the form, review it for any errors before submission to avoid delays in processing.

Steps to complete the Lavalink Loans

Completing the Lavalink Loans form requires a systematic approach. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Provide personal information, including your name, address, and Social Security number.

- Detail your financial situation, including income, expenses, and existing debts.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or in person, depending on the lender's requirements.

Legal use of the Lavalink Loans

The Lavalink Loans form must be used in compliance with applicable laws and regulations. This includes ensuring that all information provided is accurate and that the form is filled out according to the lender's guidelines. Legal compliance is essential to prevent issues during the loan approval process.

Eligibility Criteria

Eligibility for Lavalink Loans typically depends on several factors, including credit score, income level, and employment status. Lenders may have specific requirements regarding the minimum credit score or income threshold that applicants must meet. Understanding these criteria is crucial for potential borrowers to determine their likelihood of approval.

Application Process & Approval Time

The application process for Lavalink Loans generally involves submitting the completed form along with any required documentation. After submission, lenders will review the application, which can take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application. Staying informed about the status of your application can help manage expectations during this period.

Quick guide on how to complete lavalink loans

Effortlessly Prepare Lavalink Loans on Any Device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the proper format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Lavalink Loans on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Lavalink Loans effortlessly

- Locate Lavalink Loans and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Alter and electronically sign Lavalink Loans and guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lavalink loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are lavalink loans and how do they work?

Lavalink loans are innovative financing solutions designed to provide businesses with quick access to capital. These loans work by allowing businesses to apply online, where they can receive funds based on their specific needs and credit profile. With flexible terms and competitive rates, lavalink loans aim to empower businesses to manage cash flow efficiently.

-

What are the benefits of choosing lavalink loans?

Choosing lavalink loans offers several benefits, including rapid approval times and flexible repayment options. The streamlined application process means that businesses can obtain financing without the lengthy paperwork often associated with traditional loans. Additionally, lavalink loans can help businesses invest in growth opportunities quickly.

-

How can I apply for lavalink loans?

Applying for lavalink loans is straightforward and can be completed online in just a few minutes. Prospective borrowers need to submit an application form along with basic financial information. Once submitted, the review process is quick, allowing you to access your funds sooner.

-

What features are included with lavalink loans?

Lavalink loans come equipped with features that enhance the borrowing experience, such as transparent fee structures and customizable loan terms. Borrowers can choose repayment plans that align with their budgets, ensuring that financial management is optimized. This ensures that lavalink loans are adaptable to a variety of business scenarios.

-

Are there any fees associated with lavalink loans?

When it comes to lavalink loans, there are typically minimal associated fees, which are clearly detailed during the application process. Understanding these fees upfront helps businesses to budget effectively for their financing costs. Competitive rates are designed to make the repayment process as affordable as possible.

-

Can I use lavalink loans for any purpose?

Yes, lavalink loans are versatile and can be utilized for various purposes, such as purchasing inventory, expanding operations, or covering unexpected expenses. This flexibility enables businesses to direct funds toward their most urgent financial needs. Whether you're a startup or an established enterprise, lavalink loans can support your objectives.

-

How long does it take to receive lavalink loans after applying?

The time frame for receiving lavalink loans can vary based on the application details, but many borrowers receive funds within a few business days. This quick turnaround is designed to help businesses get access to capital when they need it most. After an approval decision, funds are often deposited directly into the borrower's account.

Get more for Lavalink Loans

Find out other Lavalink Loans

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease