Tpt Form

What is the Tpt Form

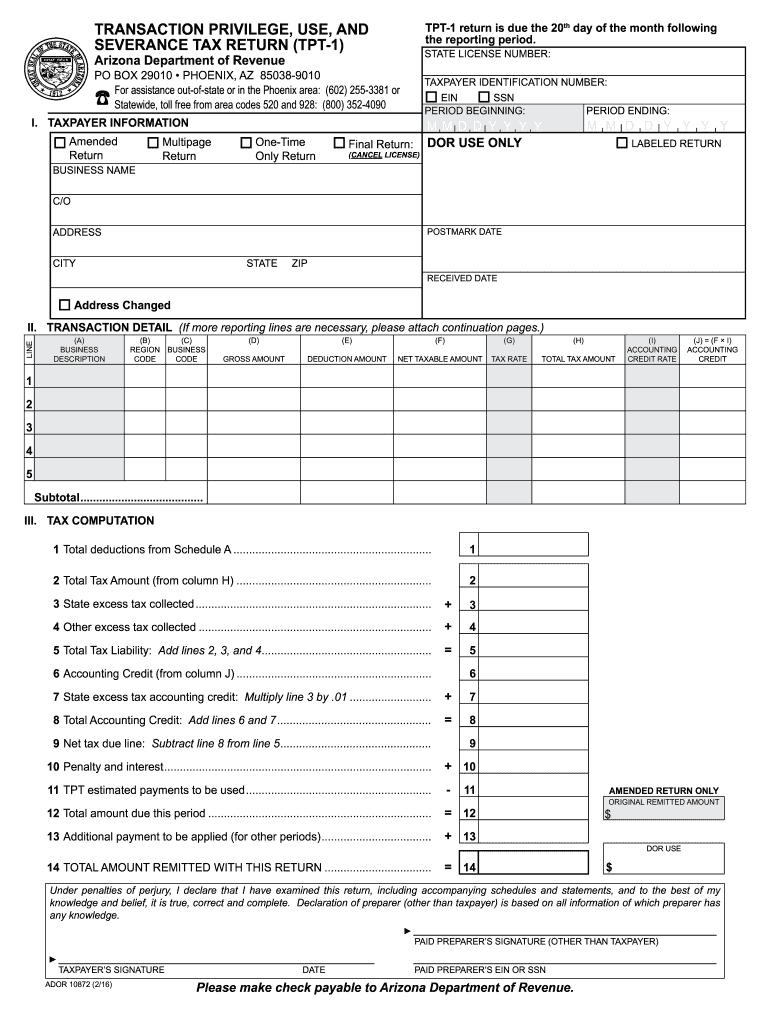

The Transaction Privilege Tax (TPT) form is a crucial document used by businesses in Arizona to report and pay taxes on their gross income from sales. Unlike a traditional sales tax, the TPT is levied on the seller for the privilege of doing business in the state. This form is essential for various types of businesses, including retail, contracting, and utility services. Understanding the TPT form is vital for compliance with Arizona tax regulations and for avoiding potential penalties.

Steps to complete the Tpt Form

Completing the TPT form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and expense reports. Next, accurately calculate your gross income for the reporting period. This includes all sales made, minus any allowable deductions. Once you have your figures, fill out the TPT form, ensuring that all required fields are completed. Finally, review the form for any errors before submitting it to the Arizona Department of Revenue.

Legal use of the Tpt Form

The TPT form must be used in accordance with Arizona state laws to ensure its legal validity. This includes adhering to the guidelines set forth by the Arizona Department of Revenue regarding reporting periods, tax rates, and payment deadlines. Failure to comply with these regulations can result in penalties or audits. It is important to keep records of all submitted forms and payments for future reference and verification.

Form Submission Methods

Businesses can submit the TPT form through various methods, including online, by mail, or in person. The online submission is often the most efficient, allowing for immediate processing and confirmation. For those who prefer traditional methods, mailing the completed form is an option, though it may take longer for processing. In-person submissions can be made at designated Arizona Department of Revenue offices, providing an opportunity to ask questions or clarify any issues directly.

Required Documents

When completing the TPT form, certain documents are required to substantiate the information provided. These include sales records, invoices, and any relevant receipts that detail gross income. Additionally, businesses may need to provide documentation for any deductions claimed, such as sales returns or discounts offered. Having these documents organized and readily available can streamline the completion process and ensure compliance.

Penalties for Non-Compliance

Failure to file the TPT form accurately and on time can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. The Arizona Department of Revenue actively enforces compliance, making it essential for businesses to understand their obligations. Regularly reviewing tax responsibilities and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete tpt form

Complete Tpt Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Tpt Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Tpt Form without any hassle

- Obtain Tpt Form and click Get Form to initiate.

- Use the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign Tpt Form and ensure excellent communication during every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpt form

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is azdor gov and how does it relate to airSlate SignNow?

Azdor gov is a government initiative aimed at streamlining digital processes, including electronic signatures. airSlate SignNow is an ideal solution that aligns with azdor gov by empowering businesses to eSign documents easily and securely, enhancing workflow efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, making it an affordable option in line with azdor gov standards. Each plan includes special features to help organizations manage their documents effectively without breaking the bank.

-

What features does airSlate SignNow offer that support azdor gov compliance?

airSlate SignNow includes multiple features designed to ensure compliance with azdor gov guidelines, such as secure storage, advanced encryption, and audit trails. These features help businesses manage their eSigning processes while adhering to regulatory requirements.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow helps businesses save time and money by simplifying the document signing process. With its user-friendly interface and compliance with initiatives like azdor gov, organizations can facilitate faster agreements and improve overall productivity.

-

Is airSlate SignNow easy to integrate with other software?

Yes, airSlate SignNow easily integrates with various third-party applications and services, enhancing its functionality in an ecosystem that supports azdor gov initiatives. This seamless integration allows businesses to streamline their operations and improve workflow efficiency.

-

Can airSlate SignNow help with managing multiple signers?

Absolutely! airSlate SignNow provides tools to manage multiple signers effortlessly, making it easier for organizations to adhere to azdor gov processes. With features that support team collaboration, signing documents in bulk becomes a quick and efficient task.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes the security of its users by implementing robust encryption and authentication measures that comply with standards such as those promoted by azdor gov. Users can trust that their documents and data are protected throughout the signing process.

Get more for Tpt Form

- Strategic plan for the hunger project sweden hungerprojektet form

- Ohio civil service application gen 4268 fillable form

- Bexar county alarm permit form

- Agsv tennis score sheet other than firsts form

- Hughston clinic medical records form

- Fsa form

- Thyroid worksheet ultrasound radiology of indiana form

- The university of tennessee equipment inventory change controller tennessee form

Find out other Tpt Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement