Iowa Individual Income Tax Long Form IA 1040 State of Iowa Iowa

What is the Iowa Individual Income Tax Long Form IA 1040?

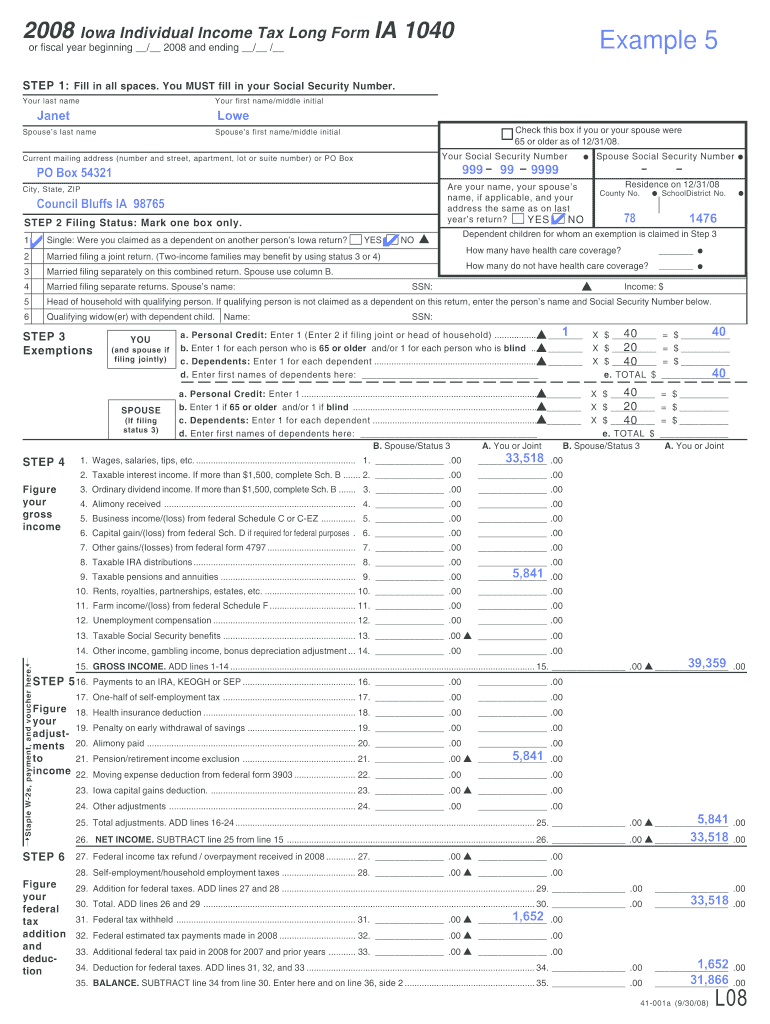

The Iowa Individual Income Tax Long Form IA 1040 is a comprehensive document used by residents of Iowa to report their income and calculate their state income tax liability. This form is essential for individuals who earn income in Iowa and need to comply with state tax regulations. It includes various sections where taxpayers must provide personal information, income details, deductions, and credits. Understanding this form is crucial for ensuring accurate reporting and compliance with Iowa tax laws.

Steps to Complete the Iowa Individual Income Tax Long Form IA 1040

Completing the Iowa Individual Income Tax Long Form IA 1040 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, dividends, and business income.

- Claim deductions and credits applicable to your situation, which may include standard deductions or itemized deductions.

- Calculate your total tax liability based on the income reported and deductions claimed.

- Review the form for accuracy and completeness before submission.

How to Obtain the Iowa Individual Income Tax Long Form IA 1040

The Iowa Individual Income Tax Long Form IA 1040 can be obtained through several methods. Taxpayers can download the form directly from the Iowa Department of Revenue website, where it is available in PDF format. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal Use of the Iowa Individual Income Tax Long Form IA 1040

The Iowa Individual Income Tax Long Form IA 1040 is legally binding when completed accurately and submitted in accordance with state laws. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Iowa Department of Revenue. This includes providing truthful information and signing the form where required. Electronic submissions of the form are also recognized as valid under current eSignature laws, provided that the appropriate digital signature methods are used.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Individual Income Tax Long Form IA 1040 are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 30 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, as late submissions may incur penalties and interest on unpaid taxes.

Required Documents

To complete the Iowa Individual Income Tax Long Form IA 1040, taxpayers need to gather various documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of payments made for estimated taxes, if applicable

- Any additional documentation that supports income or deductions

Quick guide on how to complete iowa individual income tax long form ia 1040 state of iowa iowa

Complete Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa with ease

- Acquire Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa individual income tax long form ia 1040 state of iowa iowa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Iowa state income tax?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents efficiently. Understanding your Iowa state income tax obligations is important for businesses, and using SignNow streamlines the document management process, ensuring compliance with tax regulations.

-

How does airSlate SignNow help with managing Iowa state income tax forms?

With airSlate SignNow, users can easily send and receive Iowa state income tax forms electronically. This reduces paperwork, accelerates the signing process, and keeps all tax documents organized, which is essential for timely submission and compliance.

-

What pricing plans does airSlate SignNow offer for Iowa residents?

airSlate SignNow offers various pricing plans that cater to different business needs in Iowa. These plans provide cost-effective solutions for document management, helping businesses efficiently handle their Iowa state income tax forms without breaking the bank.

-

Can airSlate SignNow integrate with tax software for Iowa state income tax preparation?

Yes, airSlate SignNow seamlessly integrates with popular tax software, making it easier to prepare Iowa state income tax returns. This integration allows for quick access to signed documents and reduces the hassle of transferring information between applications.

-

How secure is airSlate SignNow when handling Iowa state income tax documents?

airSlate SignNow prioritizes security by using advanced encryption and secure storage protocols to protect your Iowa state income tax documents. With features like audit trails and user authentication, users can feel confident that their sensitive information is safe.

-

Does airSlate SignNow support mobile access for Iowa state income tax tasks?

Absolutely! airSlate SignNow provides a mobile-friendly platform, allowing users to manage their Iowa state income tax documents on-the-go. This flexibility ensures that you can sign and send important tax documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for Iowa state income tax documentation?

Using airSlate SignNow offers several benefits for managing Iowa state income tax documentation, including increased efficiency, reduced turnaround times, and lower administrative costs. These advantages help streamline the tax filing process, ensuring your business stays compliant with Iowa tax laws.

Get more for Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa

- Preneed funeral contract form

- Ub 04 cms form

- Aha instructor monitor form 441848097

- Printing services ampamp digiprint centersprint ampamp mail services form

- Legal name dba include all legal entities and associated dba for each business form

- Chapter officers handbook afcea form

- Wound assessment angelus home health home angelushomehealth form

- Golden gate pediatrics a medical corporation form

Find out other Iowa Individual Income Tax Long Form IA 1040 State Of Iowa Iowa

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT