Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky Form

What is the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky

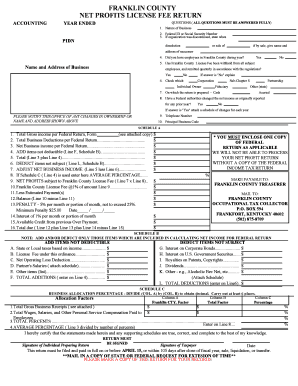

The Crystal Reports Franklin County Net Profits License Fee Return is a specific form required by the local government of Franklin County, Kentucky. This document is used by businesses to report their net profits and calculate the corresponding license fee owed to the county. It is essential for ensuring compliance with local tax regulations and for maintaining good standing with the county authorities. The form captures critical financial information, which is used to assess the tax liability of businesses operating within the county.

Steps to complete the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky

Completing the Crystal Reports Franklin County Net Profits License Fee Return involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Calculate your net profits by subtracting total expenses from total income.

- Fill out the form, entering your calculated net profits and any other required information accurately.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form by the specified deadline, either online or via mail, as per the county's guidelines.

Legal use of the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky

The legal use of the Crystal Reports Franklin County Net Profits License Fee Return is governed by local tax laws in Franklin County, Kentucky. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with these regulations can result in penalties, including fines or interest on unpaid fees. Additionally, the information provided on the form may be subject to audits by local tax authorities, making it crucial for businesses to maintain accurate records and ensure compliance with all legal requirements.

Who Issues the Form

The Crystal Reports Franklin County Net Profits License Fee Return is issued by the Franklin County Clerk's Office. This office is responsible for overseeing the collection of local taxes and ensuring that businesses comply with county regulations. The form is typically available through the clerk's office or their official website, where businesses can also find additional resources and guidance on completing the form correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Crystal Reports Franklin County Net Profits License Fee Return are crucial for businesses to adhere to in order to avoid penalties. Generally, the form must be submitted by April 15th of each year for the previous calendar year's earnings. However, businesses should verify specific deadlines with the Franklin County Clerk's Office, as they may vary based on local regulations or changes in tax law.

Required Documents

To complete the Crystal Reports Franklin County Net Profits License Fee Return, businesses need to prepare several required documents, including:

- Income statements detailing total revenue.

- Expense records to calculate net profits accurately.

- Previous year's tax returns, if applicable, for reference.

- Any additional documentation requested by the Franklin County Clerk's Office.

Quick guide on how to complete crystal reports franklin county net profits license fee return franklincounty ky

Effortlessly Prepare Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without delays. Handle Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky Smoothly

- Obtain Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only moments and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crystal reports franklin county net profits license fee return franklincounty ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky.?

The Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky. is a comprehensive report designed to help businesses accurately calculate and submit their license fee returns to Franklin County. This document ensures compliance with local tax regulations and simplifies the reporting process.

-

How can airSlate SignNow help with the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky.?

airSlate SignNow streamlines the process of generating and electronically signing the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky. Our platform allows businesses to create, send, and manage these documents efficiently, reducing turnaround times and enhancing accuracy.

-

What features does airSlate SignNow offer for managing Crystal Reports?

airSlate SignNow provides features tailored for managing Crystal Reports, including eSignature capabilities, document templates, and cloud storage. These functionalities enable businesses to generate the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky. quickly and share them securely with stakeholders.

-

Is there a cost associated with using airSlate SignNow for the Crystal Reports?

Yes, using airSlate SignNow involves subscription pricing tailored for different business needs. Our plans are designed to be cost-effective, ensuring that the benefits of managing Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky. far outweigh the expenses.

-

Can I integrate airSlate SignNow with other software for better document management?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your document management processes. Connecting with your existing software allows for a seamless workflow when preparing the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky.

-

How secure is the data when using airSlate SignNow for Crystal Reports?

Data security is a priority for us at airSlate SignNow. We employ advanced encryption protocols and comply with industry standards to ensure that your Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky. and other sensitive documents remain safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for my license fee returns?

Using airSlate SignNow for your license fee returns, including the Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky., simplifies the filing process. It allows for quicker approvals, decreased paperwork errors, and provides a complete audit trail for your records.

Get more for Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky

- Peoplesbankdirect form

- Payroll direct deposit authorization form use this form fampm bank

- Eaglemark savings bank form

- Tachi palace win loss statement form

- Qsst election statement sample form

- Wells fargo business loan application pdf form

- Iwi805 v17 aim portfolio iht plan cal investec form

- Arvest direct deposit form

Find out other Crystal Reports FRANKLIN COUNTY NET PROFITS LICENSE FEE RETURN Franklincounty Ky

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement