Form T 218 Georgia Department of Revenue Motor Etax Dor Ga

What is the Form T-218 Georgia Department of Revenue Motor Etax Dor Ga

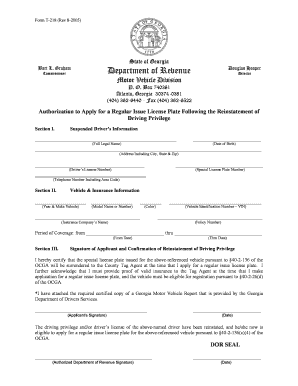

The Form T-218 is a document issued by the Georgia Department of Revenue specifically for motor vehicle taxation. This form is essential for individuals and businesses that need to report and pay motor vehicle taxes in Georgia. It serves as a declaration of the vehicle's value and tax liability, ensuring compliance with state tax regulations. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form T-218 Georgia Department of Revenue Motor Etax Dor Ga

Using the Form T-218 involves several steps to ensure proper completion and submission. First, gather all necessary information about the vehicle, including its make, model, year, and value. Next, fill out the form accurately, ensuring that all details are correct to avoid delays. Once completed, the form can be submitted electronically or via mail, depending on your preference and the options provided by the Georgia Department of Revenue.

Steps to complete the Form T-218 Georgia Department of Revenue Motor Etax Dor Ga

Completing the Form T-218 requires attention to detail. Here are the steps to follow:

- Gather vehicle information, including make, model, year, and VIN.

- Determine the vehicle's fair market value using reliable sources.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically through the Georgia Department of Revenue's website or mail it to the appropriate address.

Legal use of the Form T-218 Georgia Department of Revenue Motor Etax Dor Ga

The Form T-218 is legally binding when completed and submitted according to the guidelines set by the Georgia Department of Revenue. It must be filled out truthfully, as providing false information can lead to legal consequences. The form's legal standing is supported by compliance with state tax laws, making it a critical document for vehicle owners in Georgia.

Key elements of the Form T-218 Georgia Department of Revenue Motor Etax Dor Ga

Key elements of the Form T-218 include:

- Vehicle identification details, such as make, model, and VIN.

- Owner information, including name and address.

- Assessment of the vehicle's fair market value.

- Calculation of the applicable motor vehicle tax.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the Form T-218. Typically, the form must be submitted by the end of the tax year to avoid penalties. Keeping track of these dates ensures compliance with state regulations and helps avoid unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The Form T-218 can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via the Georgia Department of Revenue's official website.

- Mailing the completed form to the designated address.

- In-person submission at local Department of Revenue offices.

Quick guide on how to complete form t 218 georgia department of revenue motor etax dor ga

Manage Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga smoothly on any device

Digital document management has become favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow offers you all the tools you need to create, modify, and electronically sign your documents quickly without delays. Work with Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga on any platform using airSlate SignNow Android or iOS applications and simplify any document-focused process today.

The easiest way to modify and electronically sign Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga effortlessly

- Find Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t 218 georgia department of revenue motor etax dor ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form T 218 for the Georgia Department of Revenue?

Form T 218 is a specific document required by the Georgia Department of Revenue for Motor Vehicle taxes. It is essential for ensuring compliance with state tax regulations. By completing Form T 218 accurately, you can avoid potential penalties and streamline the registration process for your motor vehicle.

-

How can airSlate SignNow help me with Form T 218?

airSlate SignNow provides an efficient platform to complete, eSign, and submit Form T 218 Georgia Department of Revenue Motor Etax Dor Ga. Our easy-to-use interface allows you to manage the document signing process to save time and ensure compliance with state requirements.

-

Is there a cost to use airSlate SignNow for Form T 218?

airSlate SignNow offers a cost-effective solution for handling Form T 218 Georgia Department of Revenue Motor Etax Dor Ga. We provide various pricing plans tailored for businesses of all sizes, allowing you to choose the option that best fits your needs and budget.

-

What features does airSlate SignNow offer for document signing?

With airSlate SignNow, you can quickly eSign Form T 218 Georgia Department of Revenue Motor Etax Dor Ga and access features like document templates, automated workflows, and real-time tracking. Our platform makes it simple to send, sign, and manage your documents securely.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow easily integrates with a variety of popular applications and software tools. This means you can streamline your processes related to Form T 218 Georgia Department of Revenue Motor Etax Dor Ga alongside your existing workflow systems.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, such as Form T 218 Georgia Department of Revenue Motor Etax Dor Ga, enhances efficiency and security. You can quickly finalize documents digitally, reducing paperwork, and ensuring that sensitive information is protected.

-

How does airSlate SignNow ensure the security of my Form T 218 submissions?

airSlate SignNow utilizes advanced encryption and secure cloud storage to protect your Form T 218 Georgia Department of Revenue Motor Etax Dor Ga submissions. We prioritize data security, so you can confidently share and eSign your documents without compromising sensitive information.

Get more for Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga

- Maryland state unemployment application form

- Intern evaluation forms dbm maryland

- How to fill up dtr form

- How to get work permit in michigan 2011 form

- Michigan form

- Modes 4 7 fillable 2012 form

- Quarterly contribution and wage report form

- Request for assistance for child victims of human trafficking request for assistance form

Find out other Form T 218 Georgia Department Of Revenue Motor Etax Dor Ga

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed