Arkansas Homestead Exemption Form

What is the Arkansas Homestead Exemption Form

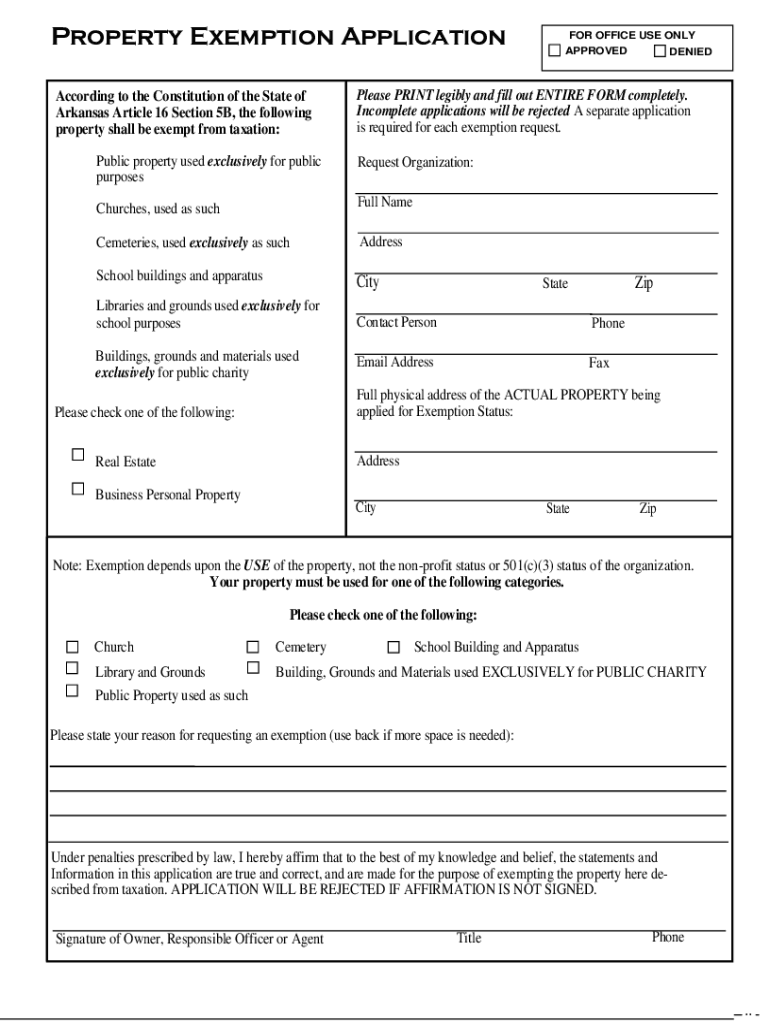

The Arkansas Homestead Exemption Form is a legal document that allows property owners in Arkansas to apply for a reduction in their property taxes. This form is essential for homeowners seeking to benefit from the homestead exemption, which can significantly lower their tax burden. The exemption applies to the primary residence of the homeowner, providing financial relief by exempting a portion of the property's value from taxation. Understanding the purpose and importance of this form is crucial for eligible homeowners looking to maximize their tax savings.

Steps to Complete the Arkansas Homestead Exemption Form

Completing the Arkansas Homestead Exemption Form involves several important steps to ensure accuracy and compliance. First, gather the necessary information, including your property details and identification. Next, carefully fill out the form, ensuring all sections are completed accurately. Pay special attention to the eligibility criteria, as this will determine your qualification for the exemption. After completing the form, review it for any errors before submitting it to the appropriate local tax authority. Proper completion and submission are vital for successfully obtaining the exemption.

Eligibility Criteria

To qualify for the Arkansas Homestead Exemption, applicants must meet specific eligibility criteria. Generally, the applicant must be the owner of the property and use it as their primary residence. Additionally, the homeowner must not have claimed a homestead exemption in another state. Certain exemptions may apply for individuals over sixty-five or those with disabilities. Understanding these criteria is essential for homeowners to determine their eligibility and ensure they complete the form correctly.

Required Documents

When applying for the Arkansas Homestead Exemption, specific documents are required to support your application. These typically include proof of ownership, such as a deed or title, and identification documents like a driver's license or state ID. If applicable, documentation proving age or disability status may also be necessary. Gathering these documents in advance can streamline the application process and help ensure that your form is processed without delays.

Form Submission Methods

Homeowners in Arkansas have several options for submitting the Homestead Exemption Form. The form can be submitted online through the local tax authority's website, which provides a convenient and efficient way to apply. Alternatively, homeowners may choose to mail the completed form to their local assessor's office or deliver it in person. Each submission method has its own advantages, and selecting the right one can enhance the overall experience of applying for the exemption.

Legal Use of the Arkansas Homestead Exemption Form

The Arkansas Homestead Exemption Form is legally binding once submitted and accepted by the local tax authority. This form must be filled out accurately and truthfully to avoid any potential legal issues. Misrepresentation or failure to comply with the eligibility criteria can result in penalties, including the loss of the exemption or additional fines. Understanding the legal implications of this form is essential for homeowners to protect their rights and ensure compliance with state laws.

Key Elements of the Arkansas Homestead Exemption Form

Several key elements are essential to the Arkansas Homestead Exemption Form. These include the property owner's name, address, and details about the property itself, such as its location and assessed value. The form also requires information regarding the homeowner's eligibility, including age or disability status if applicable. Providing accurate and complete information in these sections is crucial for the successful processing of the exemption application.

Quick guide on how to complete arkansas homestead exemption form

Complete Arkansas Homestead Exemption Form effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Arkansas Homestead Exemption Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Arkansas Homestead Exemption Form with ease

- Locate Arkansas Homestead Exemption Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Arkansas Homestead Exemption Form and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arkansas homestead exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arkansas homestead exemption?

The Arkansas homestead exemption is a legal provision that allows homeowners to protect a portion of their home’s value from property taxes. This exemption can signNowly reduce the taxable value of a home, making it beneficial for eligible residents.

-

Who qualifies for the Arkansas homestead exemption?

To qualify for the Arkansas homestead exemption, homeowners must be residents of Arkansas and occupy the property as their primary residence. Additional eligibility criteria may apply, such as income limits or age restrictions.

-

How much can I save with the Arkansas homestead exemption?

The Arkansas homestead exemption can provide savings of up to $30,000 off the assessed value of your home, depending on local tax rates. This can lead to substantial reductions in annual property taxes for qualifying homeowners.

-

How do I apply for the Arkansas homestead exemption?

To apply for the Arkansas homestead exemption, homeowners must complete an application form and submit it to their local county assessor's office. It is essential to provide all necessary documentation to ensure eligibility for the exemption.

-

Does the Arkansas homestead exemption apply to all property types?

No, the Arkansas homestead exemption specifically applies to residential properties that serve as the homeowner’s primary residence. Other types of properties, such as rental or commercial properties, do not qualify for this exemption.

-

Can I combine the Arkansas homestead exemption with other tax benefits?

Yes, homeowners can often combine the Arkansas homestead exemption with other tax relief programs available at the state and federal levels. It’s advisable to consult a tax professional to explore all available tax benefits.

-

How often do I need to reapply for the Arkansas homestead exemption?

In Arkansas, once you qualify for the homestead exemption, you typically do not need to reapply annually. However, if you change your residency status or if there are changes in ownership, you may need to reapply.

Get more for Arkansas Homestead Exemption Form

- Mediator form

- Estoppel affidavit form

- Rescission of trustees deed chicago title connection form

- California sublease agreement form

- Fillable online legalforms nc 121 proof of service of

- Application for legal assistance from colorado legal services form

- Free delaware power of attorney forms pdf eforms

- Florida bar form release

Find out other Arkansas Homestead Exemption Form

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF