Tax Excempt Form

What is the Tax Exempt Form?

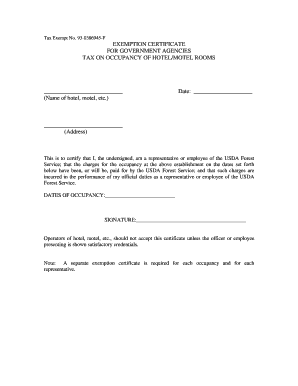

The tax exempt form, specifically identified as 93 0386945 f, is a crucial document used by organizations and individuals to claim exemption from certain taxes. This form is typically utilized by non-profit entities, educational institutions, and other qualifying organizations to certify their tax-exempt status. By submitting this form, entities can avoid paying specific taxes, thereby allowing them to allocate more resources toward their missions and services.

How to Use the Tax Exempt Form

Using the tax exempt form involves several key steps. First, ensure that your organization qualifies for tax-exempt status under IRS guidelines. Next, complete the form accurately, providing all required information, such as the organization’s name, address, and tax identification number. After filling out the form, review it for completeness and accuracy. Finally, submit the form to the appropriate state or federal agency, depending on the requirements specific to your location.

Steps to Complete the Tax Exempt Form

Completing the tax exempt form effectively requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including proof of your organization’s tax-exempt status.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Tax Exempt Form

The legal use of the tax exempt form is governed by specific regulations set forth by the IRS and state tax authorities. To ensure compliance, organizations must adhere to the guidelines for maintaining tax-exempt status, which include proper use of the form and adherence to reporting requirements. Failure to comply with these regulations may result in penalties or the loss of tax-exempt status.

Key Elements of the Tax Exempt Form

Understanding the key elements of the tax exempt form is essential for successful completion. Important components include:

- Organization Information: Name, address, and tax identification number.

- Type of Exemption: Specify the type of tax exemption being claimed.

- Signature: Authorized representative must sign the form.

- Date: The date of submission must be clearly indicated.

IRS Guidelines

The IRS provides comprehensive guidelines for the use of the tax exempt form. These guidelines outline eligibility criteria, proper completion of the form, and necessary documentation. Organizations should familiarize themselves with these regulations to ensure compliance and avoid potential issues with their tax-exempt status.

Quick guide on how to complete tax excempt form

Effortlessly prepare Tax Excempt Form on any device

Online document management has become increasingly popular among businesses and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Tax Excempt Form on any device using airSlate SignNow's apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to edit and eSign Tax Excempt Form smoothly

- Locate Tax Excempt Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Shade important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether through email, SMS, or an invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and eSign Tax Excempt Form to ensure seamless communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax excempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 93 0386945 f?

airSlate SignNow is a powerful e-signature solution that allows businesses to automate document workflows. The reference '93 0386945 f' showcases our commitment to providing users with an effective and efficient way to send and eSign important documents securely.

-

What are the main features of airSlate SignNow?

airSlate SignNow offers a range of features including document templates, real-time tracking, and mobile access. Users benefit from the streamlined processes associated with '93 0386945 f' that enhance productivity while maintaining robust security measures.

-

How does airSlate SignNow improve business collaboration?

By utilizing airSlate SignNow, teams can collaborate seamlessly through shared documents and instant notifications. The ease of integration with existing tools enhances the ‘93 0386945 f’ experience, making collaboration more efficient and less time-consuming.

-

What pricing options does airSlate SignNow offer?

airSlate SignNow provides a variety of pricing plans to suit different business needs. Each plan includes features that leverage the capabilities of '93 0386945 f,' ensuring you get the best value while facilitating document signing and management.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integration with many popular applications like Salesforce, Google Drive, and Zapier. The flexibility of '93 0386945 f' ensures that you can create a customized workflow that fits into your existing tech stack.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security through features like encryption, multi-factor authentication, and compliance with major regulations. This dedication to security aligns with the promise of '93 0386945 f,' providing a safe environment for all your document signing needs.

-

How user-friendly is the airSlate SignNow interface?

The interface of airSlate SignNow is designed to be intuitive and easy to navigate, even for users with minimal technical knowledge. This user-friendliness is a key aspect of '93 0386945 f,' ensuring that all users can maximize their productivity without a steep learning curve.

Get more for Tax Excempt Form

Find out other Tax Excempt Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors