Form 8802 Instructions

Understanding Form 8802 Instructions

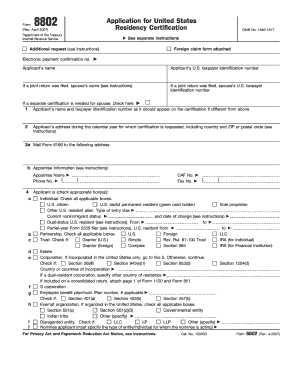

The Form 8802 instructions provide essential guidance for individuals seeking to obtain a U.S. residency certification. This form is primarily used to request the issuance of a Certificate of U.S. Residency, which is crucial for taxpayers who need to claim benefits under tax treaties. Understanding these instructions is vital to ensure compliance with IRS regulations and to facilitate a smooth application process.

Steps to Complete the Form 8802 Instructions

Completing the Form 8802 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your personal identification details and tax information.

- Fill out the form accurately, ensuring all fields are completed as instructed.

- Review the form for any errors or omissions before submission.

- Sign and date the form where required.

Following these steps will help ensure that your application is processed without delays.

Legal Use of the Form 8802 Instructions

The legal validity of the Form 8802 instructions hinges on adherence to IRS guidelines. The form must be completed accurately to ensure that the resulting certificate is recognized by tax authorities. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, ensuring compliance with electronic signature laws such as ESIGN and UETA.

Required Documents for Form 8802

When submitting Form 8802, certain documents are required to support your application. These typically include:

- A copy of your U.S. tax return for the relevant year.

- Any additional documentation that verifies your residency status.

- Identification documents, such as a driver's license or passport.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

Form 8802 can be submitted through various methods, including:

- Online submission via the IRS website.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can affect the processing time, so consider your options carefully.

Filing Deadlines for Form 8802

It is important to be aware of filing deadlines associated with Form 8802. Generally, the form should be submitted well in advance of any tax treaty claims to ensure timely processing. The IRS recommends checking their official guidelines for specific deadlines that may apply to your situation.

Quick guide on how to complete form 8802 instructions 1655651

Complete Form 8802 Instructions effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Form 8802 Instructions on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Form 8802 Instructions with ease

- Locate Form 8802 Instructions and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8802 Instructions and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8802 instructions 1655651

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 8802 instructions for eSigning documents with airSlate SignNow?

The 8802 instructions for eSigning with airSlate SignNow provide guidelines on how to efficiently complete and sign IRS Form 8802 electronically. This process ensures that your document meets regulatory requirements while streamlining your workflow. By using airSlate SignNow, you can easily manage these instructions and maintain compliance throughout the signing process.

-

How can I access the 8802 instructions using airSlate SignNow?

To access the 8802 instructions with airSlate SignNow, simply log into your account and navigate to the document section. There, you can find templates and resources that include detailed guidelines for filling out Form 8802. This user-friendly platform simplifies the process for all users, allowing quick access and guidance as needed.

-

Are there any costs associated with using the 8802 instructions on airSlate SignNow?

Using the 8802 instructions on airSlate SignNow can be very cost-effective, as the platform offers various pricing plans that cater to different business needs. Depending on your chosen plan, you can benefit from unlimited access to document signing features and dedicated support. Contact our sales team to find the best pricing option tailored for your requirements.

-

What features does airSlate SignNow offer for working with 8802 instructions?

airSlate SignNow offers several features to enhance your experience with the 8802 instructions, including document templates, automated workflows, and real-time tracking. These functionalities make it easy to manage your signing process effectively and ensure compliance with IRS regulations. Additionally, the ability to integrate with other applications simplifies your overall workflow.

-

How does airSlate SignNow ensure compliance with 8802 instructions?

airSlate SignNow is designed with compliance in mind, ensuring that all 8802 instructions are followed responsibly throughout the eSigning process. The platform uses advanced security measures, including encryption and audit trails, to protect sensitive information while following federal guidelines. This helps users maintain thorough records and ensures compliance with regulatory standards.

-

Can I integrate airSlate SignNow with other software to facilitate 8802 instructions?

Yes, airSlate SignNow offers various integrations with popular software solutions to enhance your experience with 8802 instructions. You can seamlessly connect it with CRMs, project management tools, and cloud storage services for better workflow management. These integrations improve efficiency and help you easily manage your documents related to Form 8802.

-

What are the benefits of using airSlate SignNow for 8802 instructions?

Using airSlate SignNow for 8802 instructions provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform streamlines the eSigning process, allowing for quick turnaround times while ensuring that your documents are correctly completed. These advantages contribute to a more efficient and effective compliance experience.

Get more for Form 8802 Instructions

Find out other Form 8802 Instructions

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent