MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn Form

Understanding the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

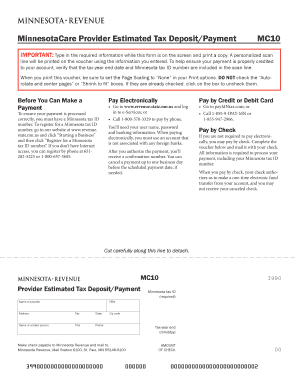

The MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn is a crucial document for healthcare providers in Minnesota. It is used to report and remit estimated tax payments related to MinnesotaCare revenue. This form is particularly important for providers who receive payments from the MinnesotaCare program, as it helps ensure compliance with state tax obligations.

Steps to Complete the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

Completing the MC10 form involves several key steps:

- Gather necessary information, including your MinnesotaCare provider number and estimated tax payment amount.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the information for accuracy to avoid potential issues with your submission.

- Sign the form electronically or physically, depending on your submission method.

- Submit the form by the specified deadline to avoid penalties.

How to Obtain the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

The MC10 form can typically be obtained through the Minnesota Department of Human Services website or directly from the MinnesotaCare program's resources. It is essential to ensure that you are using the most current version of the form to comply with state regulations.

Legal Use of the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

The MC10 form is legally binding when completed and submitted in accordance with Minnesota state laws. It is essential to follow all guidelines for electronic signatures and submissions to ensure that the document holds legal weight. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is necessary for the form to be valid.

Filing Deadlines and Important Dates

Filing deadlines for the MC10 form are critical to avoid penalties. Typically, estimated tax payments are due quarterly. It is advisable to check the Minnesota Department of Revenue website for specific dates and any updates that may affect your filing schedule.

Penalties for Non-Compliance

Failure to submit the MC10 form on time or inaccuracies in the information provided can lead to penalties. These may include fines or interest on unpaid taxes. Understanding the consequences of non-compliance is essential for healthcare providers to maintain good standing with state tax authorities.

Quick guide on how to complete mc10 minnesotacare provider estimated tax payment voucher revenue state mn

Complete MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Manage MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn with ease

- Find MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Modify and electronically sign MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn to ensure effective communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mc10 minnesotacare provider estimated tax payment voucher revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn?

The MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn is a document used by MinnesotaCare providers to calculate and remit estimated tax payments. It helps ensure that healthcare professionals adhere to state tax requirements while managing their finances. Understanding this voucher is crucial for maintaining compliance and avoiding potential penalties.

-

How can airSlate SignNow assist with the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn?

airSlate SignNow streamlines the process of preparing and signing the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn. Our platform allows you to easily create, eSign, and manage your documents securely. This efficiency simplifies your tax preparation, saving you time and helping ensure accuracy in your submissions.

-

Is airSlate SignNow cost-effective for managing the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn. By using our service, you can reduce overhead costs associated with paper documentation and streamline your workflow. This results in signNow savings over time while ensuring compliance with Minnesota tax regulations.

-

Are there any specific features in airSlate SignNow that cater to healthcare providers dealing with the MC10?

Absolutely! airSlate SignNow offers features tailored for healthcare providers, such as templates for the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn, secure cloud storage, and audit trails for compliance. These features ensure that your tax documents are organized, secure, and accessible whenever needed, optimizing your documentation process.

-

Can airSlate SignNow integrate with other tools for managing my MinnesotaCare tax documents?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing how you manage your MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn. These integrations can include accounting software and document management systems, facilitating a more streamlined workflow and effective data management across platforms.

-

What are the benefits of using airSlate SignNow for the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn?

Using airSlate SignNow for the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn offers numerous benefits including increased efficiency, enhanced security, and easy document tracking. Our platform ensures that you can focus on providing healthcare services while we handle the intricacies of document management and compliance. This leads to improved productivity and peace of mind.

-

How secure is airSlate SignNow when handling sensitive tax documents like the MC10?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn. Our platform employs advanced encryption and security protocols to protect your data. Additionally, we provide features like two-factor authentication to ensure that your documents remain safe and secure.

Get more for MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

Find out other MC10, MinnesotaCare Provider Estimated Tax Payment Voucher Revenue State Mn

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney