Saraswat Bank Rtgs Form

What is the Saraswat Bank Rtgs Form

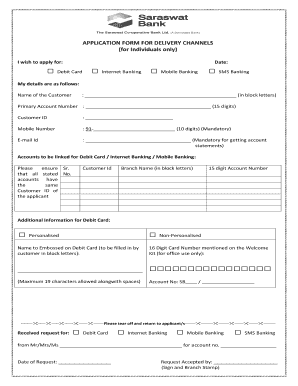

The Saraswat Bank RTGS form is a crucial document used for initiating Real Time Gross Settlement (RTGS) transactions. This form allows individuals and businesses to transfer large sums of money electronically between banks in real-time. It is particularly useful for high-value transactions, ensuring that funds are transferred securely and efficiently. The RTGS system is regulated by the Reserve Bank of India, making the form essential for compliance with banking regulations.

How to use the Saraswat Bank Rtgs Form

Using the Saraswat Bank RTGS form involves a few straightforward steps. First, obtain the form from the bank's website or a local branch. Once you have the form, fill in the required details, which typically include the sender's and receiver's account information, the amount to be transferred, and the purpose of the transaction. After completing the form, submit it to the bank either online or in person, depending on your preference and the bank's options. Ensure that all information is accurate to avoid delays in processing.

Steps to complete the Saraswat Bank Rtgs Form

Completing the Saraswat Bank RTGS form requires careful attention to detail. Follow these steps:

- Download or collect the RTGS form from the Saraswat Bank website or branch.

- Fill in your personal information, including your name, address, and account number.

- Provide the beneficiary's details, including their name, account number, and bank information.

- Specify the amount to be transferred and the purpose of the transaction.

- Review all entered information for accuracy.

- Sign the form to authorize the transaction.

- Submit the completed form to the bank for processing.

Legal use of the Saraswat Bank Rtgs Form

The legal use of the Saraswat Bank RTGS form is governed by banking regulations and electronic transaction laws. For the form to be considered legally binding, it must be filled out accurately and signed appropriately. The electronic submission of the form, when done through a secure platform, is recognized under various legal frameworks, including the Electronic Signatures in Global and National Commerce Act (ESIGN) in the United States. This ensures that the transaction is valid and enforceable.

Key elements of the Saraswat Bank Rtgs Form

Key elements of the Saraswat Bank RTGS form include:

- Sender's Information: Name, account number, and contact details.

- Beneficiary's Information: Name, account number, and bank details.

- Transaction Amount: The total sum to be transferred.

- Purpose of Transfer: A brief description of why the funds are being sent.

- Signature: The sender's authorization for the transaction.

Form Submission Methods

The Saraswat Bank RTGS form can be submitted through various methods. Customers can choose to submit the form online via the bank's digital banking platform, ensuring a quick and efficient process. Alternatively, the form can be printed and submitted in person at a local bank branch. Some customers may also opt to send the form via mail, although this method may take longer for processing. Regardless of the method chosen, it is essential to ensure that all information is complete and accurate to avoid any delays.

Quick guide on how to complete saraswat bank rtgs form

Easily Prepare Saraswat Bank Rtgs Form on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and effortlessly. Handle Saraswat Bank Rtgs Form on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Saraswat Bank Rtgs Form with Ease

- Obtain Saraswat Bank Rtgs Form and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Saraswat Bank Rtgs Form and guarantee superior communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the saraswat bank rtgs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Saraswat Bank RTGS form and how do I use it?

The Saraswat Bank RTGS form is a document used to initiate Real Time Gross Settlement transactions with Saraswat Bank. To use it, simply fill in the required details in the form, ensuring accuracy in account numbers and amounts, and submit it through your bank's provided channels. This process enables quick fund transfers without delays.

-

What are the fees associated with the Saraswat Bank RTGS form?

Using the Saraswat Bank RTGS form incurs a nominal fee, typically set by the bank based on the transaction amount. It is essential to review the bank's fee schedule to understand costs associated with your funds transfer. The charges are usually lower compared to other modes of transaction, making it a cost-effective option.

-

How quickly are transactions processed using the Saraswat Bank RTGS form?

Transactions made using the Saraswat Bank RTGS form are generally processed in real-time, ensuring that funds are transferred immediately to the beneficiary's account. This immediacy makes RTGS a preferred option for large-value transactions where timing is crucial. Be sure to submit the form during banking hours for timely processing.

-

Can I fill out the Saraswat Bank RTGS form online?

Yes, you can fill out the Saraswat Bank RTGS form online through the bank's internet banking platform. This online option saves time and allows you to process your transactions from the comfort of your home or office. Ensure that you have a secure internet connection while completing the form.

-

What details are required on the Saraswat Bank RTGS form?

The Saraswat Bank RTGS form requires specific details including the sender's account number, beneficiary's account number, the IFSC code of the beneficiary's bank, and the amount to be transferred. Additionally, personal details such as the sender's name and contact information may also be needed. Accurate information is crucial to avoid transaction errors.

-

Are there any benefits to using the Saraswat Bank RTGS form over other transfer methods?

Yes, the Saraswat Bank RTGS form offers several benefits such as immediate fund transfers, higher transaction limits, and the ability to transfer funds across banks seamlessly. Compared to methods like NEFT, RTGS is quicker, making it ideal for urgent payments. This feature is particularly beneficial for businesses requiring fast payment solutions.

-

Is the Saraswat Bank RTGS form suitable for corporate transactions?

Absolutely, the Saraswat Bank RTGS form is highly suitable for corporate transactions, especially those involving large sums of money. It provides a secure, efficient, and prompt method for businesses to make payments to suppliers, contractors, and others. Corporate clients often prefer RTGS for its reliability in handling signNow transactions.

Get more for Saraswat Bank Rtgs Form

- Instructions for form aia02 substitute statement in li united

- Ey tax covid 19 response tracker readkongcom form

- Temporary on premises sign application form

- Application for licensure new jersey division of consumer form

- Ots 2 go screening form hamilton health sciences

- Faculty of nursing student academic appeals committee form

- Access and overview for new personnel english form

- Occupational therapist job description salary skills ampampamp more form

Find out other Saraswat Bank Rtgs Form

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online