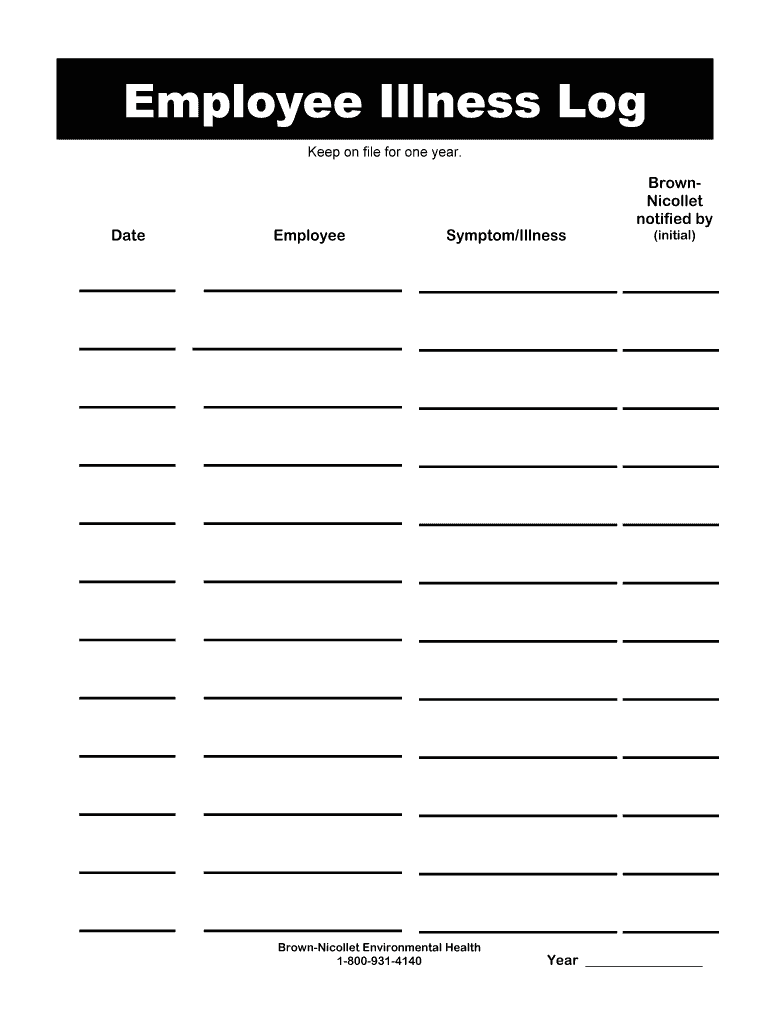

Keep on File for One Year Form

What is the Keep On File For One Year

The "Keep On File For One Year" form is a document that organizations use to retain essential records for a specified period. This form is particularly relevant in various business and legal contexts, ensuring that necessary documentation is available for reference or compliance purposes. By maintaining these records for one year, businesses can adhere to regulatory requirements, facilitate audits, and ensure proper record-keeping practices.

How to Use the Keep On File For One Year

Using the "Keep On File For One Year" form involves a straightforward process. First, identify the documents that need to be retained. Once identified, complete the form by providing necessary details such as the type of documents, dates, and any relevant identifiers. After completing the form, ensure it is securely stored in a digital format or a physical file, depending on your organization’s record-keeping policies. Regularly review the stored documents to ensure compliance with retention policies.

Steps to Complete the Keep On File For One Year

Completing the "Keep On File For One Year" form involves several key steps:

- Gather all relevant documents that need to be retained.

- Fill out the form with accurate details, including document types and retention dates.

- Review the completed form for accuracy and completeness.

- Store the form and associated documents in a secure location, either digitally or in physical form.

- Set reminders to review the documents before the one-year retention period expires.

Legal Use of the Keep On File For One Year

The legal use of the "Keep On File For One Year" form is essential for compliance with various regulations. Maintaining records for a specified duration helps organizations meet legal obligations and supports transparency. It is crucial to ensure that the form is completed correctly and that all relevant documents are included. Proper usage can protect businesses during audits or legal inquiries, demonstrating adherence to record-keeping standards.

Key Elements of the Keep On File For One Year

Several key elements define the "Keep On File For One Year" form:

- Document Identification: Clearly specify the documents being retained.

- Retention Dates: Indicate the start and end dates for the retention period.

- Signatures: Ensure appropriate signatures are obtained to validate the form.

- Storage Method: Specify how and where the documents will be stored.

Examples of Using the Keep On File For One Year

Examples of situations where the "Keep On File For One Year" form may be utilized include:

- Retaining employee records for compliance with labor laws.

- Keeping financial statements for audit purposes.

- Storing contracts and agreements that may be referenced in the future.

Quick guide on how to complete keep on file for one year

Easy Preparation of Keep On File For One Year on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow offers you all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Keep On File For One Year on any device using airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

Effortlessly Edit and Electronically Sign Keep On File For One Year

- Locate Keep On File For One Year and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Keep On File For One Year to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the keep on file for one year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'Keep On File For One Year' mean in the context of airSlate SignNow?

The phrase 'Keep On File For One Year' refers to the duration for which signed documents are securely stored within the airSlate SignNow system. This feature ensures that your important documents are easily accessible for compliance or review purposes. It's ideal for businesses needing to retain records for legal and operational needs.

-

How does airSlate SignNow support document retention for one year?

airSlate SignNow provides users with the ability to keep documents on file for one year through its secure cloud storage. This ensures that all signed agreements and essential documents are organized and available for reference over the specified timeframe. You can easily retrieve any document you need, promoting efficient record-keeping.

-

Is there a cost associated with keeping documents on file for one year?

airSlate SignNow offers competitive pricing plans that include the option to keep documents on file for one year. The costs vary depending on the features chosen, but the value of secure document retention is built into the service. Investing in this feature can help your business stay organized and compliant while managing document storage efficiently.

-

What are the benefits of keeping documents on file for one year with airSlate SignNow?

By choosing to keep documents on file for one year with airSlate SignNow, businesses enhance their compliance and streamline their document management processes. This feature also assists in avoiding costly penalties due to missed documentation requirements. Overall, it improves accessibility and promotes efficient workflow within your organization.

-

Can I integrate other tools to manage my files kept on file for one year?

Yes, airSlate SignNow supports various integrations that enhance how you manage files kept on file for one year. Whether you use CRM software or other business applications, you can seamlessly connect tools to streamline operations. This integration capability ensures that your document management aligns with your existing workflows.

-

What security measures are in place for documents kept on file for one year?

AirSlate SignNow prioritizes the security of your documents kept on file for one year. The platform utilizes encryption, secure storage solutions, and stringent access controls to protect sensitive data. This commitment to security ensures that your documents remain confidential and are only accessible to authorized personnel.

-

How do I retrieve documents kept on file for one year?

Retrieving documents kept on file for one year with airSlate SignNow is simple and user-friendly. You can search for specific documents using various filters or directly access them through your account dashboard. This ease of access ensures that you can quickly find and utilize documents, enhancing your operational efficiency.

Get more for Keep On File For One Year

Find out other Keep On File For One Year

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History