Llc 4 8 Form

What is the LLC 4 8?

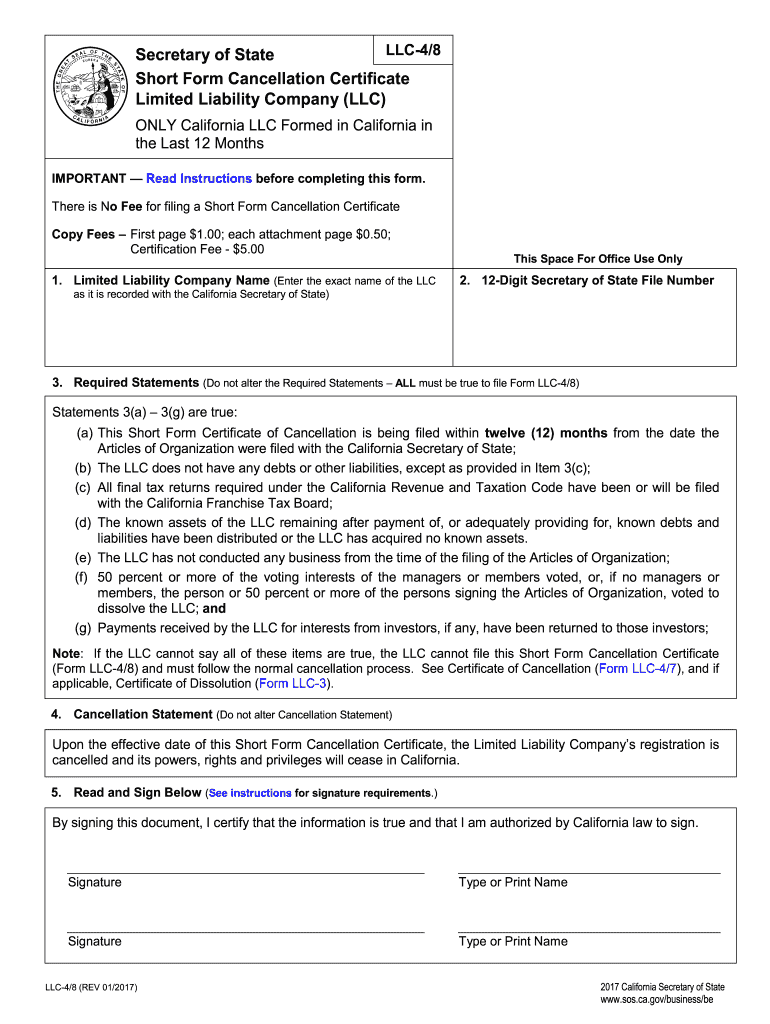

The LLC 4 8 form, officially known as the Certificate of Cancellation, is a legal document used in California to formally dissolve a limited liability company (LLC). This form is essential for businesses that have decided to cease operations and wish to terminate their LLC status with the California Secretary of State. Filing this form ensures that the LLC is officially removed from the state’s records, preventing any future liabilities or obligations associated with the business.

Steps to Complete the LLC 4 8

Completing the LLC 4 8 involves several key steps to ensure accuracy and compliance with state regulations. Here is a straightforward guide to help you through the process:

- Gather necessary information, including the LLC's name, Secretary of State file number, and the reason for cancellation.

- Provide the effective date of cancellation if it is different from the filing date.

- Ensure all members or managers of the LLC have approved the cancellation and are in agreement.

- Sign the form, ensuring that the signature is from an authorized person.

- Submit the completed form to the California Secretary of State, either online, by mail, or in person.

Legal Use of the LLC 4 8

The LLC 4 8 form serves a critical legal function in the dissolution process of an LLC. By filing this form, the LLC officially communicates its intent to dissolve to the state. This legal action protects the members from future liabilities and obligations related to the business. It is important to follow all legal requirements and ensure that the form is completed accurately to avoid complications during the dissolution process.

Required Documents for the LLC 4 8

When preparing to file the LLC 4 8, certain documents may be required to support the cancellation process. These documents include:

- The original Articles of Organization, if applicable.

- Any amendments to the Articles that may have been filed.

- Meeting minutes or a resolution from members approving the dissolution.

- Proof of compliance with any tax obligations, ensuring that all fees and taxes have been paid.

Form Submission Methods

The LLC 4 8 can be submitted through various methods, providing flexibility for business owners. The available submission methods include:

- Online: Submit the form electronically through the California Secretary of State's website.

- By Mail: Send the completed form to the appropriate address for the Secretary of State.

- In Person: Deliver the form directly to the Secretary of State's office for immediate processing.

Penalties for Non-Compliance

Failing to file the LLC 4 8 can result in significant penalties for business owners. Non-compliance may lead to:

- Continued liability for taxes and fees associated with the LLC.

- Potential legal actions against the members or managers.

- Inability to conduct business legally in California.

Quick guide on how to complete llc 4 8

Complete Llc 4 8 effortlessly on any device

Online document handling has gained signNow traction among enterprises and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents quickly and without delays. Manage Llc 4 8 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to modify and electronically sign Llc 4 8 effortlessly

- Find Llc 4 8 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow efficiently manages all your document handling needs in just a few clicks from any device you prefer. Modify and electronically sign Llc 4 8 to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the llc 4 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is llc4 and how does it work with airSlate SignNow?

The term 'llc4' refers to the standard you may consider when forming an LLC. airSlate SignNow integrates seamlessly into your business processes, allowing you to manage the documentation required for llc4 efficiently. With electronic signatures and easy-to-use features, you can execute llc4 documents quickly and securely.

-

What are the pricing options for airSlate SignNow related to llc4 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses needing to handle llc4 documentation. Whether you’re a startup or a large enterprise, there’s a plan suitable for your needs. Check our pricing page for details that highlight how we can support your llc4 needs without breaking the bank.

-

Are there any features specifically designed for managing llc4 paperwork?

Yes, airSlate SignNow includes features tailored for efficient management of llc4 paperwork. You can benefit from template creation, automated workflows, and dedicated storage for llc4 forms to streamline your business operations. This makes the process of handling llc4 documents easier and more organized.

-

What are the benefits of using airSlate SignNow for llc4?

Using airSlate SignNow for llc4 offers numerous benefits including reducing paperwork, saving time, and enhancing security. Your llc4 documents are stored securely and can be accessed from anywhere at any time. Plus, the electronic signature feature allows you to finalize llc4 agreements quickly.

-

Can airSlate SignNow integrate with other tools for managing llc4 processes?

Absolutely, airSlate SignNow offers various integrations that can enhance the management of your llc4 processes. It connects with popular platforms like Google Drive, Dropbox, and CRM systems, enabling a seamless workflow. This integration capability ensures that you can efficiently handle llc4-related tasks without switching platforms.

-

Is airSlate SignNow compliant with legal standards for llc4 documentation?

Yes, airSlate SignNow is fully compliant with legal standards necessary for llc4 documentation. Our platform adheres to the ESIGN Act and UETA, ensuring that your llc4 electronic signatures are legally binding. This compliance gives you peace of mind when managing your llc4 documents.

-

How can I get support if I encounter issues with llc4 documentation on airSlate SignNow?

airSlate SignNow provides robust customer support that can assist you with any issues related to your llc4 documentation. Our team is available through various channels including live chat, email, and phone. Whether you have a question about llc4 features or need help troubleshooting, we’re here to help.

Get more for Llc 4 8

- New jersey judiciary nj courts form

- Jdf 525 affidavit form

- Photo kuva garages street cars ry form

- Rule 45 subpoenafederal rules of civil procedurelii legal form

- Jdf453 form

- Around eel and trinity rivers the capt has all control form

- Probate in colorado denver bar association form

- Courts state co 6968474 form

Find out other Llc 4 8

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT