St7 Form

What is the ST7 Form

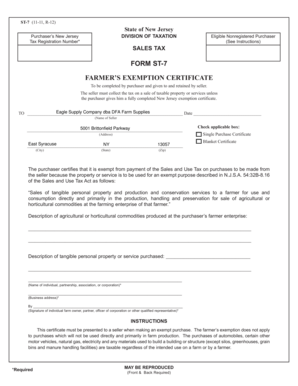

The ST7 form, also known as the New Jersey Tax Exempt Certificate, is a critical document used by businesses and organizations in New Jersey to claim exemption from sales tax. This form is essential for entities that qualify for tax-exempt status under specific categories, such as non-profit organizations, government entities, and certain educational institutions. By submitting the ST7 form, businesses can purchase goods and services without incurring sales tax, thereby reducing operational costs.

How to Use the ST7 Form

To effectively use the ST7 form, businesses must first confirm their eligibility for tax-exempt status. Once eligibility is established, the form should be filled out accurately, providing all required information, including the name of the organization, address, and the specific reason for tax exemption. After completing the form, it must be presented to the vendor at the time of purchase. Vendors are required to keep a copy of the ST7 form on file to substantiate the tax-exempt sale.

Steps to Complete the ST7 Form

Completing the ST7 form involves several straightforward steps:

- Gather necessary information about your organization, including its legal name and address.

- Identify the specific reason for claiming tax exemption.

- Fill out the form clearly and accurately, ensuring all sections are completed.

- Sign and date the form to validate it.

- Provide the completed form to the vendor at the time of purchase.

Legal Use of the ST7 Form

The ST7 form is legally binding when used correctly. It is essential for organizations to ensure that they meet the eligibility criteria for tax exemption. Misuse of the form, such as providing it to vendors without proper qualification, can lead to penalties and legal repercussions. Compliance with state regulations regarding the use of the ST7 form helps maintain the integrity of tax-exempt transactions.

Required Documents

When filling out the ST7 form, organizations may need to provide additional documentation to support their tax-exempt status. This can include:

- Proof of non-profit status, such as IRS determination letters.

- Bylaws or articles of incorporation that outline the organization's purpose.

- Any relevant state-issued documents that verify tax-exempt status.

Form Submission Methods

The ST7 form does not require formal submission to a government agency; however, it must be presented to vendors during purchases. It is advisable for organizations to maintain copies of all ST7 forms provided to vendors for their records. This practice ensures compliance and provides documentation in case of audits or inquiries regarding tax-exempt transactions.

Quick guide on how to complete st7 form

Complete St7 Form effortlessly on any device

Online document management has gained immense traction among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle St7 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign St7 Form with ease

- Find St7 Form and click on Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign St7 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st7 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st7 form and how is it used?

The st7 form is a critical document used in various business transactions for tax purposes and compliance. It helps facilitate the collection and submission of necessary information to governmental entities. Utilizing airSlate SignNow enhances the process of managing and signing the st7 form, making it simpler and more efficient.

-

How can airSlate SignNow streamline the st7 form signing process?

airSlate SignNow streamlines the signing process for the st7 form by allowing users to prepare, send, and sign documents electronically. The platform provides real-time notifications and tracking, ensuring that all stakeholders are informed throughout the process. With a user-friendly interface, airSlate SignNow minimizes the time spent on paperwork.

-

Is airSlate SignNow affordable for small businesses needing to manage st7 forms?

Yes, airSlate SignNow offers affordable pricing plans tailored to small businesses looking to manage the st7 form efficiently. With various subscription options, users can choose a plan that fits their budget while accessing essential features for document management. Cost-effectiveness is a key benefit of using airSlate SignNow.

-

What features does airSlate SignNow offer for managing the st7 form?

AirSlate SignNow includes features such as customizable templates, document sharing, and secure eSignature capabilities for managing the st7 form. These functionalities enhance productivity and ensure that all documents are easily accessible and compliant. The platform's integration with cloud storage services further simplifies the document management process.

-

Does airSlate SignNow integrate with other software for handling st7 forms?

Absolutely, airSlate SignNow integrates seamlessly with popular software applications like CRM systems, project management tools, and cloud storage services. This connectivity allows users to manage their st7 forms in conjunction with other business processes, fostering enhanced collaboration and efficiency. Integration options make it a versatile choice for businesses.

-

How secure is the process of signing the st7 form with airSlate SignNow?

The signing process for the st7 form using airSlate SignNow is highly secure, utilizing advanced encryption protocols to protect sensitive data. The platform complies with industry standards for data security and retains audit trails to ensure trustworthiness. Users can feel confident that their documents and information are well protected.

-

Can I track the status of my st7 form with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow users to monitor the status of their st7 form throughout the signing process. Notifications keep all parties informed of any changes, approvals, or completions, enhancing communication and workflow transparency. This tracking capability helps ensure timely completion of important documents.

Get more for St7 Form

- Psers application form

- Public utility commission peco bill form

- Pennsylvania participate death blank form

- Civ 709 form

- Teaching kids about courts form

- Ca ignition interlock verification form

- Jv531 form

- Jv 456 twenty four month postpermanency attachment child reunified welf amp inst code 36625 judicial council forms courts ca

Find out other St7 Form

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe