1040 U S Individual Income Tax Return Filing Status Exemptions Irs Form

What is the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs

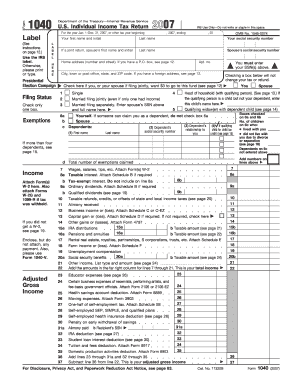

The 1040 U S Individual Income Tax Return is a crucial form used by individuals to report their annual income to the Internal Revenue Service (IRS). This form allows taxpayers to declare their filing status, which can significantly affect their tax obligations. The filing status options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each status has different implications for tax rates and eligibility for certain credits and deductions. Additionally, the form includes sections for claiming exemptions, which can reduce taxable income based on the number of dependents and other qualifying factors.

Steps to complete the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs

Completing the 1040 U S Individual Income Tax Return involves several key steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status by evaluating your marital situation and dependents. Then, fill out the form by entering your personal information, income, and deductions. Be sure to accurately claim any exemptions for dependents. After completing the form, review all entries for accuracy. Finally, submit your return either electronically or by mail, ensuring that you meet the IRS deadlines to avoid penalties.

Legal use of the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs

The 1040 U S Individual Income Tax Return is legally binding when properly completed and submitted to the IRS. To ensure its legality, the form must be signed, either physically or electronically, depending on the submission method. Electronic signatures are recognized under the ESIGN Act, provided that the signing process complies with specific legal requirements. It is important to retain copies of the submitted form and any supporting documents for your records, as they may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 U S Individual Income Tax Return are critical to avoid penalties. Typically, the deadline for submitting your tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, allowing them to file by October 15. However, it is essential to note that an extension to file does not extend the time to pay any taxes owed, which are still due by the original deadline.

Required Documents

To successfully complete the 1040 U S Individual Income Tax Return, specific documents are required. These include income statements such as W-2 forms from employers, 1099 forms for freelance work or interest income, and any other documentation related to income sources. Additionally, gather records of deductions and credits, such as receipts for medical expenses, mortgage interest statements, and educational expenses. Having all necessary documents organized will streamline the filing process and help ensure accuracy.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the 1040 U S Individual Income Tax Return. These guidelines cover various aspects, including eligibility criteria for different filing statuses, the treatment of various types of income, and the rules for claiming deductions and credits. It is essential to consult the IRS website or official publications for the most current information and instructions, as tax laws can change annually. Understanding these guidelines helps taxpayers comply with federal tax regulations and optimize their tax returns.

Quick guide on how to complete 1040 u s individual income tax return filing status exemptions irs

Complete 1040 U S Individual Income Tax Return Filing Status Exemptions Irs seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a suitable eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents promptly without delays. Manage 1040 U S Individual Income Tax Return Filing Status Exemptions Irs on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 1040 U S Individual Income Tax Return Filing Status Exemptions Irs effortlessly

- Obtain 1040 U S Individual Income Tax Return Filing Status Exemptions Irs and then click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all information and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040 U S Individual Income Tax Return Filing Status Exemptions Irs to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 u s individual income tax return filing status exemptions irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs?

The 1040 U S Individual Income Tax Return Filing Status Exemptions Irs allows individuals to report their annual income and claim any applicable exemptions, deductions, and credits. This form is essential for calculating the tax liabilities and determining the refund amount, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs?

airSlate SignNow simplifies the process of preparing and eSigning the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs. Users can easily fill out the necessary information and securely send documents for signatures, streamlining the tax filing experience.

-

Are there any costs associated with using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring cost-effective solutions for managing the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs and other documents. Pricing is typically based on the number of users and features chosen, providing flexibility to fit your budget.

-

What features does airSlate SignNow provide for eSigning tax documents?

With airSlate SignNow, users benefit from features like templates, automatic reminders, and secure eSigning, making it easier to manage the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs. These tools help ensure that all relevant parties can sign and return forms swiftly and securely.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow offers seamless integrations with various tax software applications, making it easy to incorporate the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs. This integration helps streamline the workflow, allowing for better management of tax documents and reducing the potential for errors.

-

What benefits does airSlate SignNow provide for managing tax-related documents?

AirSlate SignNow enhances efficiency and security when handling tax documents, including the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs. Its user-friendly platform ensures quick document processing, reduces paperwork, and minimizes the hassle of traditional filing methods.

-

Is airSlate SignNow compliant with IRS regulations for tax filings?

Yes, airSlate SignNow adheres to industry best practices and complies with IRS regulations when it comes to tax filings, including the 1040 U S Individual Income Tax Return Filing Status Exemptions Irs. This compliance ensures that users can conduct their tax transactions with confidence and security.

Get more for 1040 U S Individual Income Tax Return Filing Status Exemptions Irs

Find out other 1040 U S Individual Income Tax Return Filing Status Exemptions Irs

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed