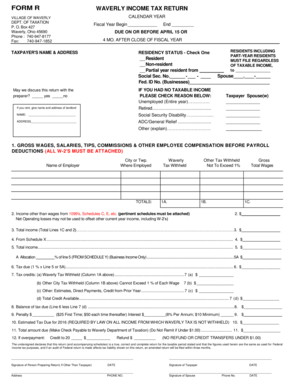

FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet 2016-2026

Understanding the Waverly Income Tax Return Form

The Waverly Income Tax Return Form, often referred to as the FORM R, is essential for residents of Waverly, Ohio, to report their income and calculate their city taxes. This form is specifically designed for individuals and businesses operating within the city limits. It ensures compliance with local tax regulations and helps the city fund essential services. Understanding the purpose and requirements of this form is crucial for accurate filing and avoiding penalties.

Steps to Complete the Waverly Income Tax Return Form

Completing the Waverly Income Tax Return Form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include both earned and unearned income.

- Calculate your total taxable income and apply any deductions or credits applicable to your situation.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that your tax return is filed correctly and on time.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines for the Waverly Income Tax Return Form to avoid late fees and penalties. Typically, the deadline for filing is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you expect to owe taxes, it is advisable to make estimated payments throughout the year to prevent a large tax bill at the time of filing.

Required Documents for Filing

When preparing to file your Waverly Income Tax Return, ensure you have the following documents ready:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions or medical expenses

- Previous year’s tax return for reference

Having these documents organized will streamline the filing process and help ensure accuracy.

Methods for Submitting the Waverly Income Tax Return Form

Residents of Waverly have several options for submitting their income tax returns. You can file the Waverly Income Tax Return Form online through the city’s tax department website, which offers a straightforward and secure process. Alternatively, you may choose to mail your completed form to the Waverly tax department or deliver it in person. Each method has its benefits, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to file the Waverly Income Tax Return Form on time can result in penalties and interest charges. The city imposes a late filing penalty, which can accumulate over time, increasing the total amount owed. Additionally, if you underreport your income or fail to pay the taxes owed, further penalties may apply. It is essential to file accurately and on time to avoid these financial repercussions.

Eligibility Criteria for Filing the Waverly Income Tax Return

To file the Waverly Income Tax Return Form, you must meet specific eligibility criteria. Generally, all residents of Waverly who earn income must file this form, regardless of the amount earned. This includes both full-time and part-time workers, as well as self-employed individuals. Additionally, businesses operating within the city limits are required to file. Understanding these criteria helps ensure compliance with local tax laws.

Quick guide on how to complete form r waverly income tax return cityofwaverlynet

Effortlessly prepare FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet on any gadget

Managing documents online has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest way to modify and eSign FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet without hassle

- Obtain FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet and click on Get Form to begin the process.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to share your form, via email, text (SMS), invitation link, or download it to your computer.

Ditch the worry of lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet and ensure flawless communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form r waverly income tax return cityofwaverlynet

Create this form in 5 minutes!

How to create an eSignature for the form r waverly income tax return cityofwaverlynet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for eSigning my 2016 income tax return using airSlate SignNow?

To eSign your 2016 income tax return with airSlate SignNow, simply upload your document to our platform. You can then add your signature and any necessary fields before sending it for finalization. Our user-friendly interface ensures that the process is quick and efficient.

-

Are there any costs associated with eSigning my 2016 income tax return?

airSlate SignNow offers a cost-effective solution for eSigning documents, including your 2016 income tax return. We provide various pricing plans to suit different needs, ensuring that you can find an option that fits your budget. You can also take advantage of our free trial to explore our features.

-

What features does airSlate SignNow offer for managing my 2016 income tax return?

Our platform includes features such as document templates, customizable fields, and secure storage, all designed to streamline the management of your 2016 income tax return. Additionally, you can track the status of your documents and receive notifications when they are signed. This enhances your overall experience and efficiency.

-

Can I integrate airSlate SignNow with other software for my 2016 income tax return?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage your 2016 income tax return alongside your other business tools. Whether you use accounting software or document management systems, our integrations help streamline your workflow and improve productivity.

-

Is airSlate SignNow secure for signing my 2016 income tax return?

Absolutely! airSlate SignNow prioritizes security, ensuring that your 2016 income tax return and other documents are protected. We utilize advanced encryption and comply with industry standards to safeguard your information, giving you peace of mind while eSigning.

-

How can airSlate SignNow benefit my business when handling 2016 income tax returns?

Using airSlate SignNow can signNowly benefit your business by simplifying the eSigning process for 2016 income tax returns. Our platform reduces the time spent on paperwork, enhances collaboration, and ensures compliance with legal requirements. This allows you to focus more on your core business activities.

-

What support options are available if I have questions about my 2016 income tax return?

airSlate SignNow provides comprehensive support options for users needing assistance with their 2016 income tax return. You can access our help center for FAQs, tutorials, and guides, or signNow out to our customer support team via chat or email for personalized assistance.

Get more for FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet

- Castle pines hoa 2 form

- Petition for occupational drivers license i petitioners personal texaslawhelp form

- Dut offer acceptance form pdf download

- School attendance contract form

- Download form and follow the return instructions mddc society for

- Cnp 925 form

- Nurse form 3

- Physician assistant practice agreement template form

Find out other FORM R WAVERLY INCOME TAX RETURN Cityofwaverlynet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors