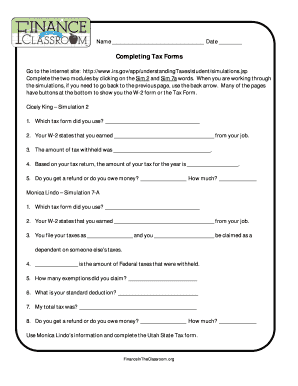

Completing Tax Forms Answer Key

What is the Completing Tax Forms Answer Key

The Completing Tax Forms Answer Key is a resource designed to assist individuals in accurately filling out tax forms. It provides detailed explanations and guidance on the various sections of tax forms, ensuring that users understand what information is required. This key is particularly useful for educators and students in finance-related courses, as it helps clarify complex tax concepts and procedures.

How to Use the Completing Tax Forms Answer Key

To effectively use the Completing Tax Forms Answer Key, individuals should first familiarize themselves with the specific tax form they are working on. The answer key can be referenced alongside the form to provide context and clarity. Users can compare their answers with the key to ensure accuracy and completeness. It is advisable to review each section thoroughly, as the answer key often includes explanations of common mistakes and tips for correct completion.

Steps to Complete the Completing Tax Forms Answer Key

Completing the tax forms using the answer key involves several steps:

- Identify the specific tax form required for your situation.

- Gather all necessary financial documents, such as W-2s or 1099s.

- Refer to the Completing Tax Forms Answer Key for guidance on each section of the form.

- Fill out the form, ensuring that all information is accurate and complete.

- Cross-check your entries with the answer key to verify correctness.

- Submit the completed form through the appropriate channels, whether online or by mail.

Legal Use of the Completing Tax Forms Answer Key

The Completing Tax Forms Answer Key serves as a legitimate educational tool, aiding in the understanding of tax form completion. While it provides valuable insights, it is important to note that the answer key itself does not replace official tax advice or guidance from certified professionals. Users should ensure compliance with all applicable tax laws and regulations when utilizing the information provided in the answer key.

IRS Guidelines

Understanding IRS guidelines is essential when completing tax forms. The IRS provides specific instructions for each form, outlining eligibility criteria, required documents, and filing procedures. The Completing Tax Forms Answer Key often aligns with these guidelines, helping users navigate the complexities of tax filing. It is crucial to stay updated on any changes in IRS regulations that may affect how forms should be completed.

Required Documents

When completing tax forms, certain documents are typically required to provide accurate information. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements for income verification

- Form 1040 for individual income tax returns

Having these documents readily available can streamline the process of filling out the forms and ensure that all necessary information is included.

Quick guide on how to complete completing tax forms answer key

Complete Completing Tax Forms Answer Key effortlessly on any device

Online document organization has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you are able to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Completing Tax Forms Answer Key on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign Completing Tax Forms Answer Key effortlessly

- Find Completing Tax Forms Answer Key and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your preference. Edit and eSign Completing Tax Forms Answer Key and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the completing tax forms answer key

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it support finance in the classroom completing tax forms answer key?

airSlate SignNow is an electronic signature and document management solution that simplifies the process of sending, signing, and managing documents. Specifically, for educators working on finance in the classroom completing tax forms answer key, it provides tools that streamline the creation and collection of digital signatures, enhancing the overall efficiency in handling tax-related paperwork.

-

How can airSlate SignNow benefit teachers using finance in the classroom completing tax forms answer key?

Teachers can greatly benefit from airSlate SignNow by saving time and reducing paperwork. By utilizing its intuitive interface, educators can facilitate the process of finance in the classroom completing tax forms answer key, allowing students to easily access, fill out, and submit necessary documents without delays.

-

What pricing options does airSlate SignNow offer for schools focusing on finance in the classroom completing tax forms answer key?

airSlate SignNow offers flexible pricing tailored to different needs, including options for educational institutions. This ensures that schools focusing on finance in the classroom completing tax forms answer key can adopt the service at a price point that best fits their budget while benefiting from full features.

-

Are there any features in airSlate SignNow that specifically aid in finance in the classroom completing tax forms answer key?

Yes, airSlate SignNow includes features such as customizable templates and form fields that can be beneficial for finance in the classroom completing tax forms answer key. These features allow educators to create structured documents that guide students in accurately filling out their tax forms.

-

Can airSlate SignNow integrate with other tools used in finance education?

Absolutely! airSlate SignNow offers integrations with various educational platforms and tools, making it easier for teachers to incorporate it into their existing systems. This adaptability enhances the effectiveness of finance in the classroom completing tax forms answer key by ensuring seamless access to necessary resources.

-

Is airSlate SignNow secure for handling sensitive tax information in the context of finance in the classroom completing tax forms answer key?

Yes, airSlate SignNow prioritizes security and compliance, employing advanced encryption methods to protect sensitive information. When using the platform for finance in the classroom completing tax forms answer key, both teachers and students can feel confident that their data is safe and secure.

-

How easy is it to use airSlate SignNow for newcomers focused on finance in the classroom completing tax forms answer key?

airSlate SignNow is designed with user-friendliness in mind, making it accessible even to those who are not tech-savvy. New users focusing on finance in the classroom completing tax forms answer key will find the platform intuitive, with helpful resources and tutorials available to guide them through the eSigning process.

Get more for Completing Tax Forms Answer Key

Find out other Completing Tax Forms Answer Key

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer