NOL Revenue Mt Form

What is the NOL Revenue Mt

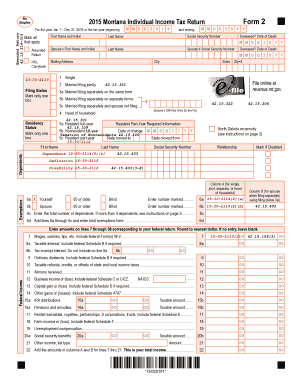

The NOL Revenue Mt form is a tax document used to report net operating losses (NOLs) for businesses. These losses can be utilized to offset taxable income in other years, providing potential tax relief. This form is essential for entities that have experienced financial setbacks, allowing them to carry forward or back losses to reduce their tax liabilities. Understanding the specific requirements and implications of this form is crucial for effective tax planning and compliance.

How to use the NOL Revenue Mt

Using the NOL Revenue Mt form involves several key steps. First, businesses must determine their net operating loss by calculating total income and allowable deductions for the year. Once the NOL is established, it can be reported on the form. It is important to accurately complete all sections, including any relevant schedules that may be required. Businesses should ensure they keep detailed records to support their claims, as this documentation may be necessary for future audits.

Steps to complete the NOL Revenue Mt

Completing the NOL Revenue Mt form requires careful attention to detail. Here are the primary steps:

- Gather financial statements and records for the relevant tax year.

- Calculate the net operating loss by subtracting total deductions from total income.

- Fill out the NOL Revenue Mt form, ensuring all required fields are completed accurately.

- Attach any necessary supporting documentation, such as income statements and tax returns.

- Review the completed form for accuracy before submission.

Legal use of the NOL Revenue Mt

The NOL Revenue Mt form must be used in compliance with IRS regulations. To ensure legal validity, businesses need to adhere to the guidelines set forth by the IRS regarding the reporting of net operating losses. This includes meeting deadlines for submission and maintaining accurate records. Proper use of the form can help businesses mitigate tax liabilities while staying within legal boundaries.

Eligibility Criteria

Eligibility to use the NOL Revenue Mt form generally depends on the nature of the business and its financial performance. To qualify, a business must have incurred a net operating loss in the current tax year. This form is typically applicable to various business entities, including corporations and partnerships. It is essential for businesses to assess their eligibility based on their specific circumstances and the IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the NOL Revenue Mt form are critical for compliance. Generally, businesses must submit the form along with their tax returns by the due date of the return, including any extensions. Missing these deadlines can result in penalties or the inability to carry forward losses. It is advisable for businesses to mark these important dates on their calendars to ensure timely submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the NOL Revenue Mt form. These guidelines outline the proper procedures for calculating and reporting net operating losses. Businesses should familiarize themselves with these regulations to ensure compliance and maximize their potential tax benefits. Staying informed about any updates or changes to IRS guidelines is also essential for accurate reporting.

Quick guide on how to complete nol revenue mt

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a seamless eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents quickly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NOL Revenue Mt

Create this form in 5 minutes!

People also ask

-

What is NOL Revenue Mt. in relation to airSlate SignNow?

NOL Revenue Mt. refers to how our platform helps businesses manage and optimize their revenue through efficient document signing processes. By digitizing and streamlining your workflows, airSlate SignNow enhances productivity, ensuring that your revenue management practices align with your operational goals.

-

How does airSlate SignNow support NOL Revenue Mt. for my business?

With airSlate SignNow, businesses can enhance their NOL Revenue Mt. by reducing turnaround times for document signatures. Our platform allows you to automate the signing process, ensuring quicker execution of revenue-related agreements which contributes signNowly to your financial performance.

-

What are the pricing options for airSlate SignNow and how do they relate to NOL Revenue Mt.?

Our pricing options for airSlate SignNow are designed to be cost-effective and scalable, allowing businesses of all sizes to leverage NOL Revenue Mt. capabilities. We offer different plans that cater to diverse needs, so you can select a solution that enhances your revenue processes without breaking the bank.

-

Can airSlate SignNow integrate with my existing systems to improve NOL Revenue Mt.?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your NOL Revenue Mt. strategies. By connecting with your CRM, ERP, or accounting systems, you can ensure a continuous flow of information, which helps in tracking and managing your revenue effectively.

-

What key features of airSlate SignNow contribute to better NOL Revenue Mt.?

Key features such as templates, document tracking, and automated reminders in airSlate SignNow can signNowly enhance your NOL Revenue Mt. experience. These capabilities help ensure timely document execution, thereby facilitating faster revenue recognition and improved cash flow.

-

How does e-signing with airSlate SignNow benefit NOL Revenue Mt.?

E-signing with airSlate SignNow expedites the signing process, which is essential for improving NOL Revenue Mt. By eliminating delays associated with traditional paper signatures, you can close deals and finalize agreements more quickly, which positively impacts your revenue streams.

-

Is airSlate SignNow user-friendly for teams focusing on NOL Revenue Mt.?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for teams working on NOL Revenue Mt. Regardless of technical expertise, users can quickly learn to navigate the platform, allowing them to focus on maximizing their revenue potential without the hassle of complicated processes.

Get more for NOL Revenue Mt

Find out other NOL Revenue Mt

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy