Formulario 481 1 Para Llenar

What is the Formulario 481 1 Para Llenar

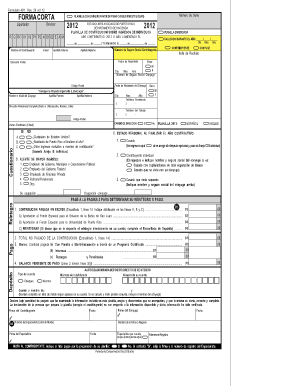

The Formulario 481 1 para llenar is a specific tax form used in the United States, primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It collects data that may impact tax liabilities, deductions, and credits. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Formulario 481 1 Para Llenar

Completing the Formulario 481 1 para llenar involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand each section's requirements. Fill out the form methodically, ensuring that all information is accurate and complete. Double-check your entries for any errors before submitting the form to avoid delays or issues with the IRS.

How to Obtain the Formulario 481 1 Para Llenar

The Formulario 481 1 para llenar can be obtained through various channels. It is available on the official IRS website, where users can download and print the form. Additionally, physical copies may be accessible at local IRS offices or through tax preparation services. Ensuring that you have the most current version of the form is essential, as updates may occur annually.

Legal Use of the Formulario 481 1 Para Llenar

The legal use of the Formulario 481 1 para llenar is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these guidelines can result in penalties, including fines or increased scrutiny from the IRS. It is important to maintain copies of submitted forms for record-keeping and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 481 1 para llenar are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April fifteenth of the tax year, although extensions may be available under certain circumstances. Staying informed about these deadlines helps taxpayers avoid late fees and potential legal issues. It is advisable to mark important dates on a calendar to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the Formulario 481 1 para llenar. Taxpayers can file the form online through the IRS e-file system, which offers a convenient and secure option. Alternatively, the form can be mailed to the appropriate IRS address, depending on the taxpayer's location. In-person submissions may also be possible at local IRS offices, providing assistance for those who need help completing the form. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Quick guide on how to complete formulario 481 1 para llenar

Prepare Formulario 481 1 Para Llenar effortlessly on any device

Digital document management has become increasingly favored among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Formulario 481 1 Para Llenar on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The simplest method to alter and eSign Formulario 481 1 Para Llenar with ease

- Find Formulario 481 1 Para Llenar and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Formulario 481 1 Para Llenar and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 481 1 para llenar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a formulario para llenar and how can it benefit my business?

A formulario para llenar is a digital form that allows users to input information easily. Using airSlate SignNow, businesses can create custom formularios para llenar that streamline data collection and enhance efficiency. This solution reduces paperwork and helps you manage your documents seamlessly.

-

How much does it cost to use airSlate SignNow for creating formularios para llenar?

airSlate SignNow offers various pricing plans to suit different business needs. Our plans include a free trial, allowing you to explore features such as creating formularios para llenar without any commitment. Pricing starts at a competitive rate, ensuring businesses of all sizes can access our robust solutions.

-

What features does airSlate SignNow offer for formularios para llenar?

airSlate SignNow provides a variety of features for creating formularios para llenar, including drag-and-drop form builders, customizable templates, and e-signature capabilities. Users can easily add fields to collect the necessary information and integrate the forms into existing workflows for improved productivity.

-

Can I integrate airSlate SignNow with other applications for formularios para llenar?

Yes, airSlate SignNow supports numerous integrations with popular applications, allowing you to automate your processes. By connecting with CRM systems, project management tools, and more, you can utilize your formularios para llenar in various contexts to enhance your business operations.

-

Are my data and formularios para llenar secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security by employing robust encryption methods and compliance with industry standards. Your formularios para llenar and sensitive data are well-protected, giving you peace of mind while conducting business online.

-

How do I get started with creating a formulario para llenar?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you'll gain access to our intuitive interface for creating formularios para llenar. Our platform also provides handy tutorials and customer support to assist you in designing effective forms.

-

Can I track submissions of my formulario para llenar with airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities for all your formularios para llenar. You can monitor submissions in real-time, receive notifications, and manage responses effectively, ensuring you never miss critical information from your clients or team members.

Get more for Formulario 481 1 Para Llenar

Find out other Formulario 481 1 Para Llenar

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title