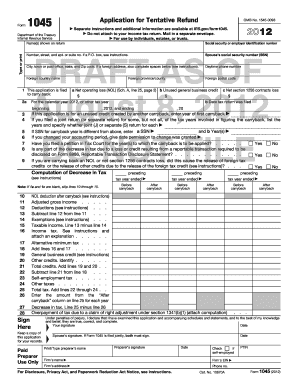

Form 1045 Example

What is the Form 1045 Example

The Form 1045 is a tax form used by individuals and businesses in the United States to apply for a quick refund of taxes that were overpaid. This form is particularly useful for taxpayers who have experienced a net operating loss (NOL) and want to amend their tax return to recover some of the taxes paid in previous years. By filing Form 1045, taxpayers can expedite the process of receiving their refund, allowing them to access funds more quickly than through the standard refund process.

How to use the Form 1045 Example

Using the Form 1045 involves several steps to ensure accurate completion. First, gather all necessary financial documents that support your claim for a refund. This includes prior tax returns, records of income, and any documentation related to the net operating loss. Next, fill out the form with accurate information regarding your income and deductions. It is essential to follow the IRS guidelines closely to avoid errors that could delay your refund. Once completed, submit the form to the IRS either electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the Form 1045 Example

Completing Form 1045 requires careful attention to detail. Here are the key steps:

- Step 1: Download the latest version of Form 1045 from the IRS website.

- Step 2: Fill in your personal information, including your name, address, and Social Security number.

- Step 3: Report your net operating loss and any adjustments to your income.

- Step 4: Calculate the amount of tax you are entitled to receive as a refund.

- Step 5: Review the completed form for accuracy and completeness.

- Step 6: Submit the form to the IRS along with any required documentation.

Legal use of the Form 1045 Example

The legal use of Form 1045 is governed by IRS regulations, which stipulate that it can only be used to claim a refund for overpaid taxes due to a net operating loss. It is important to ensure that all information provided is truthful and supported by appropriate documentation. Filing this form incorrectly or fraudulently can lead to penalties, including fines and potential legal action. Therefore, understanding the legal implications and ensuring compliance with IRS guidelines is crucial when using Form 1045.

Filing Deadlines / Important Dates

Filing deadlines for Form 1045 are critical to ensure a timely refund. Generally, the form must be filed within twelve months of the end of the tax year in which the net operating loss occurred. For example, if you experienced an NOL in 2022, you would need to submit Form 1045 by December 31, 2023. It is advisable to keep track of these deadlines to avoid missing out on potential refunds.

Required Documents

When filing Form 1045, certain documents are required to support your claim. These typically include:

- Your prior year tax returns.

- Documentation of the net operating loss, such as profit and loss statements.

- Any other relevant financial records that validate your income and deductions.

Having these documents ready can streamline the filing process and help ensure that your claim is processed without delays.

Quick guide on how to complete form 1045 example

Effortlessly prepare Form 1045 Example on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Form 1045 Example on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1045 Example with ease

- Find Form 1045 Example and click Get Form to begin.

- Use the provided tools to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1045 Example and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1045 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1045 and how does it work with airSlate SignNow?

Form 1045 is used by taxpayers to apply for a quick tax refund. With airSlate SignNow, you can easily eSign and send form 1045 digitally, streamlining the submission process and reducing the time it takes to receive your refund.

-

What features does airSlate SignNow offer for managing form 1045?

airSlate SignNow provides a user-friendly platform for managing form 1045, including templates, customizable workflows, and secure eSigning capabilities. These features ensure that your tax documents are managed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for form 1045?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to essential features for managing form 1045 and other documents at a competitive price.

-

Can airSlate SignNow integrate with other applications for form 1045?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for the easy transfer of data when managing form 1045. This ensures that your workflows are efficient and that all necessary information is consolidated.

-

What are the benefits of using airSlate SignNow for form 1045?

Using airSlate SignNow for form 1045 offers signNow benefits, including faster processing times and enhanced security for your sensitive tax data. Additionally, the intuitive platform minimizes the hassle of paper documents, making tax season more manageable.

-

How secure is the eSigning process for form 1045 with airSlate SignNow?

The eSigning process for form 1045 through airSlate SignNow is highly secure, utilizing state-of-the-art encryption and compliance with eSignature laws. This gives you peace of mind knowing that your personal and tax information is protected.

-

Who can benefit from using airSlate SignNow for form 1045?

Individuals, small businesses, and tax professionals can all benefit from using airSlate SignNow for form 1045. Its user-friendly interface and powerful features enable anyone to manage their tax documents efficiently.

Get more for Form 1045 Example

- What is an owneroperator report 2010 form

- What does a hardship license look like 2005 form

- Dl 14a application for license form 2011

- Vsf online application forms 2010

- Txdmv form1899 2012

- Car lien document 1998 form

- Heirship affidavit to print 1997 form

- Feefeefederal well landowner authorization form blm

Find out other Form 1045 Example

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation