Idaho Form 41

What is the Idaho Form 41

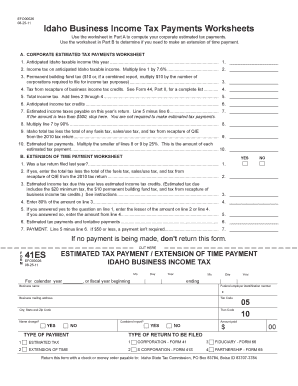

The Idaho Form 41 is a state income tax return form specifically designed for corporations operating within Idaho. This form is essential for reporting corporate income, deductions, and credits to the Idaho State Tax Commission. It allows corporations to calculate their tax liability based on their net income, ensuring compliance with state tax laws. Understanding the purpose and requirements of this form is crucial for businesses to maintain good standing and avoid penalties.

How to use the Idaho Form 41

Using the Idaho Form 41 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, download the form from the Idaho State Tax Commission website or obtain a physical copy. Fill out the form by entering your corporation's financial information, ensuring that all calculations are correct. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Idaho Form 41

Completing the Idaho Form 41 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including profit and loss statements.

- Download the Idaho Form 41 from the official website.

- Fill in your corporation's name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions accurately.

- Calculate the tax due based on the net income.

- Sign and date the form, ensuring all required signatures are included.

- Submit the completed form by the designated deadline.

Legal use of the Idaho Form 41

The Idaho Form 41 is legally binding when completed and submitted according to state regulations. To ensure its legal standing, corporations must adhere to the guidelines set forth by the Idaho State Tax Commission. This includes providing accurate information, meeting filing deadlines, and maintaining compliance with all applicable tax laws. Failure to comply may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines to avoid penalties. The Idaho Form 41 is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but they require timely submission of an extension request. Keeping track of these important dates is essential for maintaining compliance.

Required Documents

To complete the Idaho Form 41, several documents are necessary. Corporations should prepare the following:

- Financial statements, including balance sheets and income statements.

- Records of all income received and expenses incurred during the tax year.

- Documentation for any tax credits or deductions claimed.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Idaho Form 41 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the Idaho State Tax Commission's e-filing system.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete idaho form 41

Complete Idaho Form 41 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Idaho Form 41 on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Idaho Form 41 with ease

- Obtain Idaho Form 41 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Idaho Form 41 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho form 41

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Idaho Form 41 instructions for 2017?

The Idaho Form 41 instructions for 2017 provide detailed guidance on how to complete the state income tax return effectively. This document explains the various sections of the form, including how to report income, deductions, and credits. It's essential to follow these instructions carefully to ensure accurate filing and compliance with Idaho tax laws.

-

How can airSlate SignNow assist with Idaho Form 41 submissions?

airSlate SignNow simplifies the process of completing and submitting Idaho Form 41 by providing a user-friendly platform to eSign documents securely. With our solution, you can easily upload your form, gather necessary signatures, and submit it electronically, making the process faster and more efficient. This can help you stay compliant with Idaho's tax regulations.

-

Is there a cost associated with using airSlate SignNow for Idaho Form 41?

Yes, while airSlate SignNow offers various pricing plans, the cost is quite competitive for businesses looking to streamline their document signing processes. Our services include features that make managing forms like the Idaho Form 41 efficient and hassle-free. Pricing options are designed to fit businesses of all sizes.

-

What features does airSlate SignNow offer for seamless tax form management?

airSlate SignNow provides features such as document templates, secure eSignature capabilities, and real-time tracking to help manage tax forms like the Idaho Form 41 efficiently. Additionally, the platform ensures all your documents are stored securely and can be accessed from anywhere. This enhances the overall workflow and helps ensure timely submissions.

-

Can I integrate airSlate SignNow with my existing accounting software for Idaho Form 41?

Absolutely! airSlate SignNow offers various integrations with popular accounting software solutions, allowing you to streamline how you manage tax forms like the Idaho Form 41. This means you can easily transfer data between platforms, reducing the risk of errors and saving time in the tax preparation process.

-

Will using airSlate SignNow help me save time when preparing Idaho Form 41?

Yes, using airSlate SignNow can signNowly reduce the time spent preparing Idaho Form 41. The platform allows you to automate parts of the process, such as document sharing and eSigning, which means fewer manual steps and quicker turnaround. This efficiency is key during the busy tax season.

-

Is airSlate SignNow user-friendly for first-time users handling Idaho Form 41?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for first-time users managing Idaho Form 41. Our straightforward interface guides you through the eSigning and document management processes, ensuring you can complete your forms without confusion. Comprehensive support is also available if you need assistance.

Get more for Idaho Form 41

Find out other Idaho Form 41

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form