8869 Instructions Form

What is the 8869 Instructions

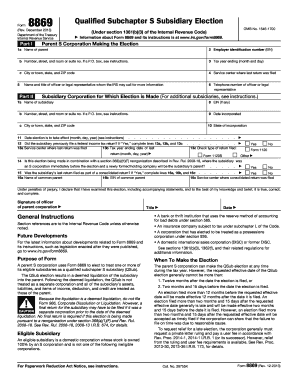

The 8869 instructions refer to the guidelines provided by the IRS for completing Form 8869, which is used to make an election under Section 761(a) to be treated as a partnership for federal tax purposes. This form is essential for certain business entities that wish to change their tax classification. Understanding the 8869 instructions is crucial for ensuring compliance with IRS regulations and for accurately reporting income and expenses.

Steps to complete the 8869 Instructions

Completing the 8869 instructions involves several key steps:

- Gather necessary information about your business entity, including its legal name, address, and Employer Identification Number (EIN).

- Determine the tax classification you wish to elect and ensure it aligns with the requirements outlined in the instructions.

- Fill out the form accurately, following the guidance provided in the instructions to avoid errors.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the IRS by the specified deadline to ensure timely processing.

Legal use of the 8869 Instructions

The legal use of the 8869 instructions is fundamental for businesses seeking to comply with federal tax laws. By following these instructions, taxpayers can ensure that their election to be treated as a partnership is valid and recognized by the IRS. This compliance helps avoid potential penalties and ensures that the business's tax obligations are met correctly.

Filing Deadlines / Important Dates

Filing deadlines for Form 8869 are critical to maintaining compliance with IRS regulations. Typically, the form must be filed by the 15th day of the third month following the close of the tax year for which the election is being made. It is important to keep track of these deadlines to avoid late filing penalties and ensure that the election is effective for the desired tax year.

Required Documents

To complete the 8869 instructions, several documents may be required, including:

- Articles of incorporation or organization, if applicable.

- Partnership agreements or operating agreements that outline the structure of the business.

- Previous tax returns, if available, to provide context for the election.

Having these documents on hand will facilitate a smoother completion of the form and help ensure that all necessary information is accurately reported.

Examples of using the 8869 Instructions

Examples of using the 8869 instructions can help clarify their application. For instance, a limited liability company (LLC) that wishes to be taxed as a partnership would utilize these instructions to complete the form accurately. Another example might involve a corporation electing to change its tax status to that of a partnership. In both cases, following the 8869 instructions is essential for a successful election.

Quick guide on how to complete 8869 instructions

Complete 8869 Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle 8869 Instructions on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest method to edit and eSign 8869 Instructions effortlessly

- Obtain 8869 Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact confidential information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign 8869 Instructions to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8869 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 'form 8869 instructions' and why are they important?

The 'form 8869 instructions' provide detailed guidance on how to apply for an election under Section 761 of the Internal Revenue Code. It helps businesses ensure compliance and avoids potential legal issues. Understanding these instructions is crucial for accurate submission to the IRS.

-

How can airSlate SignNow assist in completing the 'form 8869 instructions'?

airSlate SignNow allows businesses to easily fill out and eSign the 'form 8869 instructions' digitally. Our user-friendly interface streamlines the document preparation process, ensuring that all necessary fields are completed correctly. This helps you focus on your business rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for processing 'form 8869 instructions'?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. These plans are cost-effective and ensure you get the tools necessary to efficiently manage forms, including the 'form 8869 instructions.' Choose a plan that best suits your business size and needs.

-

What features does airSlate SignNow provide for handling the 'form 8869 instructions'?

airSlate SignNow includes features such as document templates, automated workflows, and eSigning capabilities, specifically designed to streamline the handling of the 'form 8869 instructions.' These features ensure quick access, easy edits, and secure submission of your documents.

-

What are the benefits of using airSlate SignNow for 'form 8869 instructions'?

Using airSlate SignNow simplifies the process of managing the 'form 8869 instructions,' eliminating the hassles of paper-based submissions. It enhances productivity, reduces turnaround time, and ensures compliance with IRS guidelines. Plus, it allows easy tracking of document status.

-

Can I integrate airSlate SignNow with other software to manage 'form 8869 instructions'?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, making it easy to manage 'form 8869 instructions' within your existing workflows. This integration capability allows you to maintain consistency and improve efficiency across your business processes.

-

How secure is airSlate SignNow when handling 'form 8869 instructions'?

Security is a top priority at airSlate SignNow. When handling the 'form 8869 instructions,' your documents are protected with advanced encryption and security protocols. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for 8869 Instructions

Find out other 8869 Instructions

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast