City of Hopkinsville Net Profit License Fee Return Form

What is the City of Hopkinsville Net Profit License Fee Return

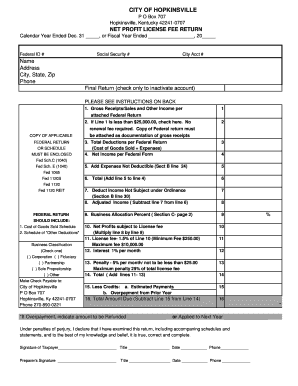

The City of Hopkinsville Net Profit License Fee Return is a form used by businesses operating within the city to report their net profits for taxation purposes. This return is essential for local revenue collection and ensures compliance with municipal tax regulations. The form typically requires businesses to disclose their total income, allowable deductions, and the resulting net profit, which is subject to the city's license fee. Understanding this form is crucial for business owners to fulfill their tax obligations accurately.

Steps to Complete the City of Hopkinsville Net Profit License Fee Return

Completing the City of Hopkinsville Net Profit License Fee Return involves several key steps:

- Gather financial documents, including income statements and expense records.

- Calculate your total revenue and allowable deductions to determine your net profit.

- Fill out the return form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Following these steps will help ensure that your return is filed correctly and on time.

Legal Use of the City of Hopkinsville Net Profit License Fee Return

The City of Hopkinsville Net Profit License Fee Return is legally binding once submitted. It must be filled out in accordance with local tax laws and regulations. Accurate reporting is critical, as discrepancies can lead to audits or penalties. Businesses should retain copies of their submitted returns and any supporting documentation for record-keeping and potential future reference.

Form Submission Methods

Businesses can submit the City of Hopkinsville Net Profit License Fee Return through various methods:

- Online: Many cities offer electronic submission options through their official websites, allowing for quicker processing.

- Mail: Completed forms can be mailed to the designated city tax office address.

- In-Person: Businesses may also choose to deliver their forms directly to the tax office during business hours.

Choosing the appropriate submission method can streamline the filing process and ensure timely compliance.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the City of Hopkinsville Net Profit License Fee Return. Typically, the return is due annually, with specific dates set by the city. Late submissions may incur penalties or interest charges. Business owners should mark their calendars and prepare their returns in advance to ensure compliance with these important dates.

Required Documents

To complete the City of Hopkinsville Net Profit License Fee Return, businesses will need to prepare several key documents:

- Financial Statements: These include income statements and balance sheets that detail revenue and expenses.

- Tax Identification Number: A federal or state-issued tax ID is necessary for identification purposes.

- Previous Year’s Returns: Having prior returns can provide a useful reference for completing the current form.

Gathering these documents ahead of time can facilitate a smoother filing process.

Quick guide on how to complete city of hopkinsville net profit license fee return

Effortlessly Complete City Of Hopkinsville Net Profit License Fee Return on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and electronically sign your documents without delays. Manage City Of Hopkinsville Net Profit License Fee Return on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign City Of Hopkinsville Net Profit License Fee Return With Ease

- Find City Of Hopkinsville Net Profit License Fee Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and eSign City Of Hopkinsville Net Profit License Fee Return while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of hopkinsville net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of hopkinsville net profit license fee return?

The city of Hopkinsville net profit license fee return refers to the financial documentation that businesses must submit to report their net profit and pay any associated license fees. This fee is vital for local compliance and helps ensure that your business operates legally within the city.

-

How do I file my city of hopkinsville net profit license fee return?

Filing your city of Hopkinsville net profit license fee return can be done easily by following the guidelines provided by the local tax authority. Typically, you would gather your financial statements, complete the necessary forms, and submit them online or via mail to the relevant department.

-

What are the due dates for the city of hopkinsville net profit license fee return?

The due dates for the city of Hopkinsville net profit license fee return usually align with the standard tax filing deadlines. Businesses should check with the city's finance department to confirm specific due dates for their returns to ensure timely submission.

-

What happens if I miss the city of hopkinsville net profit license fee return deadline?

Missing the deadline for your city of Hopkinsville net profit license fee return can result in penalties and interest on the unpaid fees. It is crucial to file on time to avoid additional costs and maintain good standing with local authorities.

-

Can airSlate SignNow help with my city of hopkinsville net profit license fee return?

Yes, airSlate SignNow can assist you in managing your city of Hopkinsville net profit license fee return process by providing easy-to-use document solutions. With eSigning capabilities, you can quickly finalize your returns and ensure secure submissions to local tax authorities.

-

What features does airSlate SignNow offer for document management related to the city of hopkinsville net profit license fee return?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for your documents related to the city of Hopkinsville net profit license fee return. These tools streamline the process, minimize errors, and enhance efficiency.

-

Is airSlate SignNow cost-effective for handling my city of hopkinsville net profit license fee return?

Absolutely! airSlate SignNow offers a cost-effective solution for handling your city of Hopkinsville net profit license fee return, with competitive pricing plans designed to fit various business sizes. This allows you to save on costs while ensuring compliance with local regulations.

Get more for City Of Hopkinsville Net Profit License Fee Return

- Reinforcement worksheet properties of water answer key form

- School clearance for transfer form

- Oklahoma notary application online form

- Opra request form city of vineland

- Sample letter to beneficiaries distribution of funds 203965299 form

- Apnc form

- Rg active half ironman training plan form

- Lees sandwiches rowland heights form

Find out other City Of Hopkinsville Net Profit License Fee Return

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe