Forma 1099 Puerto Rico

What is the Forma 1099 Puerto Rico

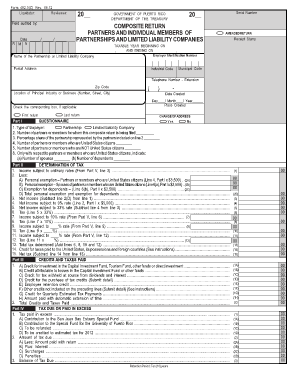

The Forma 1099 Puerto Rico is a tax document used to report various types of income other than wages, salaries, and tips. This form is crucial for individuals and businesses in Puerto Rico who need to report payments made to non-employees, such as freelancers or independent contractors. It serves as a record for both the payer and the recipient, ensuring that income is accurately reported to the Puerto Rico Department of Treasury (Hacienda).

How to use the Forma 1099 Puerto Rico

To use the Forma 1099 Puerto Rico, you must first gather the necessary information about the payee. This includes their name, address, and taxpayer identification number (TIN). Once you have this information, you can fill out the form, detailing the amount paid during the tax year. After completing the form, you must provide a copy to the payee and submit the original to the Hacienda by the specified deadline.

Steps to complete the Forma 1099 Puerto Rico

Completing the Forma 1099 Puerto Rico involves several key steps:

- Gather information about the payee, including their name, address, and TIN.

- Fill in the total amount paid to the payee during the tax year.

- Ensure all information is accurate to avoid penalties.

- Provide a copy of the completed form to the payee.

- Submit the original form to the Puerto Rico Department of Treasury by the deadline.

Legal use of the Forma 1099 Puerto Rico

The legal use of the Forma 1099 Puerto Rico is essential for compliance with tax regulations. This form must be accurately completed and submitted to avoid penalties. It is legally binding and serves as proof of income for the payee. Both the payer and the payee should retain copies for their records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Forma 1099 Puerto Rico are critical to ensure compliance. Typically, the form must be submitted to the Hacienda by January thirty-first of the following year after the income was paid. It is advisable to check for any updates or changes to deadlines, as they may vary from year to year.

Who Issues the Form

The Forma 1099 Puerto Rico is issued by businesses or individuals who make payments to non-employees. This includes various entities such as corporations, partnerships, and sole proprietors. It is the responsibility of the payer to ensure that the form is filled out correctly and submitted on time to comply with tax laws.

Quick guide on how to complete forma 1099 puerto rico

Complete Forma 1099 Puerto Rico effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Manage Forma 1099 Puerto Rico on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Forma 1099 Puerto Rico with ease

- Obtain Forma 1099 Puerto Rico and click on Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Forma 1099 Puerto Rico to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forma 1099 puerto rico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 form in Puerto Rico?

The 1099 form in Puerto Rico is a tax document used to report income received by individuals or businesses that are not classified as employees. It is essential for freelancers, contractors, and various types of service providers in Puerto Rico to file this form to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with 1099 forms in Puerto Rico?

airSlate SignNow simplifies the process of sending and eSigning 1099 forms in Puerto Rico. Our platform allows users to create, manage, and electronically sign their 1099 forms efficiently, ensuring that vital documents are completed accurately and submitted timely.

-

What features does airSlate SignNow offer for managing 1099 forms in Puerto Rico?

With airSlate SignNow, users can enjoy features such as document templates, real-time collaboration, and secure eSigning specifically tailored for 1099 forms in Puerto Rico. These features enhance the workflow, making it easier to collaborate with clients and contractors.

-

Is airSlate SignNow cost-effective for handling 1099 forms in Puerto Rico?

Yes, airSlate SignNow is a cost-effective solution for managing 1099 forms in Puerto Rico. Our competitive pricing plans ensure that businesses of all sizes can afford to streamline their document management processes without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing 1099 forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easier to manage your 1099 forms in Puerto Rico alongside other accounting and financial software. Integrating these tools helps ensure that your data is consistent and accessible.

-

What are the benefits of eSigning 1099 forms in Puerto Rico with airSlate SignNow?

The primary benefits of eSigning 1099 forms in Puerto Rico with airSlate SignNow include enhanced security, increased efficiency, and reduced paperwork. By utilizing our electronic signature capabilities, you can eliminate the need for physical copies and ensure your documents are signed and returned swiftly.

-

How secure is the eSigning process for 1099 forms in Puerto Rico with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform complies with industry standards and regulations for handling sensitive information, ensuring that your eSigned 1099 forms in Puerto Rico are stored safely and remain confidential.

Get more for Forma 1099 Puerto Rico

- Cover letter feedback request form wesley college wesley

- School verification form

- Literacy comprehensive exam application west chester form

- Elements new student outdoor program is an outdoor adventure experience for new incoming freshmen to the university of west form

- Substantive change monitoring policy form

- Student recordsinformation

- Medical studentresident rotation application form

- Education enrollment servicessdsu san diego state form

Find out other Forma 1099 Puerto Rico

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer