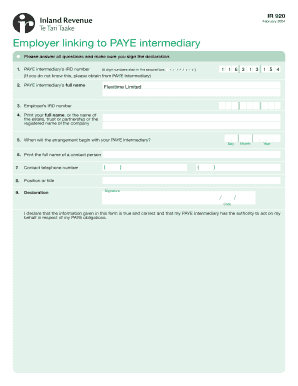

Ir920 Form

What is the IR920?

The IR920 form is a specific document used in various tax and legal processes. It serves as a crucial tool for individuals and businesses to report certain financial information to the IRS. Understanding its purpose is essential for compliance with federal regulations. The form typically includes sections that require detailed information about income, deductions, and other relevant financial data. Properly completing the IR920 ensures that the information submitted is accurate and adheres to legal standards.

How to use the IR920

Using the IR920 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all figures are correct and that you have included all required information. After completing the form, review it for accuracy before submitting it to the appropriate IRS office. Utilizing digital tools can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the IR920

Completing the IR920 form requires attention to detail. Follow these steps for accurate submission:

- Gather necessary documentation, including income records and deduction receipts.

- Fill out the personal information section, ensuring all details are correct.

- Complete the financial sections, entering accurate figures for income and deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form electronically or via mail, following the specific guidelines provided by the IRS.

Legal use of the IR920

The IR920 form is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it must include accurate information and be signed by the appropriate parties. Compliance with federal laws regarding eSignatures is vital, as it confirms the authenticity of the submission. Utilizing a reliable digital platform can enhance the security and legality of the form, ensuring that it meets all necessary legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the IR920 form are crucial for compliance. Typically, the form must be submitted by a specific date each tax year, often coinciding with the general tax filing deadline. It is essential to stay informed about any changes to these deadlines, as late submissions may result in penalties. Keeping track of important dates helps ensure that all necessary forms are filed on time, avoiding unnecessary complications.

Required Documents

When preparing to complete the IR920 form, certain documents are essential. These include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductions you plan to claim.

- Previous tax returns, if applicable.

- Identification information, such as Social Security numbers.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your submission.

Quick guide on how to complete ir920

Complete Ir920 effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without obstacles. Manage Ir920 on any platform utilizing airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Ir920 seamlessly

- Locate Ir920 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign Ir920 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir920

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir920 and how does it benefit my business?

The ir920 is a powerful feature within airSlate SignNow that enhances document signing processes. It allows businesses to streamline their workflows, reduce turnaround times, and improve overall efficiency. By utilizing ir920, companies can enjoy a more organized approach to document management.

-

How much does it cost to use the ir920 feature in airSlate SignNow?

Pricing for airSlate SignNow with the ir920 feature varies based on the subscription plan you choose. We offer flexible pricing options to accommodate businesses of all sizes, ensuring that you only pay for what you need. For detailed pricing information, visit our pricing page or contact our sales team.

-

What features are included with the ir920 functionality?

The ir920 functionality includes a suite of features such as customizable templates, advanced security options, and tracking capabilities. These features make it easier to manage and sign documents efficiently. By using ir920, businesses can enhance their productivity and compliance.

-

Can ir920 be integrated with other software programs?

Yes, ir920 seamlessly integrates with various applications and platforms, enhancing your existing workflows. Whether you're using CRM systems, project management tools, or cloud storage solutions, airSlate SignNow's ir920 can connect and work alongside them. This integration capability ensures a smooth user experience.

-

Is it easy to get started with the ir920 feature?

Absolutely! Getting started with the ir920 feature in airSlate SignNow is simple and user-friendly. We offer intuitive guides, tutorials, and customer support to help you navigate the process quickly. You can begin optimizing your document management in no time.

-

What security measures are in place for ir920?

Security is a top priority for airSlate SignNow, and the ir920 feature comes with robust measures to protect your documents. We utilize encryption, secure access controls, and audit trails to ensure your information remains safe. This gives businesses peace of mind when managing sensitive documents.

-

How does ir920 improve team collaboration?

The ir920 feature facilitates team collaboration by enabling multiple users to sign and manage documents simultaneously. This helps eliminate bottlenecks and ensures that everyone stays in sync throughout the signing process. Enhanced collaboration leads to quicker decisions and improved productivity.

Get more for Ir920

- Wwwmyalabamataxescom form booklet

- 2020 california form 593 v payment voucher for real estate

- Form i f t p 2019 20c d instructions corp alabama

- Due dates alabama department of revenue alabamagov form

- Do you have to pay back social security when someone dies form

- It103 v form

- California form 100 s california s corporation franchise or

- About form 8805 foreign partners information statement of

Find out other Ir920

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors