13 P14 End of Year Summary Form 2014

What is the P14 Form?

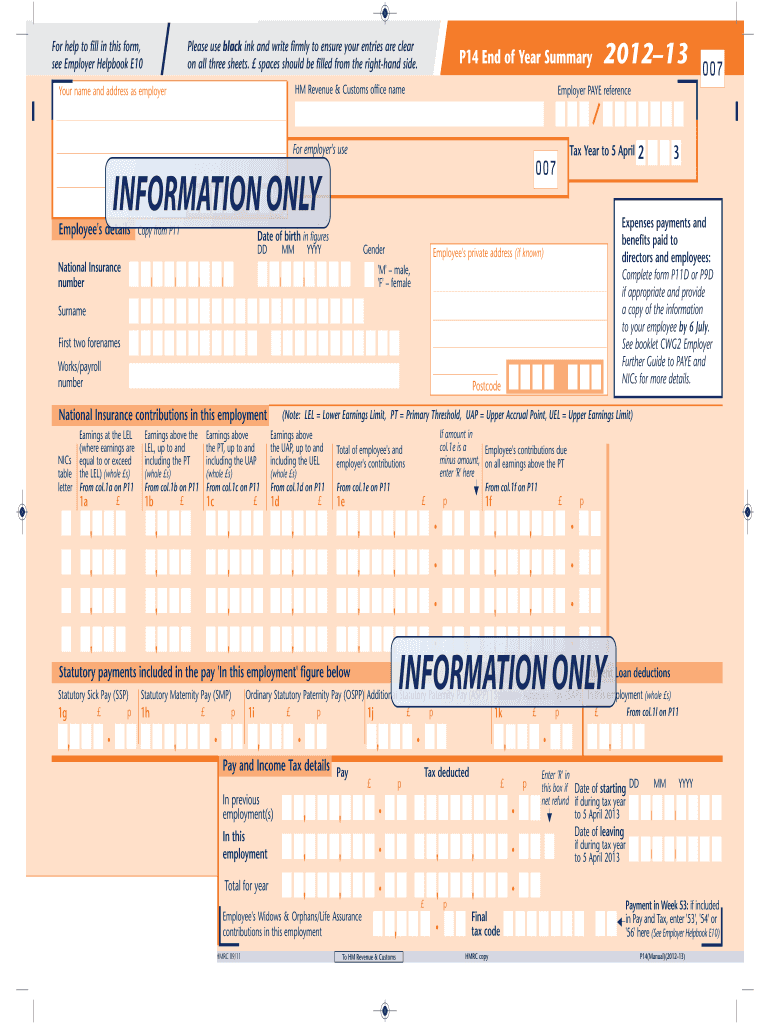

The P14 form, also known as the 13 P14 End Of Year Summary Form, is a document used primarily in the United Kingdom for tax purposes. It summarizes the earnings and tax deductions of employees for a specific tax year. This form is crucial for both employers and employees, as it provides a comprehensive overview of an individual's tax contributions and income. Understanding the P14 form is essential for accurate tax reporting and compliance with tax regulations.

How to Use the P14 Form

To effectively use the P14 form, employers must complete it accurately at the end of the tax year. This involves compiling all relevant employee data, including total earnings, tax deductions, and National Insurance contributions. Employees can use the information from the P14 form to verify their tax records and ensure that their tax returns are accurate. It is important for both parties to keep a copy for their records, as it may be required for future reference or audits.

Steps to Complete the P14 Form

Completing the P14 form involves several key steps:

- Gather all necessary employee information, including name, address, and National Insurance number.

- Calculate total earnings for the tax year, including bonuses and overtime.

- Determine total tax deductions and National Insurance contributions made during the year.

- Fill in the P14 form accurately, ensuring all figures are correct.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal Use of the P14 Form

The P14 form is legally binding and must be filled out in accordance with tax laws and regulations. Employers are required to provide this form to their employees at the end of each tax year. Failure to issue the P14 form or inaccuracies in the information provided can result in penalties for the employer. It is essential to ensure compliance with all legal requirements to avoid any complications with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the P14 form are critical to ensure compliance. Employers must submit the P14 form by the end of the tax year, which typically falls on April fifth in the UK. It is advisable to check for any updates or changes in deadlines, as these can vary based on specific circumstances or changes in tax legislation.

Who Issues the Form

The P14 form is issued by employers to their employees. It is the employer's responsibility to complete and distribute the form accurately at the end of the tax year. Employees should receive their P14 forms in a timely manner to allow for accurate tax reporting and filing.

Quick guide on how to complete 2012 13 p14 end of year summary form

Complete 13 P14 End Of Year Summary Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers a superb eco-conscious substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly without delays. Manage 13 P14 End Of Year Summary Form on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign 13 P14 End Of Year Summary Form effortlessly

- Find 13 P14 End Of Year Summary Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from any preferred device. Alter and electronically sign 13 P14 End Of Year Summary Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 13 p14 end of year summary form

Create this form in 5 minutes!

How to create an eSignature for the 2012 13 p14 end of year summary form

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is a P14 form?

The P14 form is a tax document used in the UK by employers to report employees' income and tax deductions. airSlate SignNow enables you to send and eSign P14 forms securely and efficiently, ensuring that your documents are processed quickly and accurately.

-

How can airSlate SignNow help with the P14 form?

airSlate SignNow simplifies the process of preparing and sending P14 forms. With our platform, you can create, eSign, and store P14 forms electronically, making it easier for businesses to manage their payroll documentation while ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for P14 forms?

Yes, airSlate SignNow offers various pricing plans to suit businesses of different sizes. Our plans are cost-effective and provide access to features that streamline the completion and submission of P14 forms and other essential documents.

-

Can I integrate airSlate SignNow with other tools for P14 forms?

Absolutely! airSlate SignNow seamlessly integrates with various productivity and accounting tools, making it easy to manage your P14 forms alongside other business processes. This flexibility helps you maintain an organized workflow and enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for P14 forms?

Using airSlate SignNow for your P14 forms provides numerous benefits, including reduced turnaround times, enhanced security, and the ability to track document status. Our solution also helps improve accuracy, minimizing the likelihood of errors that can occur with manual processes.

-

How secure is airSlate SignNow when handling P14 forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance with legal standards to ensure that your P14 forms and sensitive data remain safe from unauthorized access and bsignNowes.

-

How quickly can I send a P14 form using airSlate SignNow?

With airSlate SignNow, you can send a P14 form in just a few clicks. Our intuitive platform allows you to prepare and send documents rapidly, ensuring that your payroll processes run smoothly without unnecessary delays.

Get more for 13 P14 End Of Year Summary Form

Find out other 13 P14 End Of Year Summary Form

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application