Florida Sales Tax Form

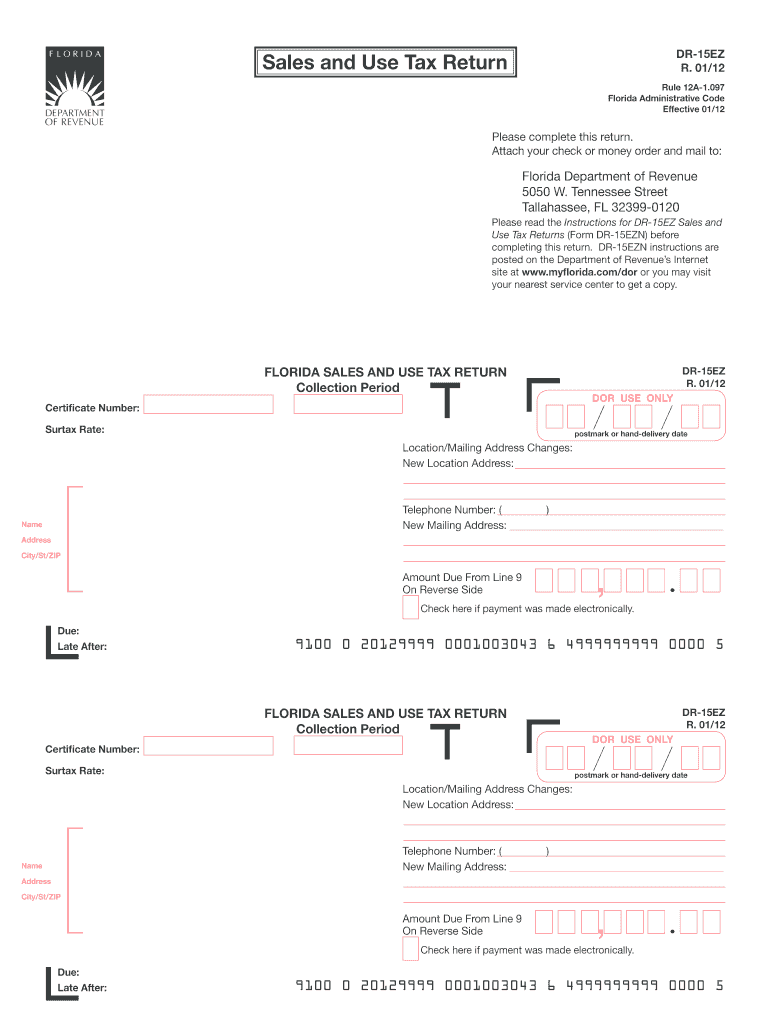

What is the Florida Sales Tax Form

The Florida Sales Tax Form is a document used by businesses to report and remit sales tax collected on taxable transactions within the state of Florida. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately. The form typically includes details such as the total sales amount, the sales tax collected, and any exemptions that may apply. Understanding the purpose and requirements of this form is crucial for any business operating in Florida.

How to use the Florida Sales Tax Form

Using the Florida Sales Tax Form involves several key steps. First, businesses must gather all relevant sales data for the reporting period, including total sales and any exempt sales. Next, the form should be filled out accurately, ensuring that all required fields are completed. After filling out the form, businesses must calculate the total sales tax due and prepare for submission. It is important to keep a copy of the completed form for record-keeping purposes. Finally, the form can be submitted electronically or via mail, depending on the chosen method of filing.

Steps to complete the Florida Sales Tax Form

Completing the Florida Sales Tax Form involves a systematic approach. Start by collecting all sales records for the reporting period. Then, follow these steps:

- Enter your business information, including name, address, and sales tax identification number.

- Report the total sales amount and any exempt sales.

- Calculate the total sales tax collected based on the applicable tax rate.

- Double-check all entries for accuracy to avoid errors.

- Sign and date the form, confirming the information is true and accurate.

Once completed, the form is ready for submission.

Legal use of the Florida Sales Tax Form

The legal use of the Florida Sales Tax Form is governed by state tax laws. Businesses are required to file this form to report sales tax collected on taxable sales. Failure to file accurately and on time can result in penalties and interest charges. It is essential for businesses to understand their legal obligations regarding sales tax collection and reporting to avoid non-compliance issues. Compliance with the regulations ensures that businesses maintain good standing with the Florida Department of Revenue.

Form Submission Methods

The Florida Sales Tax Form can be submitted through various methods, offering flexibility for businesses. The primary submission methods include:

- Online: Businesses can file electronically through the Florida Department of Revenue's online portal, which is often the most efficient method.

- Mail: Completed forms can be printed and mailed to the appropriate address as specified by the Florida Department of Revenue.

- In-Person: Some businesses may choose to deliver their forms in person at local tax offices.

Choosing the right submission method can help ensure timely processing and compliance with filing deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Sales Tax Form are critical for businesses to adhere to in order to avoid penalties. Typically, sales tax returns are due on the first day of the month following the reporting period, with payment also due at that time. For example, sales tax collected in January is due by February first. Businesses should keep track of these deadlines and consider setting reminders to ensure timely filing. Additionally, it is important to stay informed about any changes in deadlines that may occur due to state regulations.

Quick guide on how to complete florida sales tax form 100065962

Complete Florida Sales Tax Form seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Florida Sales Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Florida Sales Tax Form effortlessly

- Locate Florida Sales Tax Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Florida Sales Tax Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida sales tax form 100065962

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Florida Sales Tax Form?

The Florida Sales Tax Form is a document that businesses in Florida must use to collect and report sales tax to the state. It is essential for compliance with Florida tax laws, ensuring that your business meets its tax obligations correctly and efficiently.

-

How can airSlate SignNow help with Florida Sales Tax Forms?

airSlate SignNow streamlines the process of completing and signing Florida Sales Tax Forms by providing an easy-to-use digital platform. With our eSigning capabilities, businesses can quickly gather necessary signatures and submit forms without any hassle, making tax management simpler.

-

Is there a cost to use airSlate SignNow for Florida Sales Tax Forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, starting with a cost-effective option. We believe in providing excellent value for businesses looking to handle documents like the Florida Sales Tax Form efficiently.

-

What are the key features of airSlate SignNow for handling tax documents?

AirSlate SignNow includes features such as customizable templates, eSignature functionality, and secure document storage, specifically beneficial for handling Florida Sales Tax Forms. These tools provide a comprehensive solution for managing tax-related documents smoothly.

-

Can I integrate airSlate SignNow with other software for my tax filings?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business management software to enhance your workflow. Integrating with these tools makes managing your Florida Sales Tax Forms and other tax documents more efficient.

-

How do I get started with airSlate SignNow for my Florida Sales Tax Forms?

Getting started with airSlate SignNow is simple. Sign up for a free trial on our website, explore our platform, and begin creating, signing, and managing your Florida Sales Tax Forms right away. Our user-friendly interface will guide you through the process.

-

What benefits does airSlate SignNow provide for small businesses in Florida?

For small businesses in Florida, airSlate SignNow provides an affordable and efficient way to manage essential documents like the Florida Sales Tax Form. The platform helps save time, reduce paperwork, and improve compliance with tax regulations, allowing businesses to focus on growth.

Get more for Florida Sales Tax Form

- Document checklist for uncontested civil union divorce courts state hi form

- Attorney court jacket application hawaii state judiciary courts state hi 6969007 form

- Custody visitation statement form

- Hawaii administrative revocation form

- Fiscal policies general information general information courts state hi

- Sample of form 7a hourly worksheet indigent courts state hi

- Hourly worksheet indigent representation appellate case courts state hi form

- Request for subpoenas to be issued courts state hi form

Find out other Florida Sales Tax Form

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online