Form 5806 Instructions

What is the Form 5806?

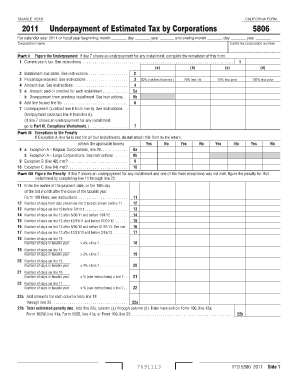

The Form 5806 is a California state tax form used primarily for reporting specific tax-related information. It is essential for individuals and businesses that need to disclose certain financial details to the California Franchise Tax Board (FTB). Understanding the purpose of this form is crucial for compliance with state tax regulations.

Steps to Complete the Form 5806 Instructions

Completing the Form 5806 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information required for the form. Next, carefully follow the instructions provided on the form, ensuring that each section is filled out completely. Pay attention to any specific calculations or entries that may be required. Finally, review the completed form for accuracy before submission.

Legal Use of the Form 5806 Instructions

The legal use of the Form 5806 is governed by California tax laws. It is important to ensure that the form is filled out correctly and submitted by the appropriate deadlines to avoid potential penalties. The form must be signed and dated to be considered valid. Using a reliable electronic signature tool can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5806 are critical to avoid late fees and penalties. Typically, the form must be submitted by a specific date each year, often coinciding with the annual tax filing deadline. It is advisable to check the California Franchise Tax Board’s official calendar for the exact dates related to the current tax year.

Required Documents

When completing the Form 5806, certain documents may be required to support the information provided. This could include income statements, previous tax returns, and any relevant financial records. Having these documents readily available can streamline the completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The Form 5806 can be submitted through various methods, including online submission through the California Franchise Tax Board’s website, mailing a physical copy, or delivering it in person at designated locations. Each method has its own guidelines and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form 5806 instructions

Complete Form 5806 Instructions effortlessly on any device

Online document administration has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage Form 5806 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Form 5806 Instructions without hassle

- Find Form 5806 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specially designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5806 Instructions to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5806 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5806 and how is it used?

Form 5806 is a key document used in various business transactions to streamline processes. It ensures that all necessary information is collected efficiently, making it easier for organizations to manage their paperwork. By utilizing airSlate SignNow, you can effortlessly create, send, and eSign form 5806, enhancing your documentation workflow.

-

How does airSlate SignNow help with form 5806?

airSlate SignNow simplifies the management of form 5806 by providing an intuitive platform to create, send, and eSign documents. With features like templates and automated workflows, you can save time and reduce errors when handling this important form. Plus, it ensures security and compliance with document management best practices.

-

Is airSlate SignNow affordable for small businesses needing form 5806?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it an affordable choice for small businesses. The cost-effectiveness of this solution allows you to manage form 5806 without compromising on features. Explore our pricing options to find a plan that suits your needs.

-

What are the key features of airSlate SignNow for handling form 5806?

Key features of airSlate SignNow for managing form 5806 include easy document creation, robust eSigning capabilities, and powerful integrations. The platform supports real-time tracking and alerts, ensuring you stay informed about the status of your form 5806. Additionally, it offers customizable templates to help you streamline your documentation process.

-

Can I integrate airSlate SignNow with other tools while using form 5806?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular business applications, enhancing your workflow with form 5806. Whether you use CRM systems, project management tools, or cloud storage solutions, our integrations ensure that managing form 5806 is efficient and cohesive with your existing processes.

-

What are the benefits of using airSlate SignNow for form 5806?

The benefits of using airSlate SignNow for form 5806 include improved efficiency, enhanced security, and cost savings. By automating the electronic signing and document management processes, businesses can accelerate turnaround times and reduce paper usage. This not only streamlines workflow but also increases overall productivity.

-

How secure is airSlate SignNow when handling form 5806?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like form 5806. The platform leverages advanced encryption and compliance measures to protect your data during transmission and storage. You can trust that your confidential information is safeguarded while using our eSigning services.

Get more for Form 5806 Instructions

Find out other Form 5806 Instructions

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter