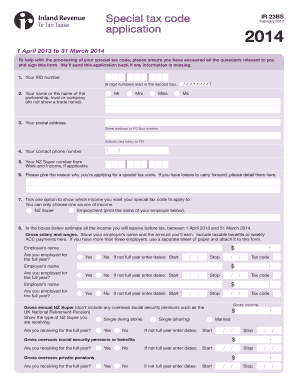

Ir23bs Form 2014

What is the Ir23bs Form

The Ir23bs form is a specific document utilized within the United States for tax-related purposes. It is primarily designed for reporting income and tax information to the Internal Revenue Service (IRS). This form plays a crucial role in ensuring compliance with federal tax regulations, helping both individuals and businesses accurately report their earnings and tax obligations. Understanding the purpose and requirements of the Ir23bs form is essential for maintaining proper tax records and fulfilling legal obligations.

How to use the Ir23bs Form

Using the Ir23bs form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. The completed Ir23bs form can be filed electronically or mailed to the appropriate IRS address, depending on your preference and the specific requirements of your situation.

Steps to complete the Ir23bs Form

Completing the Ir23bs form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, such as W-2s and 1099s.

- Provide personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that all figures match your financial records.

- Complete any additional sections required for deductions or credits.

- Review the form for accuracy and completeness before submission.

Legal use of the Ir23bs Form

The Ir23bs form is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, it is important to follow all instructions provided by the IRS, including proper signatures and submission methods. The form must also comply with relevant eSignature laws if submitted electronically. Utilizing a reliable electronic signature platform can enhance the legal standing of your submission, ensuring that all necessary legal requirements are met.

Filing Deadlines / Important Dates

Timely filing of the Ir23bs form is crucial to avoid penalties. The IRS typically sets specific deadlines for tax forms, which can vary based on individual circumstances. Generally, the deadline for filing individual tax returns falls on April fifteenth each year. However, extensions may be available under certain conditions. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines and important dates related to the Ir23bs form.

Who Issues the Form

The Ir23bs form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to fulfill their tax obligations. It is important to refer to the official IRS website for the most up-to-date version of the form and any related documentation.

Quick guide on how to complete ir23bs form

Complete Ir23bs Form effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Ir23bs Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ir23bs Form with ease

- Locate Ir23bs Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Ir23bs Form while ensuring clear communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir23bs form

Create this form in 5 minutes!

How to create an eSignature for the ir23bs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ir23bs?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents easily. It simplifies the document workflow and is highly relevant for those needing to manage forms and contracts, including the ir23bs. By integrating with airSlate SignNow, users can efficiently handle ir23bs and other essential documents.

-

How does pricing work for airSlate SignNow in relation to ir23bs?

airSlate SignNow offers a variety of pricing plans to cater to different business needs regarding document management like the ir23bs. Plans include features that specifically support eSigning and document tracking, ensuring you get comprehensive tools without overspending. You can choose a plan that suits your budget while efficiently managing ir23bs.

-

What features does airSlate SignNow provide for managing ir23bs?

airSlate SignNow provides a robust set of features designed to manage documents effectively, including custom templates, real-time notifications, and advanced security options for ir23bs. These features facilitate seamless eSigning and ensure that your ir23bs are processed swiftly and securely.

-

What benefits does airSlate SignNow offer for businesses dealing with ir23bs?

By using airSlate SignNow for managing ir23bs, businesses can streamline their document workflows, reduce turnaround times, and improve overall efficiency. The user-friendly interface makes it easy to navigate, while the cloud-based solution ensures accessibility anywhere, enhancing productivity for teams dealing with ir23bs.

-

Can airSlate SignNow integrate with other software for processing ir23bs?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM systems, cloud storage, and productivity tools, making it ideal for handling ir23bs. This integration capability allows for a streamlined workflow, enabling users to manage their documents more efficiently without switching between different applications.

-

Is airSlate SignNow compliant with legal standards for ir23bs?

airSlate SignNow complies with major electronic signature laws, ensuring that all eSigned documents, including ir23bs, are legally binding and enforceable. This compliance provides peace of mind for users, knowing that their electronically signed documents meet all relevant regulations and standards.

-

How can businesses ensure the security of their ir23bs using airSlate SignNow?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to protect documents like ir23bs. Users can set permissions and track document activity, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for Ir23bs Form

- Forensic social work referral form

- Framework apprenticeships form

- Nflpa agent regulations governing contract advisors form

- Interconnection form

- Color national origin religion creed age disability sex gender identity sexual orientation familial status pregnancy form

- Muscle contraction internet activity answer key form

- Aaha form

- Diversity surveys form

Find out other Ir23bs Form

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter