Form 433 D

What is the Form 433 D

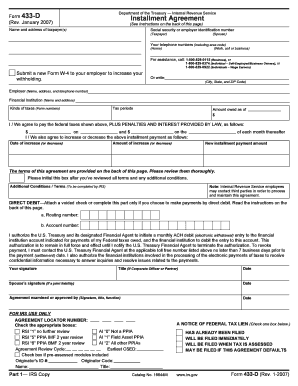

The Form 433 D is a document used by individuals and businesses to request a payment plan with the Internal Revenue Service (IRS). This form is essential for those who owe taxes and need to negotiate a manageable payment arrangement. It provides the IRS with necessary financial information to assess the taxpayer's ability to pay and determine an appropriate installment agreement.

How to use the Form 433 D

To effectively use the Form 433 D, taxpayers must accurately complete all required sections, including personal and financial information. This includes details about income, expenses, assets, and liabilities. Once completed, the form should be submitted to the IRS along with any supporting documentation that verifies the information provided. This helps the IRS evaluate the request for a payment plan.

Steps to complete the Form 433 D

Completing the Form 433 D involves several key steps:

- Gather Financial Information: Collect all necessary documents, such as pay stubs, bank statements, and expense records.

- Fill Out Personal Information: Provide your name, address, Social Security number, and other identifying details.

- Detail Income and Expenses: List all sources of income and monthly expenses to give a clear picture of your financial situation.

- Include Assets and Liabilities: Document any assets you own, such as property or vehicles, as well as any debts.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the IRS.

Legal use of the Form 433 D

The Form 433 D is legally binding when properly completed and submitted. It is essential for taxpayers to provide truthful and accurate information, as any discrepancies can lead to penalties or denial of the payment plan request. This form also serves as a formal agreement between the taxpayer and the IRS, outlining the terms of the payment arrangement.

Key elements of the Form 433 D

Several key elements are crucial for the Form 433 D:

- Personal Information: This includes the taxpayer's name, address, and identification number.

- Income Details: A comprehensive list of all income sources, including wages, business income, and other earnings.

- Expense Breakdown: Monthly expenses must be detailed to assess financial capability.

- Asset and Liability Overview: A clear account of assets owned and debts owed is necessary for evaluation.

Form Submission Methods

The Form 433 D can be submitted to the IRS through various methods. Taxpayers may choose to file it online using the IRS e-file system, mail a physical copy to the appropriate IRS address, or deliver it in person at a local IRS office. Each submission method has its own guidelines and processing times, so it's important to choose the one that best suits the taxpayer's needs.

Quick guide on how to complete form 433 d

Effortlessly Prepare Form 433 D on Any Device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Form 433 D on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Form 433 D with Ease

- Locate Form 433 D and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Edit and eSign Form 433 D to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 433 d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 433 D and how can airSlate SignNow help with it?

Form 433 D is a crucial document used by the IRS to set up an installment agreement for tax payments. With airSlate SignNow, you can easily create, send, and eSign Form 433 D, ensuring a streamlined process that saves time and reduces paperwork.

-

Is there a cost to use airSlate SignNow for Form 433 D?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose the best option for your business needs. Pricing includes sending and eSigning Form 433 D along with other document management features, providing exceptional value for a robust solution.

-

What features does airSlate SignNow provide for managing Form 433 D?

airSlate SignNow includes features such as customizable templates, real-time status tracking, and secure cloud storage, all specifically designed to facilitate the handling of Form 433 D. These features enhance efficiency and provide an organized way to manage your tax documents.

-

Can I integrate airSlate SignNow with other software for filing Form 433 D?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This means you can easily access and manage your Form 433 D alongside your other essential business tools.

-

How secure is airSlate SignNow when handling Form 433 D?

Security is a top priority for airSlate SignNow. When dealing with sensitive documents like Form 433 D, we ensure data encryption and compliance with industry standards, keeping your information safe during the eSigning process.

-

Can multiple users collaborate on Form 433 D using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form 433 D. With features like shared templates and comments, teams can work together efficiently, ensuring all necessary inputs are incorporated before finalizing the document.

-

Does airSlate SignNow provide support for completing Form 433 D?

Yes, airSlate SignNow offers comprehensive support resources, including tutorials and customer service to assist you with completing Form 433 D. Our aim is to ensure that you have the guidance needed to navigate the eSigning process smoothly.

Get more for Form 433 D

- Physical instructions form

- Form no 11 a prescribed by the secretary of state 06 14

- Seminole county public schools florida school club or scps k12 fl form

- Parent preference form berkeley unified school district

- Understanding acceptance of and adherence to a new form

- Driving school affidavit form broward county clerk of courts

- Florida certification board authorization to release information

- Registration form marion county fair marioncountyfair

Find out other Form 433 D

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document