Tax Exempt Form

What is the Tax Exempt Form

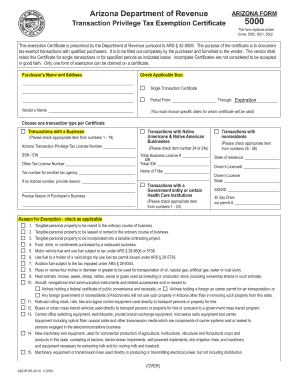

The tax exempt form in Arizona is a crucial document used by qualifying organizations to claim exemption from state sales tax. This form is typically utilized by non-profit entities, government agencies, and certain educational institutions. By submitting this form, organizations can ensure that they are not charged sales tax on eligible purchases, thereby reducing operational costs. Understanding the specific use and implications of this form is essential for organizations aiming to maximize their financial resources.

How to Obtain the Tax Exempt Form

To obtain the Arizona tax exempt form, organizations can visit the Arizona Department of Revenue's official website. The form is usually available for download in a PDF format, allowing for easy access and printing. Additionally, organizations may request a physical copy by contacting the department directly. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to Complete the Tax Exempt Form

Completing the Arizona tax exempt form involves several key steps:

- Gather necessary information, including the organization's name, address, and tax identification number.

- Provide details about the type of exempt purchases the organization will make.

- Ensure that the form is signed by an authorized representative of the organization.

- Review the completed form for accuracy before submission.

Following these steps carefully helps ensure that the form is filled out correctly, which is vital for maintaining tax-exempt status.

Legal Use of the Tax Exempt Form

The legal use of the tax exempt form in Arizona is governed by state laws that outline eligibility criteria and acceptable uses. Organizations must ensure that they meet the requirements set forth by the Arizona Department of Revenue to qualify for tax exemption. Misuse of the form, such as using it for personal purchases or by ineligible entities, can lead to penalties and loss of tax-exempt status. Therefore, understanding the legal framework surrounding this form is essential for compliance.

Key Elements of the Tax Exempt Form

The Arizona tax exempt form contains several key elements that must be accurately completed. These include:

- The name and address of the organization.

- The tax identification number assigned by the IRS.

- A description of the type of exempt purchases being made.

- The signature of an authorized representative, indicating the validity of the claims made.

Each of these elements plays a critical role in ensuring that the form is accepted and that the organization can benefit from its tax-exempt status.

Eligibility Criteria

Eligibility for using the Arizona tax exempt form is primarily determined by the type of organization. Non-profit organizations, government entities, and certain educational institutions typically qualify. Each category may have specific criteria that must be met, such as being registered with the state or maintaining a particular status with the IRS. Organizations should carefully review these criteria to ensure compliance before submitting the form.

Quick guide on how to complete tax exempt form 28689427

Complete Tax Exempt Form effortlessly on any device

Online document management has become increasingly popular with organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Exempt Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Tax Exempt Form seamlessly

- Find Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choice. Modify and eSign Tax Exempt Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form 28689427

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AZ tax exempt certificate?

An AZ tax exempt certificate is a document issued by the state of Arizona that allows certain organizations or individuals to purchase goods and services without paying sales tax. This certificate is crucial for qualifying non-profit organizations, government entities, and other tax-exempt bodies to save on tax expenses.

-

How can I apply for an AZ tax exempt certificate?

To apply for an AZ tax exempt certificate, you must complete the appropriate form provided by the Arizona Department of Revenue. Ensure you include all required documentation, such as proof of your organization’s tax-exempt status, and submit it according to the state's guidelines to obtain your certificate efficiently.

-

How does airSlate SignNow help with AZ tax exempt certificate management?

airSlate SignNow simplifies the process of managing your AZ tax exempt certificate by providing an easy-to-use platform to send and eSign documents securely. You can store, share, and access your tax exempt certificate anytime, ensuring compliance and making it easier to handle business transactions.

-

Are there any costs associated with getting an AZ tax exempt certificate?

Typically, obtaining an AZ tax exempt certificate does not involve direct fees; however, some organizations may incur costs related to preparing and submitting their application. Using airSlate SignNow can help streamline these processes at a minimal cost, making it a cost-effective solution for managing your tax exempt needs.

-

What types of organizations can utilize the AZ tax exempt certificate?

Various organizations can utilize the AZ tax exempt certificate, including non-profit entities, governmental bodies, and educational institutions. If your organization qualifies under Arizona tax laws, you can benefit from this exemption to enhance your purchasing power and increase your budget efficiency.

-

Can I use airSlate SignNow to share my AZ tax exempt certificate with vendors?

Yes, airSlate SignNow allows you to securely share your AZ tax exempt certificate with vendors through its document-sharing features. This makes it easy to provide the necessary documentation to ensure your tax exempt status is acknowledged in transactions, ensuring compliance and convenience.

-

How does airSlate SignNow ensure the security of my AZ tax exempt certificate?

airSlate SignNow utilizes advanced security protocols, including encryption and secure cloud storage, to ensure your AZ tax exempt certificate is well-protected. You can have peace of mind knowing that your sensitive documents are safe and only accessible to authorized users.

Get more for Tax Exempt Form

Find out other Tax Exempt Form

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online