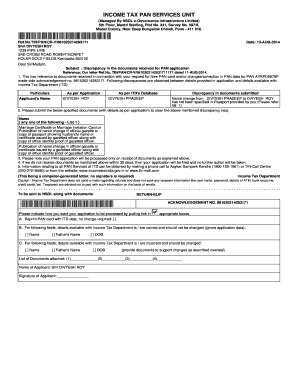

Income Tax Pan Services Unit Form

What is the Income Tax Pan Services Unit

The Income Tax Pan Services Unit is a crucial component in the U.S. tax system, designed to facilitate the management and processing of taxpayer identification numbers. This unit plays a vital role in ensuring that individuals and businesses comply with federal tax regulations. The primary function of the unit is to issue and manage Permanent Account Numbers (PANs), which are essential for tracking tax obligations and preventing tax evasion. Understanding the role of this unit is fundamental for anyone navigating the complexities of U.S. tax law.

How to use the Income Tax Pan Services Unit

Using the Income Tax Pan Services Unit involves several steps to ensure proper compliance with tax requirements. Taxpayers must first determine if they need a PAN, which is typically necessary for filing income tax returns, opening bank accounts, or conducting financial transactions. Once the need is established, individuals can apply for a PAN through the designated channels. This process may include submitting specific documentation and personal information to verify identity and tax status.

Steps to complete the Income Tax Pan Services Unit

Completing the process with the Income Tax Pan Services Unit requires careful attention to detail. Here are the essential steps:

- Gather required documents, such as identification and proof of income.

- Fill out the application form accurately, ensuring all information is correct.

- Submit the application through the appropriate method, whether online or by mail.

- Await confirmation of PAN issuance, which may take several weeks.

- Once received, keep the PAN secure for future tax-related activities.

Legal use of the Income Tax Pan Services Unit

The legal use of the Income Tax Pan Services Unit is governed by federal tax laws and regulations. It is essential for taxpayers to understand that the PAN is not just a number; it is a legal identifier that must be used correctly to avoid penalties. Misuse of the PAN can lead to serious consequences, including fines and legal action. Therefore, proper adherence to the guidelines set forth by the Internal Revenue Service (IRS) is imperative for all users of the Income Tax Pan Services Unit.

Required Documents

When applying for a PAN through the Income Tax Pan Services Unit, specific documents are required to verify identity and tax status. These documents typically include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of residency, like a utility bill or lease agreement.

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Income verification documents, such as pay stubs or tax returns.

Filing Deadlines / Important Dates

Filing deadlines related to the Income Tax Pan Services Unit are critical for compliance. Taxpayers should be aware of key dates, including:

- The annual tax return filing deadline, typically April 15.

- Extensions for filing, which must be requested by the original deadline.

- Deadlines for submitting any changes to personal information associated with the PAN.

Quick guide on how to complete income tax pan services unit

Complete Income Tax Pan Services Unit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Income Tax Pan Services Unit on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Income Tax Pan Services Unit effortlessly

- Find Income Tax Pan Services Unit and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Income Tax Pan Services Unit and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax pan services unit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the income tax pan services unit offered by airSlate SignNow?

The income tax pan services unit by airSlate SignNow is designed to streamline the process of managing your income tax PAN documents. It allows businesses to easily send, eSign, and store important tax documents securely, ensuring a seamless experience during tax season.

-

How does the income tax pan services unit improve tax document management?

With the income tax pan services unit, businesses can improve tax document management by simplifying the workflow. It offers features such as electronic signatures, document tracking, and cloud storage, allowing users to manage their tax-related documents efficiently and effectively.

-

What are the pricing options for the income tax pan services unit?

airSlate SignNow offers competitive pricing for the income tax pan services unit, catering to various business sizes and needs. Pricing plans include monthly and annual subscriptions, with options that provide flexibility and value based on usage and features required.

-

What features come with the income tax pan services unit?

The income tax pan services unit includes a variety of features such as customizable templates, secure eSigning, and real-time document tracking. These tools help ensure that businesses can manage their income tax documents easily and efficiently, minimizing the risk of errors.

-

How does airSlate SignNow ensure the security of the income tax pan services unit?

Security is a top priority at airSlate SignNow. The income tax pan services unit utilizes encryption, secure access controls, and compliance with global data protection regulations, ensuring that your sensitive tax documents remain safe throughout the signing process.

-

Can I integrate the income tax pan services unit with other software?

Yes, the income tax pan services unit seamlessly integrates with various accounting and management software. This integration allows businesses to synchronize their tax document management workflow with existing systems, enhancing overall productivity.

-

What benefits can businesses expect from using the income tax pan services unit?

Using the income tax pan services unit provides numerous benefits, including quicker turnaround times on document processing and reduced paperwork. Businesses can save time and resources with electronic signatures and digital document management, leading to enhanced operational efficiency.

Get more for Income Tax Pan Services Unit

Find out other Income Tax Pan Services Unit

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself