Employer Statement of Earnings 2011

What is the Employer Statement of Earnings

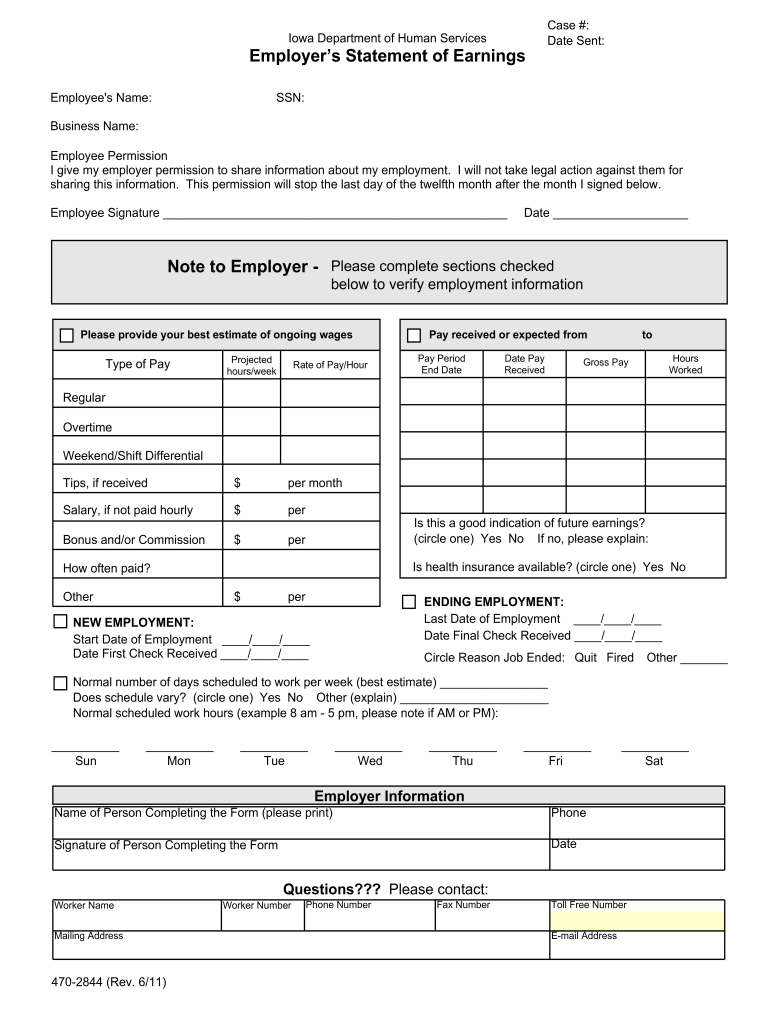

The Employer Statement of Earnings is a crucial document that outlines an employee's earnings and deductions over a specific period. This form is often required for various purposes, including tax filings, loan applications, and government assistance programs. It provides a detailed summary of wages, bonuses, and any other compensation received, along with deductions for taxes, Social Security, and other benefits. Understanding this document is essential for both employers and employees to ensure accurate reporting and compliance with financial regulations.

How to Use the Employer Statement of Earnings

To effectively use the Employer Statement of Earnings, individuals should first ensure that the document is accurately completed by their employer. Employees can refer to this statement when preparing their income tax returns, applying for loans, or verifying income for rental agreements. It is important to keep a copy of the statement for personal records. Additionally, employers should maintain accurate records of all earnings and deductions to facilitate the completion of this statement, ensuring compliance with tax regulations.

Steps to Complete the Employer Statement of Earnings

Completing the Employer Statement of Earnings involves several steps:

- Gather necessary information, including employee details, earnings, and deductions.

- Fill in the employee's total gross earnings for the reporting period.

- List all applicable deductions, such as federal and state taxes, Social Security, and health benefits.

- Ensure all calculations are accurate and double-check for any errors.

- Provide a signature and date to validate the statement.

Employers should ensure that the completed statement is distributed to employees in a timely manner, allowing them to use it for their financial needs.

Key Elements of the Employer Statement of Earnings

Several key elements must be included in the Employer Statement of Earnings to ensure its validity:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Company name, address, and Employer Identification Number (EIN).

- Earnings Summary: Total gross earnings, including wages, bonuses, and commissions.

- Deductions: Detailed list of all deductions taken from the employee's earnings.

- Period Covered: Specific dates for which the earnings are reported.

Including these elements ensures that the statement is comprehensive and meets legal requirements.

Legal Use of the Employer Statement of Earnings

The Employer Statement of Earnings serves multiple legal purposes. It is often required for tax filings, as it provides the necessary information for both the employee and the IRS. Additionally, this document can be used in legal proceedings to verify income, such as in divorce cases or disputes regarding child support. Employers must ensure that the statement is accurate and compliant with federal and state regulations to avoid potential legal issues.

Who Issues the Form

The Employer Statement of Earnings is typically issued by the employer or the payroll department of a company. Employers are responsible for generating this document based on their payroll records and must ensure that it is provided to employees at the end of the reporting period, such as annually or quarterly. In some cases, third-party payroll services may also generate this statement on behalf of the employer, but the ultimate responsibility for accuracy lies with the employer.

Quick guide on how to complete employers statement form

Utilize the simpler method to oversee your Employer Statement Of Earnings

The traditional approach to filling out and approving documents consumes a disproportionately lengthy period in comparison to contemporary document management systems. You previously searched for relevant social forms, printed them, filled in all necessary details, and dispatched them via postal service. Nowadays, you can discover, complete, and sign your Employer Statement Of Earnings within a single web browser tab using airSlate SignNow. Assembling your Employer Statement Of Earnings has never been easier.

Steps to finalize your Employer Statement Of Earnings with airSlate SignNow

- Access the category page you need and find your state-specific Employer Statement Of Earnings. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by previewing it.

- Click Get form and enter editing mode.

- Fill in your document with the required details using the editing tools.

- Review the provided information and click the Sign feature to verify your form.

- Select the most convenient method to create your signature: produce it, draw your signature, or upload its image.

- Click DONE to record changes.

- Download the document to your device or proceed to Sharing settings to send it digitally.

Robust online tools like airSlate SignNow simplify the process of completing and submitting your forms. Try it out to discover how long document management and approval routines are truly meant to take. You’ll save a considerable amount of time.

Create this form in 5 minutes or less

Find and fill out the correct employers statement form

FAQs

-

How do I apply for a Schengen visa from India, and what are the financial requirements? I would like to know how much funds I need to show on my bank account for a 14-day trip to Europe.

First thing first “Finalizing the Visa Consulate”:If you are planning to tour more than two countries in the Schengen area then apply for visa to the embassy/consulate of the country you will be residing in for most of the travelling days, often referred as the main destination. If two countries have the same number of days then choose the one where you are planning to land or exit.In case you do not have a fixed itinerary (not recommended, though), and you plan to visit several countries in the Schengen area randomly, then apply to the embassy/consulate of the country which you are entering first.Since now you know which embassy you need to apply, next is how to apply and what are the documents required.Long trail of documentation:The most painful part is this, where you need to prepare the documentation. I will keep the checklist simple and provide rationale on why they ask for the particular document which will help you understand the significance of it and you can produce a substitute, if possible and required1) Valid passport (issued within the last 10 years and with at least 3 months validity after the scheduled return; passports with observations regarding the front data page are no accepted) with at least two empty pages Nothing much to say, of course you need a valid passport. Since the maximum stay with a Schengen visa can be of 90 days, so 3 months validity is required on the passport. Two blank pages, because one will have Visa sticker and the other page will have Indian immigration stamps and the stamps from the Schengen country where you are landing and exiting.2) 2 passport pictures according to biometric specifications, not older than 6 months Go to the studio and get a photo of the dimension 35 mm in length and 45 mm in height. Your face (the start of the hairline in the forehead till end of your chin) should be between 32 mm to 36 mm. Get the photo in a light background, white is preferred. Detailed information can be obtained here Cheap Tip: Do not go to any fancy studio and spend a bomb on just the photo. The consulate needs a clean and clear photo with the above mentioned specifications (which are very general) and not for featuring you as a playboy model, so save the buck.3) Leave letter of your company (if employed)This letter serves as a proof of return to your own country, so make sure the letter clearly states your designation, since when you are working with the company, leave dates (mandatorily covering your entire stay), date on which you will resume your duties.No-objection certificate of school or university (if student) This is pretty much same as the above.4) Proof of financial status If employed:Payslips of the past three months / employment contract Provide either of them, not both. Provide three latest Payslips, as it clearly states how much you are earning and if you are capable of surviving a European trip. This document helps the Visa officer gauge your financial status and also validates that the money earned is legal.If self-employed:Certificate of Proprietorship or other proof of ownership (proof of land title, proof of income from agriculture (sales form) etc.) 5) Income Tax Return (ITR) form or Form 16(Certificate of Income Tax deducted at the source of salary)It ensures that all the fund in your bank account is earned legally. Though my experience is that, they hardly care how you have earned the money. If they see there is enough fund available in your account then they are fine.6) Personal bank statement of the past three months with sufficient fundsHere they look into couple of things; first, money in your account is sufficient to cover your entire stay in Schengen area during your travel period. Second, the fund has not been deposited all of a sudden to inflate the available balance. I have written below in detail on how much you should show in your bank account, so keep reading. The bank account statement can be online, but make sure it is a bank statement with details of transaction and not just an account summary. You can show travelers cards (with statement stating available balance), credit card statement, and fixed deposits in your name or joint accounts. If anyone is sponsoring you (like your father or mother), a sponsoring letter addressed to the consulate from him/her and his/her bank statement for last 3 months.7) Proof of accommodation for your entire stay in the Schengen area.This is vital, I have read and heard personal experiences where the Visa has been cancelled due to discrepancy in accommodation arrangements. Make sure you have confirmed hotel bookings with details of the property owner/manager and property details (address). If you are staying at friends/relatives place then copy of their passport (with valid residence permit, in case of non-EU citizen) and an invitation mail will be sufficient as long as you are sponsoring your own stay.8) Flight and transport reservation Again, very vital. Many applications got rejected because of fake bookings. DO NOT make a fake reservation. Search for flights which has minimal cancellation charges and book your flights well ahead of travel date (45-60 days prior) to get a good deal. If you are travelling within Schengen countries then it is advised to show them train/bus bookings for inter-nation travel. One need not show travel details within the country, say if you are travelling within Italy (Rome to Florence) then need not show prior bookings. But if you are travelling from Italy to Switzerland then it is advised to show a confirmed booking.9) Travel Insurance Vital to get visa and also for your own sake. If something unwanted happens and you need to avail medical services then you will be ripped off everything as healthcare is expensive in whole of Europe. The travel insurance must cover Euro 30, 000.00 in case of hospitalization and must cover emergency medical evacuation and repatriation of remains. The list of approved travel insurance companies can be fetched here.10) Proof of civil status Marriage certificate, birth certificate of children, death certificate of spouse, ration card if applicable or Aadhaar Card.11) 1 copy of your passport’s data page Print the first two pages and last two pages of your passport in an A4 size paper.12) Residency proof, if address in the passport falls outside the jurisdiction region of the consulate: Which consulate or which region you can apply? You can apply at the region (North, South, East or West) where you are residing for last 6 months.This is something none of the blogs available in the internet have mentioned clearly. In case you are a domicile of different region and applying at a different region (domicile of Uttar Pradesh, North and working in Bangalore, South for last 3 years), or simply if the address mentioned in your passport does not fall under the jurisdiction region of then consulate then you need to provide either a copy of your rent agreement, or a letter from your company HR clearly mentioning your address or some utility bill (electricity, water or telephone bill).13) Duly filled application form Kept at last, because it is important. You can either fill an online application (recommended) or also can fill an offline application. German consulate online application can be filled here , similarly other Countries’ application form can be found in the respective VFS website. Self-Declaration Form can be found here, required only for German consulate. It is recommended to fill the online application form, it not only saves time at the application center but also legibility is better than the handwritten one.14) Cover Letter A letter addressed to the consulate you are applying. It must contain the followingPurpose of visit (tourism, visiting friends or family)Detailed itinerary If you have a sponsorExplain your personal relationship with your sponsor and the reason why they will be sponsoring your tripIf you cannot submit any of the required documents, write about the reasons why you cannot submit and explain alternative documents that you may have submittedYou can also mention the reasons why you will not overstay the visa period (employment, personal assets, etc.), explain your rootedness to the countryCool Tip: You can attach the itinerary separately which will enhance the readability of your letter.Write to me at universallocalite@gmail.com if you require a specimen cover letter or template of itinerary, I will be more than happy to help you with one.Visit my blog-How to obtain a Schengen Visa-Rules and tips

-

What is the success rate of getting a Schengen visa if you provide a valid passport, filled out application form, one-month valid travel insurance, bank statements of the applicant/sponsor, employment contract, cover letter and flight itinerary?

I would say more than 90 percent if your entire documentation is correct and you don’t have any history in your passport. I have travelled to Europe twice since 2016 and my friends too keep travelling. Myself or even they have never faced any issue with schengen Visa.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

What is the property tax rate on aircraft owned for personal use in Los Angeles County?

I agree, it's a bit strange how this one works.I've paid personal property taxes on an aircraft (through my former employer). In Los Angeles, essentially you fill out the Business Property Statement (Form 571-L) declaring the value of your business personal property (i.e. equipment, building, computers, vehicles, aircraft, etc.) and send submit it without paying a tax. There are no rates which appear on this return.The county assessors perform the needed computations based upon a grouping of like fixed assets owned and based upon your declaration, then send you a bill. I no longer have access to the invoices and related rates I used to pay on the aircraft, so the best I can do is suggest that you simply call or e-mail them.

-

What does “Erwerbstätigkeit nicht gestattet aufenthaltsanzeige nach einreise” mean?

If you use Google Translate, it will tell you “Employment not allowed". But that just goes to show how unreliable Google Translate is. In fact there are two statements here:„Erwerbstätigkeit nicht gestattet“: Employment not permitted.„Aufenthaltsanzeige nach Einreise“: Registration of residence after arrival.Note the capitals. They're important in German. And the second statement is much more important than the first: you need to find an Einwohnermeldeamt (Resident reporting office) and fill out a form to register where you live. If you are renting, you'll need the signature of the landlord. Don't worry about this: it's a requirement for everybdoy in Germany, and he'll be expecting it. He will also be able to tell you where the Einwohnermeldeamt is.

-

How do you start a business in California legally?

Okay, very simple.Do a business name search at the California Secretary of State website to see if your desired business name is available.Do a business name search at http://www.ustpo.gov to make sure you are not violating any copyrights for the desired business name.Business Type:Sole Proprietorship - Risks you are personally liable for anything and everything that happens in your business.LLC - must register business with the CA Secretary of State. Go to their website, find LLC, and get directions on how to register. You will need to file Articles of Association (use their form-it is online). As an LLC, you as an individual has limited liability in case of a lawsuit, therefore the LLC is legally liable, not you. Risks are minimal.If you become an LLC, you must obtain from the IRS at Internal Revenue Service a federal tax ID Number. You can do this online with a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).Where you are located register;with the County Clerk’s office the “Fictitious Business Name (FBN).”You will have to post the FBN in a newspaper for 4 weeks, (find the cheapest rate-the County Clerk’s Office will give you a least of approved newspapers).Get a city Business License. Some communities do not require this process if they are not an incorporated city.If you are selling a tangible product, you need to get a Re-Sellers Permit from the CA Board of Equalization, do this registration on line at www.boe.ca.gov.Those are the basics for registering a business in California if you are alone and do not have any employees.If you get confused in the process, contact your local Small Business Development Center. They usually partner with a community college. If you were more specific I could be more specific. Good Luck!

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

How much do I need to prove that I can support myself in the US when I win a DV lottery?

There is no fixed amount of money you must have access to, to be a successful DV winner and visa holder. The immigrant should show ownership of property and assets, a job offer in the US, or that the immigrant is already living legally in the United States with a job that pays a sufficient income, in order to overcome the public charge ground of inadmissibility. For example, you may submit:a job offer letter from a US employer, or pay stubs from existing employment in the US.copies of bank statements showing current balance, or preferably a bank statement showing annual deposits and withdrawals as well as current balance, and how the money will be transferred to the US.copies of land deeds or other evidence of real estate ownership, along with any mortgage statements showing the amount of remaining debtcopies of documents showing ownership of insurance policiesevidence of other income, such as from investments or royalties.Having a Sponsor Sign Form I-134 Affidavit of SupportIf the immigrants' sources of financial support are not sufficient on their own, one possibility is to find a US sponsor to fill out an Affidavit of Support on Form I-134, issued by U.S. Citizenship and Immigration Services (USCIS).

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

Create this form in 5 minutes!

How to create an eSignature for the employers statement form

How to make an eSignature for the Employers Statement Form online

How to generate an electronic signature for the Employers Statement Form in Chrome

How to create an electronic signature for signing the Employers Statement Form in Gmail

How to make an eSignature for the Employers Statement Form straight from your smartphone

How to make an electronic signature for the Employers Statement Form on iOS

How to make an eSignature for the Employers Statement Form on Android devices

People also ask

-

What is an Employer Statement Of Earnings?

An Employer Statement Of Earnings is a detailed report that outlines an employee's earnings, including wages, bonuses, and deductions, for a specific period. This document is essential for employees to understand their income and for employers to maintain accurate payroll records. With airSlate SignNow, you can easily create and manage these statements digitally.

-

How can airSlate SignNow help with creating an Employer Statement Of Earnings?

airSlate SignNow simplifies the process of generating an Employer Statement Of Earnings by offering customizable templates and user-friendly tools. You can quickly fill in employee details, earnings, and deductions, then electronically sign and send the document within minutes, ensuring compliance and accuracy.

-

Is airSlate SignNow cost-effective for managing Employer Statement Of Earnings?

Yes, airSlate SignNow provides a cost-effective solution for managing Employer Statement Of Earnings. With various pricing plans tailored to different business sizes, you can choose a plan that suits your budget while benefiting from unlimited document signing and storage.

-

What features does airSlate SignNow offer for Employer Statement Of Earnings?

airSlate SignNow offers a range of features for managing Employer Statement Of Earnings, including customizable templates, electronic signatures, and real-time tracking. Additionally, the platform integrates seamlessly with various applications to streamline your payroll processes.

-

Can I integrate airSlate SignNow with other payroll software for Employer Statement Of Earnings?

Absolutely! airSlate SignNow integrates with popular payroll software, allowing you to automate the creation and distribution of Employer Statement Of Earnings. This integration helps maintain accurate payroll records and enhances operational efficiency.

-

What are the benefits of using airSlate SignNow for Employer Statement Of Earnings?

Using airSlate SignNow for Employer Statement Of Earnings offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform allows for easy document sharing and tracking, ensuring that both employers and employees have access to necessary information when they need it.

-

Is it easy to eSign an Employer Statement Of Earnings with airSlate SignNow?

Yes, eSigning an Employer Statement Of Earnings with airSlate SignNow is straightforward and user-friendly. Employees can sign documents electronically from any device, making the process quick, secure, and compliant with legal standards.

Get more for Employer Statement Of Earnings

Find out other Employer Statement Of Earnings

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online