Form St 12ec

What is the Form St 12ec

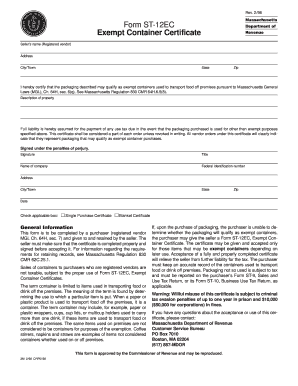

The Form St 12ec is a specific document used in the United States for tax-related purposes. It serves as a certificate that allows certain businesses to claim exemption from sales tax on specific purchases. This form is particularly relevant for organizations that qualify under state tax laws, enabling them to streamline their purchasing processes while complying with legal requirements. Understanding the purpose and function of the Form St 12ec is essential for businesses looking to optimize their tax obligations.

How to use the Form St 12ec

Using the Form St 12ec involves several steps to ensure compliance with state regulations. First, businesses must determine if they qualify for sales tax exemption based on their activities or the nature of their purchases. Once eligibility is confirmed, the form can be completed by providing necessary information such as the purchaser's name, address, and the specific items being purchased. It is crucial to ensure that the form is signed and dated to validate the exemption claim. After completion, the form should be presented to the seller at the time of purchase.

Steps to complete the Form St 12ec

Completing the Form St 12ec requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific purchases that qualify for the exemption.

- Fill out the form by entering the required details accurately.

- Review the completed form for any errors or omissions.

- Sign and date the form to authenticate it.

- Provide the completed form to the seller at the time of purchase.

Legal use of the Form St 12ec

The legal use of the Form St 12ec is governed by state tax laws, which outline the conditions under which a business can claim sales tax exemption. To ensure that the form is legally valid, it must be filled out completely and accurately. Additionally, the purchaser must be eligible for the exemption based on their business activities. Misuse of the form can lead to penalties, including back taxes and fines, making it essential to adhere strictly to legal guidelines when using the Form St 12ec.

Key elements of the Form St 12ec

Key elements of the Form St 12ec include:

- Purchaser Information: This section requires the name, address, and tax identification number of the business claiming the exemption.

- Item Description: A detailed description of the items being purchased under the exemption must be provided.

- Signature: The form must be signed by an authorized representative of the business to validate the exemption claim.

- Date: The date of signing is essential for record-keeping and compliance purposes.

Form Submission Methods

The Form St 12ec can be submitted through various methods, depending on the seller's preferences and state regulations. Common submission methods include:

- In-Person: Presenting the completed form directly to the seller at the time of purchase.

- Mail: Some sellers may allow the form to be sent via mail prior to the transaction.

- Electronic Submission: Certain jurisdictions may permit electronic submission of the form, facilitating a faster process.

Quick guide on how to complete form st 12ec

Effortlessly Prepare Form St 12ec on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Manage Form St 12ec on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

How to Modify and eSign Form St 12ec with Ease

- Obtain Form St 12ec and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about lost or misplaced files, the hassle of searching for forms, or the need to print new copies due to errors. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Form St 12ec and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 12ec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form St 12ec and how can airSlate SignNow help with it?

Form St 12ec is a specific form used for tax exemption purposes in certain jurisdictions. With airSlate SignNow, you can easily prepare, send, and eSign Form St 12ec, ensuring that your documentation is compliant and securely stored. Our platform simplifies the entire process, allowing you to focus on your business instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for Form St 12ec?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Depending on the features you require for managing Form St 12ec eSignatures, you can choose a plan that fits within your budget, ensuring you get the best value for your investment.

-

Can I customize Form St 12ec templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for Form St 12ec, making it easier to fill out and send repeatedly. You can add your branding, specific fields, and even automate parts of the document to enhance efficiency and maintain consistency.

-

What are the key features of airSlate SignNow for managing Form St 12ec?

airSlate SignNow offers features such as easy document creation, secure eSigning, and real-time collaboration, all tailored for Form St 12ec. These features enable seamless workflows and enhance productivity, allowing you to manage your documents efficiently from anywhere.

-

How does airSlate SignNow ensure the security of Form St 12ec?

Security is a top priority at airSlate SignNow. When managing Form St 12ec, all documents are encrypted for safety, and we comply with industry-standard regulations. You can trust that your sensitive information will remain protected throughout the signing process.

-

What integrations are available with airSlate SignNow for Form St 12ec?

airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and Salesforce, enhancing your experience when working with Form St 12ec. These integrations allow for easy document retrieval and enhanced functionality, making your workflow more efficient.

-

How quickly can I send and receive completed Form St 12ec using airSlate SignNow?

With airSlate SignNow, you can send and receive completed Form St 12ec in minutes. Our platform is designed for speed and efficiency, allowing you to eSign documents quickly and get back to running your business without unnecessary delays.

Get more for Form St 12ec

- 2016 unum cl 1091 form

- 2018 mtm distance verification form

- 2020 gull lake ministries release covenant agreement form

- 2013 aetna fitness reimbursement form

- 2012 peer assistance services relapse prevention plan form

- 2013 unum cl 1090 form

- 2019 evicore healthcare ptot therapy intake form neurological conditions

- 2017 il dph ioci 18 121 form

Find out other Form St 12ec

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast