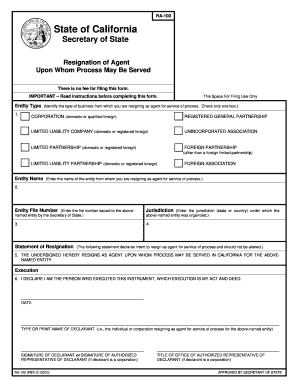

Ra 100 Form

What is the Ra 100 Form

The Ra 100 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration of a taxpayer's income and deductions, allowing the Internal Revenue Service (IRS) to assess tax obligations accurately. This form is essential for individuals and businesses alike, as it ensures compliance with federal tax laws. Understanding its purpose is crucial for anyone looking to file taxes correctly and avoid potential penalties.

How to use the Ra 100 Form

Using the Ra 100 Form involves several straightforward steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any receipts for deductible expenses. Next, accurately fill out the form, ensuring that all income and deductions are reported. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically through an e-filing service or printed and mailed to the appropriate IRS address. Familiarity with the form's structure will facilitate a smoother filing process.

Steps to complete the Ra 100 Form

Completing the Ra 100 Form can be broken down into a series of methodical steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Begin filling out the form by entering personal information, such as your name and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- List all eligible deductions, ensuring you have documentation to support each claim.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, based on your preference.

Legal use of the Ra 100 Form

The Ra 100 Form holds legal significance as it is required for compliance with U.S. tax laws. When properly completed and submitted, it serves as a formal declaration of income and deductions, which the IRS uses to determine tax liabilities. Failing to use the form correctly can lead to legal repercussions, including fines or audits. Therefore, it is essential to ensure that all information provided is accurate and truthful, as this form can be scrutinized by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ra 100 Form are crucial to adhere to in order to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, but it is important to note that any taxes owed are still due by the original deadline to avoid interest and penalties.

Who Issues the Form

The Ra 100 Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines on how to complete the form and ensures that it is accessible to taxpayers. It is important to obtain the latest version of the form directly from the IRS to ensure compliance with any updates to tax laws or regulations.

Quick guide on how to complete ra 100 form

Effortlessly Prepare Ra 100 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Ra 100 Form on any device with the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

How to Modify and eSign Ra 100 Form with Ease

- Locate Ra 100 Form and click Get Form to commence.

- Leverage the tools we provide to complete your form.

- Select pertinent sections of your documents or redact sensitive information using specific tools offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Ra 100 Form to guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ra 100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ra 100 Form and how is it used?

The Ra 100 Form is a specialized document often utilized in various business processes. It streamlines the process of obtaining necessary approvals and signatures, making it essential for organizations looking to enhance efficiency. With airSlate SignNow, users can easily create, send, and eSign the Ra 100 Form online.

-

How does airSlate SignNow help with the Ra 100 Form?

airSlate SignNow simplifies the management of the Ra 100 Form by providing a user-friendly platform for sending and signing documents electronically. Users can track the status of their forms, ensuring that they are signed promptly and securely. This digital solution saves time and reduces paperwork errors.

-

What are the pricing options for airSlate SignNow regarding the Ra 100 Form?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses using the Ra 100 Form. Plans vary based on features and user requirements, ensuring that there is an option for every budget. Check the pricing page to find the perfect plan for your organization's needs.

-

Can I customize the Ra 100 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Ra 100 Form to suit your specific business requirements. Users can add fields, change layouts, and include branding elements to create a document that reflects their company identity. This level of customization enhances professionalism in all communications.

-

What features does airSlate SignNow offer for electronic signatures on the Ra 100 Form?

airSlate SignNow provides robust features for electronic signatures on the Ra 100 Form, including secure signing, multiple signature options, and real-time tracking. Users can send documents for signing through email or a link, making the process convenient for all parties involved. This ensures that the Ra 100 Form is signed securely and efficiently.

-

Are there any integrations available for the Ra 100 Form with airSlate SignNow?

Absolutely! airSlate SignNow offers numerous integrations with popular business applications to streamline your workflow involving the Ra 100 Form. This includes CRM systems, project management tools, and more, enabling you to enhance overall productivity. With these integrations, managing your documents becomes seamless.

-

What are the benefits of using airSlate SignNow for the Ra 100 Form?

Using airSlate SignNow for the Ra 100 Form offers multiple benefits, such as increased efficiency, cost savings, and improved document security. The platform allows for rapid turnaround times with electronic signatures and reduces the need for paper documents. These enhancements lead to better time management and streamlined processes for your business.

Get more for Ra 100 Form

Find out other Ra 100 Form

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple